Deanna Harnett, CDFA®

Industry Award Winner

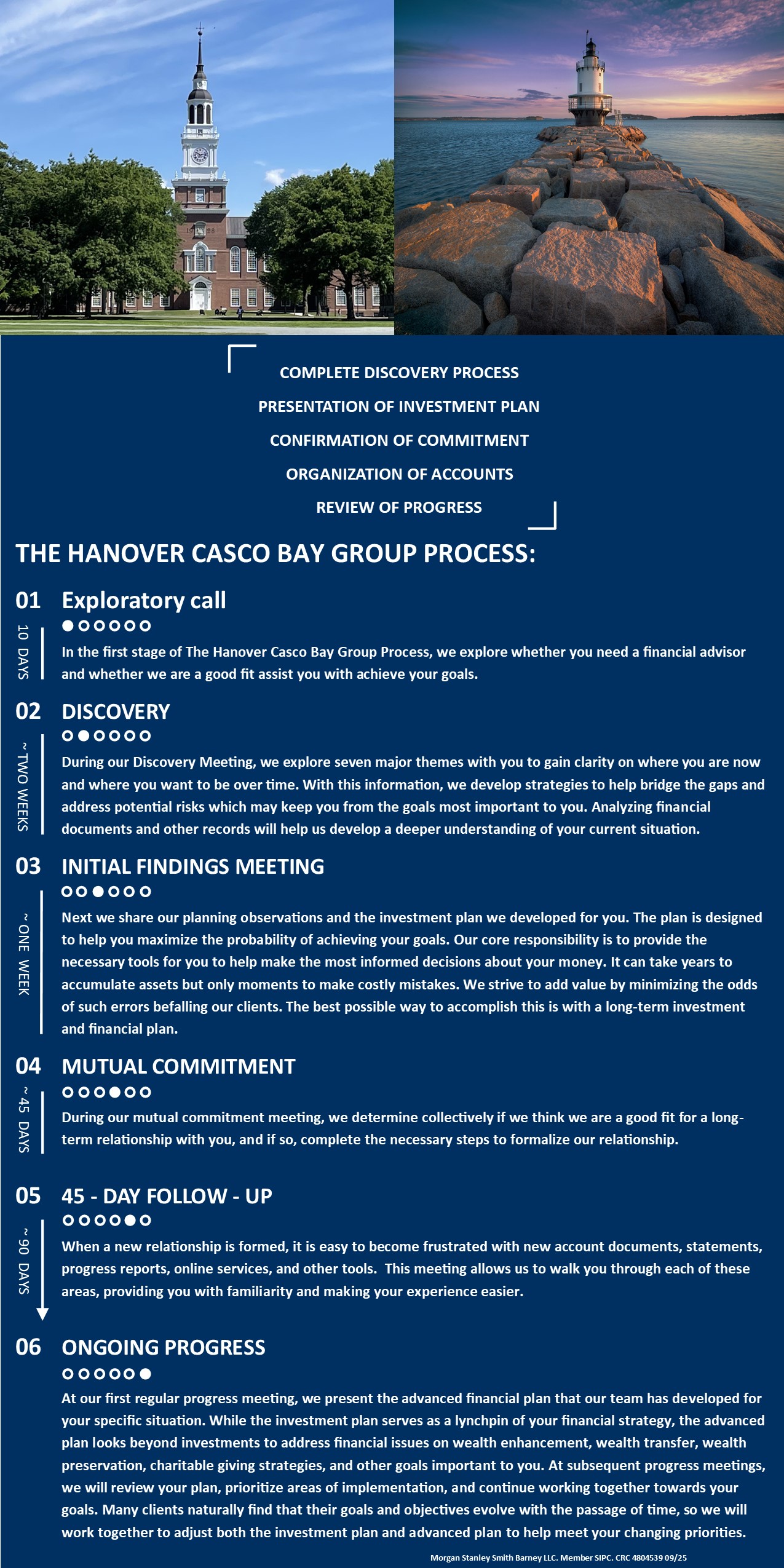

Industry Award WinnerAt The Hanover Casco Bay Group at Morgan Stanley, our mission drives every aspect of how we serve clients throughout the country from Hanover, NH and Portland, ME. Our team delivers objective, timely, thoughtful, comprehensive and tailored advice—supported by Morgan Stanley's global resources, technology, and deep institutional insight.

To fulfill our mission, we focus on five core concerns that often matter to successful individuals and families. These concerns shape our planning framework, guide our recommendations, and ensure that each strategy reflects your goals, values, and long-term vision.

How We Fulfill Our Mission: The Five Client Priorities

1. Wealth Preservation — Protecting What You've Built

Clients seek strategies that help ensure their wealth endures - supporting their lifestyles and long-term objectives through all market environments. We help preserve wealth by helping you make smart decisions about your money, disciplined investment management, risk-aligned portfolio construction, and protective strategies, including solutions such as alternative investments, sustainable investments, banking and insurance planning when appropriate. These services are foundational to the customized wealth management you receive.

2. Wealth Enhancement — Elevating After-Tax Outcomes-Tax Outcomes

Tax impact is one of the greatest headwinds to long-term wealth. While Morgan Stanley and its advisors do not provide tax advice, we collaborate with your independent tax professionals to help structure investment and cashflow strategies designed to minimize tax drag, improve efficiency, and enhance overall wealth outcomes. This lens supports your broader financial plan—from income strategies to investment selection to long-term distribution planning.

3. Wealth Transfer — Securing Your Legacy for Future Generations

For many families, prosperity is defined not only by what they build, but also by what they provide for the future. We help you collaborate with your attorneys, accountants and others to explore and implement estate planning strategies that reflect personal wishes, support heirs, and promote tax efficiency. Our team integrates these considerations into your overall plan so your wealth can create impact across generations.

4. Wealth Protection — Mitigating Major Risks

Successful individuals and families often face concerns about potential creditors, lawsuits, family complexity, and other threats to wealth. We help you consider risk mitigation approaches such as insurance solutions, business succession structures, and coordinated asset protection in collaboration with your legal professionals. For business owners, we integrate planning for continuity, buy-sell considerations, and risk management to help safeguard both family and enterprise capital.

5. Charitable Giving — Making an Impact Beyond Family

We support the development of philanthropic strategies that reflect personal values for clients who want their success to make a broader difference. From structuring meaningful giving approaches to helping align philanthropy with your long-term wealth plan, we ensure charitable intentions are thoughtfully incorporated.

The Result: A Mission Fulfilled Through Comprehensive, Personalized Service

By anchoring everything we do around these five essential client priorities, our team provides the clarity, structure, and multidisciplinary insight that help you build lasting prosperity. Supported by Morgan Stanley's capabilities and our award-winning, deeply experienced team, we deliver a wealth management experience designed for confidence, continuity, and long-term success.

Awards:

Disclosures:

Each quarter our team provides insights into the current economic and market situation and our expectations moving forward. In addition we provide some timely wealth management articles that cover many of the advanced planning issues we discuss with clients. Below are the most recent editions of Quarterly Insights.

Materials were originally created on the date referenced in each article and is provided for educational purposes only. The information is not current and should not be viewed or considered as investment advice or an investment strategy. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Morgan Stanley Wealth Management recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a Financial Advisor. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Past performance is no guarantee of future results.