The Harborview Group at Morgan Stanley

Hauppauge:

(631) 851-1685(631) 851-1685

Our Mission Statement

Your dream financial future might not be so far out of view. We plan together to weather the storms before they reach home.

Our Story and Services

With +55 years of experience, The Harborview Group personalizes the client experience & tailors specific financial solutions to their individual/family situation. The team has been coveted for their elite service model of comprehensive quarterly reviews, quarterly financial planning updates & monitoring, and tax efficient portfolio's in a risk adjusted manner.

The team's goals are to help provide clients (i) confidence about re-thinking retirement, (ii) their dream vacation/home, or (iii) transitioning wealth to the next generation or charity of their choice.

The team purposefully limits the number of clients so they can provide the attentive & detailed service that significant wealth demands and deserves. The team has the privilege of advising clients in virtually all areas of financial strategy, including concentrated stock management, asset and liability management, trust and estate planning strategies, retirement planning services, and access to cash management and lending solutions.

From an individual standpoint, we work with C-Suite Executives, small business owners, education staff, medical practitioners, tech/software professionals, and legal professionals of publicly traded companies providing them with strategies for managing their concentrated stock/wealth positions. This includes estate planning strategies, legacy formation & transfer, and providing lending and liquidity options.

The team's goals are to help provide clients (i) confidence about re-thinking retirement, (ii) their dream vacation/home, or (iii) transitioning wealth to the next generation or charity of their choice.

The team purposefully limits the number of clients so they can provide the attentive & detailed service that significant wealth demands and deserves. The team has the privilege of advising clients in virtually all areas of financial strategy, including concentrated stock management, asset and liability management, trust and estate planning strategies, retirement planning services, and access to cash management and lending solutions.

From an individual standpoint, we work with C-Suite Executives, small business owners, education staff, medical practitioners, tech/software professionals, and legal professionals of publicly traded companies providing them with strategies for managing their concentrated stock/wealth positions. This includes estate planning strategies, legacy formation & transfer, and providing lending and liquidity options.

Services Include

- Professional Portfolio ManagementFootnote1

- Financial PlanningFootnote2

- Retirement PlanningFootnote3

- Wealth PlanningFootnote4

- Estate Planning StrategiesFootnote5

- Trust ServicesFootnote6

- 401(k) Rollovers

- Business PlanningFootnote7

- Planning for Education FundingFootnote8

- Long-term Care InsuranceFootnote9

- Life InsuranceFootnote10

- Cash Management and Lending ProductsFootnote11

- Trust AccountsFootnote12

- Planning for Individuals with Special Needs and their Families

- Alternative InvestmentsFootnote13

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

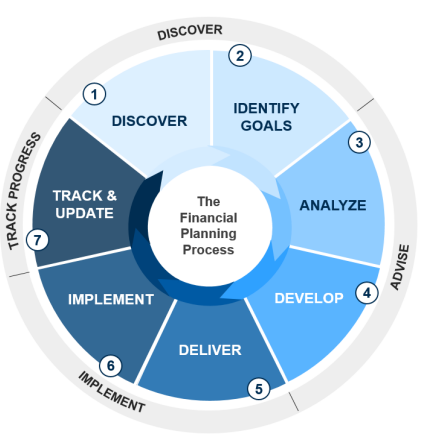

Customized Wealth Management Approach

1 & 2) We Get to Know You

We learn your current lifestyle, financial situation, long-term goals, and family values you’ve set for yourself. We learn what concerns you may have that might affect your lifestyle over time.

3 & 4) Tax, Estate, Risk Strategy

Tax management isn't just a year-end task, but a year-long process. Carry forward tax credit is critical to offset an unexpected expense while providing the ability for higher income generating vehicles. No matter where you are in your life, we want to help limit the possible tax impact. Active tax harvesting is key to take advantage of volatile market conditions.

View Our Tax Savings5) Utilizing Our Portfolio Management Designations

We create customized portfolio allocations for your specific financial situation to match the goals you’ve discussed with us, present our different solutions and you pick which one you feel comfortable doing.

Accredited Experience6 & 7) Implement & Review

After selecting the customized roadmap of investments and solutions, we do the heavy lifting for you. As the needs, wants and wishes in your life change we’ll have ongoing assessments to make sure you’re still on track to reach your goals.

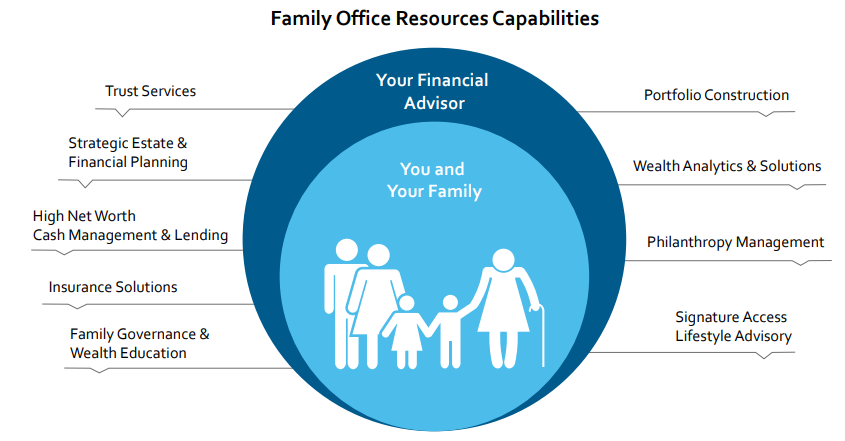

View Your Progress, Wherever, WheneverFamily Office Resources

Managing an investment portfolio is only a small part of your overall financial picture. We work with you to adapt to the different changes in your life by utilizing all of our firms services.

The term "Family Office Resources" is being used as a term of art and not to imply that Morgan Stanley and/or it's employees are acting as a family office pursuant to Investment Advisers Act of 1940.

The term "Family Office Resources" is being used as a term of art and not to imply that Morgan Stanley and/or it's employees are acting as a family office pursuant to Investment Advisers Act of 1940.

Shield, Maintain, Grow

Tax laws are complex, range across state/national boarders, and subject to many changes over time. Within the next 25 years, we'll see the largest wealth transfer in history of an estimated $68 trillion. We utilize Morgan Stanley's Tax planning and preparation services to help keep the wealth you've worked hard to grow.

You've worked hard to grow your wealth and we want to help protect it. Our Family Office Resources specializes in ultra-high net-worth families and leveraging all aspects of tax, estate, LLC/LLP and other business practices to help enjoy your lifestyle goals.

Estate PlanningYou've worked hard to grow your wealth and we want to help protect it. Our Family Office Resources specializes in ultra-high net-worth families and leveraging all aspects of tax, estate, LLC/LLP and other business practices to help enjoy your lifestyle goals.

Morgan Stanley Total Tax 365

Click here to view the Q4 Tax Savings for select UMAs in 2022 and 2023Risk Management & Investment Selection

Who likes paying taxes? No one. Being Portfolio Managers with a personalized plan in place, we can effectively manage your finances, minimize taxes, and make smart investment decisions.

Just as your lifestyle is ever changing, the investment portfolio should evolve with it. Risk management is key to minimizing market volatility in the unforeseen event of a large withdrawal. Utilizing our award winning risk analysis platform, Aladdin, we help to ease your overall risk to capture opportunistic timing.

Utilizing Experience with Firm Intellectual Capital

- Evaluating our Global Investment Committee’s Approved/Focus Lists, AAA 2.0, Risk, and Value Scoring measurements to align your ideal portfolio and goals

- With over +50years of experience, we screen individual investment product to customize your portfolio in order to achieve your goals

Location

888 Veterans Memorial Hwy

Ste 300

Hauppauge, NY 11788

US

Direct:

(631) 851-1685(631) 851-1685

101 Park Ave

New York, NY 10017

US

Meet The Harborview Group

About William R White

Securities Agent: HI, KY, SC, MI, IL, VI, VA, TN, NE, MT, MS, ME, IN, IA, CT, CO, RI, OH, NH, MD, LA, ID, FL, AK, WY, SD, NC, KS, DE, MA, AZ, VT, ND, CA, TX, PR, PA, NY, GA, AL, WA, NJ, DC, AR, UT, OR, NV, WV, WI, OK, NM, MO, MN; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1316476

NMLS#: 1316476

Contact William R White

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Kathleen Kowlessar

Kathleen Kowlessar is an Associate Private Banker serving Morgan Stanley Wealth Management offices in New York.

Associate Private Bankers partner with Private Bankers and Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Kathleen began her career in financial services in 2013, and joined Morgan Stanley in 2022. Prior to joining the firm, she was a Store Manager at the TD Bank.

Kathleen is a graduate of the Zicklin School of Business, Baruch College, where she received a Master of Science in Finance and a Bachelor of Business Administration in Business Management. She lives in Garden City, New York with her family. Outside of the office, Kathleen enjoys spending time with her family, cooking and trying new foods.

Associate Private Bankers partner with Private Bankers and Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Kathleen began her career in financial services in 2013, and joined Morgan Stanley in 2022. Prior to joining the firm, she was a Store Manager at the TD Bank.

Kathleen is a graduate of the Zicklin School of Business, Baruch College, where she received a Master of Science in Finance and a Bachelor of Business Administration in Business Management. She lives in Garden City, New York with her family. Outside of the office, Kathleen enjoys spending time with her family, cooking and trying new foods.

NMLS#: 1037493

About Mark Jansen

Mark Jansen is a Family Office Resources Generalist for Morgan Stanley’s Family Office Resources, covering the Southeast Region. In this capacity, Mark provides specialized expertise to Financial Advisors and their UHNW clients across a broad range of family wealth management issues including; family governance and wealth education, strategic estate and financial planning, philanthropy management and lifestyle advisory. Mark has over 30 years of experience advising wealthy families, business owners, and their children.

Most recently, Mark worked with New York Life in their Advanced Planning Group working with agents and their UHNW clients advising them on estate and legacy planning, business buy sell planning, and succession planning. Prior to New York Life, Mark held similar Advanced Planning Consulting roles in several National financial organizations. He originally started his career in the financial services industry in the tax department of the public accounting firm Grant Thornton. He is known for taking complex ideas and making them easy to understand. Frequently speaking to groups and individuals on estate and business planning, he brings a conversational style that helps to clarify the complex nature of these topics.

Mark received a Bachelor of Science degree from St. John’s University in Collegeville MN, received his JD degree Cum Laude from the University of Minnesota and his CPA license while working at Grant Thornton. He holds a Series 7, 24 and 63 securities licenses. He currently lives in Richmond Virginia with his wife and occasionally one of their 6 children.

Most recently, Mark worked with New York Life in their Advanced Planning Group working with agents and their UHNW clients advising them on estate and legacy planning, business buy sell planning, and succession planning. Prior to New York Life, Mark held similar Advanced Planning Consulting roles in several National financial organizations. He originally started his career in the financial services industry in the tax department of the public accounting firm Grant Thornton. He is known for taking complex ideas and making them easy to understand. Frequently speaking to groups and individuals on estate and business planning, he brings a conversational style that helps to clarify the complex nature of these topics.

Mark received a Bachelor of Science degree from St. John’s University in Collegeville MN, received his JD degree Cum Laude from the University of Minnesota and his CPA license while working at Grant Thornton. He holds a Series 7, 24 and 63 securities licenses. He currently lives in Richmond Virginia with his wife and occasionally one of their 6 children.

About Joe Saadi

Joseph Saadi is the Regional Trust Specialist for Morgan Stanley’s Central Region. Within the Trust Services Group, Joe is responsible for delivering the “Open Architecture” trustee platform, which consists of several unaffiliated third-party trust companies who serve in a fiduciary, agency or custodial role for high-net-worth and ultra-high-net-worth families. Joe and the Trust Services Group help Morgan Stanley Financial Advisors, clients, prospects and the professional community understand the corporate trustee services available through Morgan Stanley and how their corporate trustee partners provide fiduciary services to clients. The process involves reviewing trust documents and statements as well as analyzing family dynamics. Joe then uses this information to help clients select one or more of the Firm’s corporate trustee partners to possibly serve as trustee, co-trustee or administrative agent for client trust accounts.

Prior to joining the firm, Joe’s 30 years of legal and comprehensive wealth planning experience include positions as Managing Director at TIAA Trust Company, Market Trust Director at JP Morgan Trust Company, Trust & Estate Specialist at Merrill Lynch Trust Company, and District Attorney General at the Ohio Attorney General’s Office.

Joe obtained his Bachelor of Science in Business Administration degree from John Carroll University and his Juris Doctor from Cleveland-Marshall College of Law. Joe is a member of the State Bar of Ohio and holds his Series 7 and 66 licenses.

Prior to joining the firm, Joe’s 30 years of legal and comprehensive wealth planning experience include positions as Managing Director at TIAA Trust Company, Market Trust Director at JP Morgan Trust Company, Trust & Estate Specialist at Merrill Lynch Trust Company, and District Attorney General at the Ohio Attorney General’s Office.

Joe obtained his Bachelor of Science in Business Administration degree from John Carroll University and his Juris Doctor from Cleveland-Marshall College of Law. Joe is a member of the State Bar of Ohio and holds his Series 7 and 66 licenses.

Wealth Management

From Our Team

Overcoming Your 5 Biggest Retirement Challenges

Wealth Management

Global Investment Office

Portfolio Insights

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Ready to start a conversation? Contact The Harborview Group today.

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

12Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

13Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S, which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

12Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

13Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S, which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures

CRC 6491812 (04/2024)