About Brian Morgan

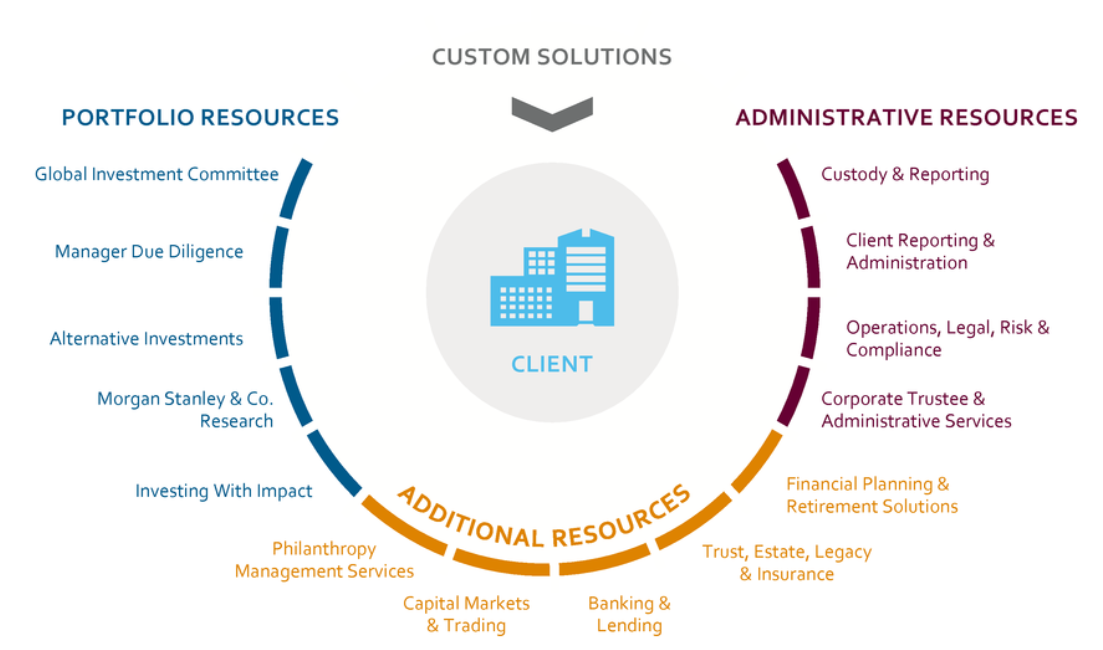

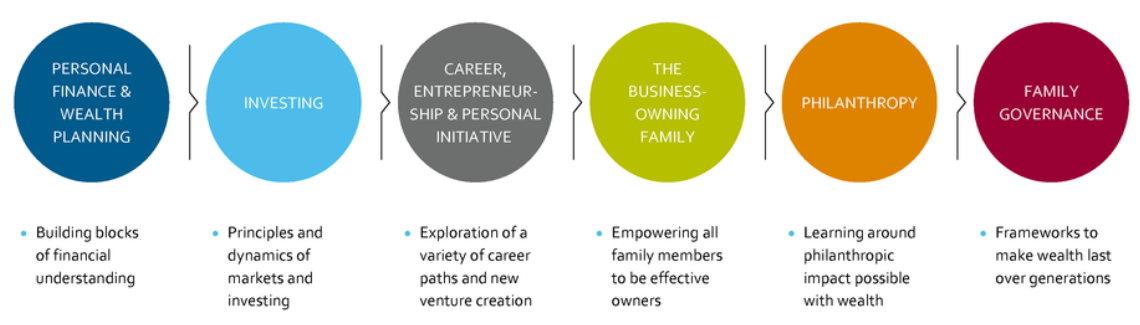

Brian joined Morgan Stanley in 2013 as an analyst in the Firm’s Global Capital Markets group in New York City, specializing in fixed income and asset-backed securitization as well as corporate strategy and pension solutions. In 2015 he moved to the Bay Area to join the Menlo Park Complex as a business development manager where he worked closely with a number of advisory teams focusing on 10b5-1 stock plans, concentrated equity strategies, holistic asset management for high net worth families and organizations, and organic business growth. He went on to become the Regional Sales Director for the Pacific Coast region for Morgan Stanley’s Portfolio Solutions Group which focused on creating tailored equity and fixed income strategies and scalable investment solutions for advisors throughout the region and interfaced directly with the portfolio management teams in Morgan Stanley’s Investment Management division.

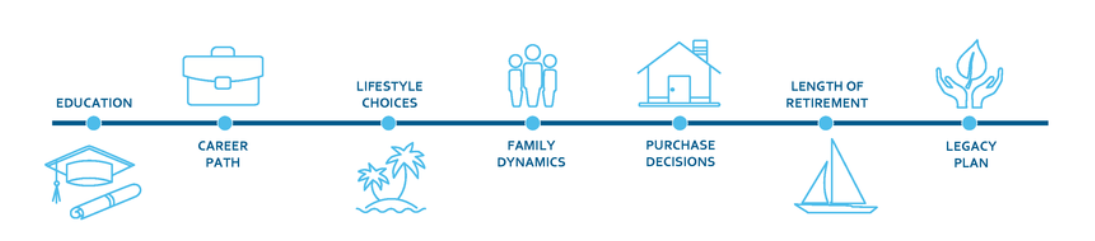

Brian’s interest in financial services began during his time in the United States Marine Corps, where he volunteered to become a Command Financial Specialist in addition to his primary responsibilities as a combat aircrewman on the KC-130J. Like many young men and women, Brian enlisted directly after graduating from high school and he observed firsthand the importance of increasing financial literacy within the junior enlisted ranks, especially during and after his deployment to Iraq in 2007. This grew into a focus on helping Marines and their families across all ranks with their transition back into the civilian sector through financial planning and continued until he was honorably discharged in 2008. The desire to have a more focused and personal impact by working directly with individual clients and families culminated with his addition to the Crystal Springs Group as a financial advisor in 2020.

Brian graduated from Columbia University with a B.A. in Political Science in 2013 and was named to the Forbes Top Next-Gen Wealth Advisors Best-in-State list for 2023* as well as the Forbes Best-in-State Wealth Management Team list for 2023 and 2024**. He continues to volunteer his time working with veteran mentorship and development organizations and is an active member of the Columbia Military Veteran alumni community. In his spare time he enjoys riding his motorcycle, hiking with his dog, and improving his patience through woodworking projects in his shop in the Oakland Hills.

* 2023 Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State

Source: Forbes.com (Awarded Aug 2023) Data compiled by SHOOK Research LLC based on time period from 3/31/22 - 3/31/23.

** 2023 and 2024 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded 2023 and 2024). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Securities Agent: FL, CT, CO, CA, NM, DC, WY, UT, PR, NJ, NH, MD, VT, OK, NC, IL, ID, HI, GA, AL, AK, VA, PA, NV, ND, MO, MA, OH, MN, IA, AZ, RI, OR, NE, KY, WA, NY, MS, ME, AR, WV, WI, TX, SC, MI, DE, VI, MT, LA, KS, IN, SD; General Securities Representative; Investment Advisor Representative

NMLS#: 1990786