About Philip Kenneth Lee

Phil has had a fascination with financial markets for as long as he can remember. His grandmother introduced him to stocks, just as her father had introduced her a generation earlier. When he graduated from Towson University with a degree in Finance, Phil knew exactly what profession he wanted to pursue.

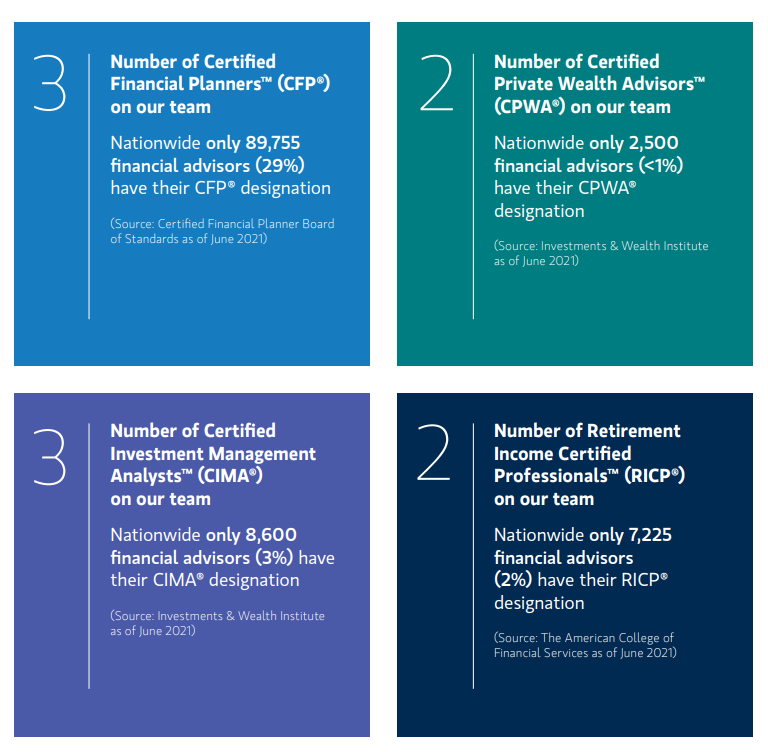

Phil joined a Morgan Stanley predecessor firm in 1998 and built a successful practice there and at UBS over the next 12 years. In 2001, he earned the prestigious Certified Financial Planner designation and met Matt May, Financial Advisor and Eric Brann, Financial Advisor two colleagues who would eventually become his teammates on The Fortis Group at Morgan Stanley.

The team was established in 2010 when Phil, Matt and Eric transitioned to Morgan Stanley. Today, Phil spearheads the team’s financial planning efforts, helping clients create personalized plans that go beyond their investment portfolios to address issues such as education funding, lending and insurance – in short, virtually every aspect of their financial lives.

Phil consciously strives to limit the team’s practice to a limited number of clients so he and his teammates can provide them with the attention they deserve. He is committed to proactive client communications and reaches out to every client on a regular basis, while staging educational events that help clients understand complex issues and make more informed financial decisions.

Brought up in Columbia, Maryland, Phil is an active member of his community. He has long been affiliated with The Rotary Club’s Hunt Valley chapter and is an avid supporter of The Shriners Hospital. When not working for his clients and community, Phil bikes, golfs, works out and spends as much time as he can with his wife Mary, daughter Theresa and his two grandchildren.

Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please visit us at http://www.morganstanleyindividual.com or consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

303 International Drive, Suite 500 Hunt Valley, MD 21030, 410 229-8200

Investments and services offered through Morgan Stanley Smith Barney LLC. Member SIPC.

Securities Agent: MI, HI, GA, FL, IL, ME, NV, DE, DC, CA, NJ, NC, TX, PA, MN, CO, MO, KS, IA, AZ, OH, NY, LA, CT, WI, MD, AR, VA, SC, NH, MA, IN, VT, PR; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1268239

Industry Award Winner

Industry Award Winner