The Sizemore Cornett Zech Group at Morgan Stanley

Our Mission Statement

Transparent investment strategies tailored for your financial objectives.

About Us

The Sizemore Cornett Zech Group at Morgan Stanley is positioned to offer clients exceptional level of service, and to provide tailored strategies to help meet specific investment goals.

We consult with our clients' dedicated tax and legal professionals in order to navigate the ever-evolving roadmap necessary to help achieve various financial milestones and to help preserve customer assets for the next generation or philanthropic purpose.

We consult with our clients' dedicated tax and legal professionals in order to navigate the ever-evolving roadmap necessary to help achieve various financial milestones and to help preserve customer assets for the next generation or philanthropic purpose.

Services Include

- Wealth ManagementFootnote1

- 401(k) Rollovers

- 529 PlansFootnote2

- Alternative InvestmentsFootnote3

- Asset Management

- Business PlanningFootnote4

- Cash Management and Lending ProductsFootnote5

- Endowments and FoundationsFootnote6

- Estate Planning StrategiesFootnote7

- Executive Financial ServicesFootnote8

- Financial PlanningFootnote9

- Fixed IncomeFootnote10

- Planning for Education FundingFootnote11

- Retirement PlanningFootnote12

- Trust AccountsFootnote13

- Wealth Consulting

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

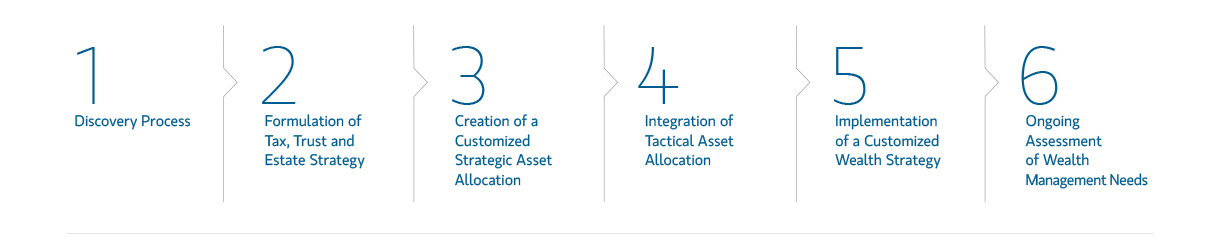

Our Approach

Discovery Process

Investing the time to learn about you and your family; your assets and liabilities and the risk exposures, enables us to formulate strategies and customize the relationship to your needs.

Formulation of Tax, Trust and Estate Strategy

Working with your tax and legal advisors, we help analyze your income and estate tax circumstances to identify and tailor planning techniques that may be used to address your objectives.

Creation of Customized Strategic Asset Allocation

Your customized asset allocation reflects risk, opportunities and taxation across multiple entities, while integrating your investing and estate plans.

Integration of Tactical Asset Allocation

Short-term adjustments seek to capitalize on temporary market distortions. Before making adjustments, we analyze the impact of taxes and trading costs on potential returns.

Implementation of a Customized Wealth Strategy

After comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform.

Ongoing Assessment

In coordination with your other advisors, we can conduct ongoing reviews and comprehensive reporting to ensure that your strategy adapts to changing financial and family needs.

Location

3801 PGA Boulevard

Suite 700

Palm Beach Gardens, FL 33410

US

Direct:

(561) 776-6472(561) 776-6472

Meet The Sizemore Cornett Zech Group

About Fred Cornett

Fred Cornett began his financial advisory career in 1983 with Merrill Lynch. Focusing on tax-free bonds and individual stock selection, his business quickly evolved and he was asked to join Prudential-Bache in Stuart, Florida in 1986. He enjoyed a long tenure with Prudential-Bache and its successor firm, Prudential Securities, before moving to Palm Beach Gardens to enroll his children in The King’s Academy, a private Christian school, and joining Morgan Stanley in 1999. He taught investment classes for more than 20 years in the Martin County Adult Education program and was one of the original founders of the Jensen Beach Florida Little League, coaching 23 teams of boys’ baseball and girls’ softball. He became a Certified Financial Planner in 1997, and concentrates on business, personal, estate and philanthropic planning.

Fred is a Morgan Stanley Senior Portfolio Management Director who designs investment portfolios that are tax efficient and easy for the client to understand and follow. He holds both a bachelor’s and master’s degree from Western Kentucky University. He and his wife, Susan, reside in Palm Beach Gardens and are involved with several community endeavors.

Fred is a Morgan Stanley Senior Portfolio Management Director who designs investment portfolios that are tax efficient and easy for the client to understand and follow. He holds both a bachelor’s and master’s degree from Western Kentucky University. He and his wife, Susan, reside in Palm Beach Gardens and are involved with several community endeavors.

Securities Agent: NC, MT, AZ, GA, PA, NY, HI, VT, OR, OH, ME, KY, VA, UT, NJ, CT, AL, NH, ID, FL, DE, CA, TN, MA, IL, WA, MO, MI, DC, TX, SC, NV, MN, MD, CO, RI; General Securities Representative; Investment Advisor Representative

NMLS#: 1285358

NMLS#: 1285358

About Dave Cornett

Dave Cornett’s career began in ministry, where he served as an ordained minister in Palm Beach Gardens, FL. In this role, he developed strong leadership and coaching skills while managing large teams of volunteers and students. Dave played a key role in the expansion of one of the largest multi-campus churches in the U.S., contributing to the creation and growth of nine medium to large-sized congregations in South Florida, which collectively drew around 10,000 attendees each week by the end of 2016.

In 2007, Dave transitioned to the financial sector, joining Morgan Stanley as a Financial Advisor alongside his father, Fred Cornett. Despite navigating one of the most challenging financial periods in U.S. history, Dave and his father achieved significant business growth. Dave continued to balance his financial career with ministry, consulting for a large local church in 2010. By 2012, he made the decision to return to full-time ministry, motivated by a deep conviction to serve his community.

In 2017, Dave’s career took a new direction when he joined Chick-fil-A to lead the early market adoption in New York City. He oversaw human resources, administration, and operations for the second Chick-fil-A store in Manhattan. After the birth of his son in 2019, Dave and his family relocated back to South Florida, where he continued in hospitality as a General Manager for Chick-fil-A. His leadership led to a remarkable 60% sales growth until he retired from hospitality in 2023.

Dave rejoined Morgan Stanley in 2023 as a Financial Advisor with The Cornett Group, where he now applies his extensive experience to help clients achieve their financial goals. A Belmont University alumnus with a Bachelor of Business Administration, Dave is also a multi-instrumentalist and music producer, having collaborated with notable talent in the music industry. Residing alongside his wife Jess and their two children, Dave is active in his community, supporting various causes and enjoying water sports.

In 2007, Dave transitioned to the financial sector, joining Morgan Stanley as a Financial Advisor alongside his father, Fred Cornett. Despite navigating one of the most challenging financial periods in U.S. history, Dave and his father achieved significant business growth. Dave continued to balance his financial career with ministry, consulting for a large local church in 2010. By 2012, he made the decision to return to full-time ministry, motivated by a deep conviction to serve his community.

In 2017, Dave’s career took a new direction when he joined Chick-fil-A to lead the early market adoption in New York City. He oversaw human resources, administration, and operations for the second Chick-fil-A store in Manhattan. After the birth of his son in 2019, Dave and his family relocated back to South Florida, where he continued in hospitality as a General Manager for Chick-fil-A. His leadership led to a remarkable 60% sales growth until he retired from hospitality in 2023.

Dave rejoined Morgan Stanley in 2023 as a Financial Advisor with The Cornett Group, where he now applies his extensive experience to help clients achieve their financial goals. A Belmont University alumnus with a Bachelor of Business Administration, Dave is also a multi-instrumentalist and music producer, having collaborated with notable talent in the music industry. Residing alongside his wife Jess and their two children, Dave is active in his community, supporting various causes and enjoying water sports.

Securities Agent: VT, OR, MT, ID, FL, NY, MO, WA, NC, ME, CT, CA, TX, MA, IL, CO, UT, PA, NH, DE, AZ, SC, NV, TN, KY, AL, GA, VA, MN, RI, OH, NJ, MI, MD, HI, DC; General Securities Representative; Investment Advisor Representative

NMLS#: 2611919

NMLS#: 2611919

About Barbara Zech

Understanding the intricate financial needs of successful business owners, top-tier executives, and retirees, Barbara is dedicated to guiding her clients through pivotal financial decisions. Her experience isn't confined to U.S. shores; with connections to International Wealth Managers, she can provide insights for globally-diverse portfolios. Whether you're an individual with substantial wealth, a growing family, or a thriving business, rest assured your financial ambitions are held in strict confidence and addressed by Barbara with tailored precision.

Having transitioned from the field of law to the bustling world of Wall Street, Barbara's diverse experience grants her a unique edge. Since joining Morgan Stanley in Palm Beach Gardens in 1995, she's diligently integrated her extensive educational foundation in Law, Finance, and Business into crafting financial strategies for her clients. With accolades like CIMA® from the Wharton School and CPWA® from the University of Chicago, Barbara ensures your wealth management is grounded in elite industry knowledge. Her primary objective? To perfectly align with your specific financial goals, ensuring security and catering to multi-faceted asset objectives.

For those who prioritize philanthropy and faith-based financial guidance, Barbara's Christian Kingdom Advisor (CKA®) certification is a testament to her dedication in serving those very goals. She actively gives back to her community, holding significant positions at the First Presbyterian Church and partnering with various animal welfare organizations.

Beyond the world of finance, Barbara's passion for international travel, arts, and physical well-being enriches her worldview, allowing her to connect with clients on many levels. Barbara's dedication and experience have been acknowledged through several accolades. She was a member of the Morgan Stanley President’s Club from 1997-2012, The Master’s Club from 2013-2021, and was invited to the Barron’s top 100 Women’s Summit from 2007-2022. Furthermore, she was recognized as one of FORBES Top Women Wealth Advisors in 2021, 2022, 2023, 2024 and 2025 by Shook Research. Over the years, these consistent recognitions underline her commitment to excellence in the financial world.

In essence, Barbara isn't just your Wealth Advisor; she's here to work with you in realizing your financial aspirations with utmost integrity, confidentiality, and skilled focus.

2021-2025 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors) Source: Forbes.com (Awarded 2021-2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

Barbara Zech in addition to the award recipients, was one of several hundred financial advisors who were selected by their firms to attend the annual Barron’s Top Women Advisors Summit, hosted by Barron’s magazine to promote best practices in the industry and the value of advice to the investing public. The invitation-only conference was held at The Breakers in Palm Beach, FL and virtually. This exclusive conference is designed to promote best practices and generate new ideas across the industry. Participants attended workshops, many led by the Top 100 Women Financial Advisors, that explored current issues ranging from business development ideas through managing high-net-worth accounts and families to portfolio management and retirement planning

Morgan Stanley has no affiliation with Kingdom Advisors and the CKA® designation is not overseen or endorsed by the Firm. Morgan Stanley does not discriminate on the basis of any protected status, and welcomes clients and provides investment advisory services without regard to religious affiliation. For more information about the designation, please see: https://kingdomadvisors.com/association/designation/overview

2023 and 2024 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2023 and 2024) Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

https://www.morganstanley.com/disclosures/awards-disclosure.html

Having transitioned from the field of law to the bustling world of Wall Street, Barbara's diverse experience grants her a unique edge. Since joining Morgan Stanley in Palm Beach Gardens in 1995, she's diligently integrated her extensive educational foundation in Law, Finance, and Business into crafting financial strategies for her clients. With accolades like CIMA® from the Wharton School and CPWA® from the University of Chicago, Barbara ensures your wealth management is grounded in elite industry knowledge. Her primary objective? To perfectly align with your specific financial goals, ensuring security and catering to multi-faceted asset objectives.

For those who prioritize philanthropy and faith-based financial guidance, Barbara's Christian Kingdom Advisor (CKA®) certification is a testament to her dedication in serving those very goals. She actively gives back to her community, holding significant positions at the First Presbyterian Church and partnering with various animal welfare organizations.

Beyond the world of finance, Barbara's passion for international travel, arts, and physical well-being enriches her worldview, allowing her to connect with clients on many levels. Barbara's dedication and experience have been acknowledged through several accolades. She was a member of the Morgan Stanley President’s Club from 1997-2012, The Master’s Club from 2013-2021, and was invited to the Barron’s top 100 Women’s Summit from 2007-2022. Furthermore, she was recognized as one of FORBES Top Women Wealth Advisors in 2021, 2022, 2023, 2024 and 2025 by Shook Research. Over the years, these consistent recognitions underline her commitment to excellence in the financial world.

In essence, Barbara isn't just your Wealth Advisor; she's here to work with you in realizing your financial aspirations with utmost integrity, confidentiality, and skilled focus.

2021-2025 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors) Source: Forbes.com (Awarded 2021-2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

Barbara Zech in addition to the award recipients, was one of several hundred financial advisors who were selected by their firms to attend the annual Barron’s Top Women Advisors Summit, hosted by Barron’s magazine to promote best practices in the industry and the value of advice to the investing public. The invitation-only conference was held at The Breakers in Palm Beach, FL and virtually. This exclusive conference is designed to promote best practices and generate new ideas across the industry. Participants attended workshops, many led by the Top 100 Women Financial Advisors, that explored current issues ranging from business development ideas through managing high-net-worth accounts and families to portfolio management and retirement planning

Morgan Stanley has no affiliation with Kingdom Advisors and the CKA® designation is not overseen or endorsed by the Firm. Morgan Stanley does not discriminate on the basis of any protected status, and welcomes clients and provides investment advisory services without regard to religious affiliation. For more information about the designation, please see: https://kingdomadvisors.com/association/designation/overview

2023 and 2024 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2023 and 2024) Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

https://www.morganstanley.com/disclosures/awards-disclosure.html

Securities Agent: WA, GA, CT, TN, VT, OH, NY, NC, MT, VA, CA, UT, RI, OR, NV, NH, MA, CO, AL, PA, MI, AZ, MN, DE, IL, MO, ME, FL, KY, MD, DC, ID, HI, TX, SC, NJ; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1261806

NMLS#: 1261806

About Preston Sizemore

Securities Agent: MO, KY, TX, NY, HI, CO, VA, GA, NJ, SC, FL, DC, CT, RI, OH, MI, MA, WA, AL, PA, OR, IL, NH, MT, UT, NV, AZ, MD, CA, VT, ID, NC, DE, TN, MN, ME; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1339267

NMLS#: 1339267

About Joan Lally

Joan is the Portfolio Associate for The Sizemore, Cornett, Zech, Group. She has been with Morgan Stanley since 2000 and in the financial services industry since 1997. Her primary responsibilities with the Cornett Bendele Group are to offer our clients excellent, personalized customer service, to reinforce our client relationships, and to handle our day-to-day administrative operations. Joan holds her Series 7 and 66 licenses.

Joan was born and raised in Rhode Island, earned her Bachelor of Science from the University of Rhode Island, and is an avid Red Sox fan. She has been a Florida resident for 43 years and resides in Palm Beach Gardens.

Joan was born and raised in Rhode Island, earned her Bachelor of Science from the University of Rhode Island, and is an avid Red Sox fan. She has been a Florida resident for 43 years and resides in Palm Beach Gardens.

Contact Fred Cornett

Contact Dave Cornett

Contact Barbara Zech

Contact Preston Sizemore

Wealth Management

From Our Team

5 Steps to Create a Budget

Wealth Management

Global Investment Office

Portfolio Insights

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Iran Conflict: Seven Takeaways for Investors

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Ready to start a conversation? Contact The Sizemore Cornett Zech Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

3Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

10Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

11When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

12When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

3Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

10Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

11When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

12When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)