The Coplin Wealth Management Group at Morgan Stanley

Direct:

(239) 449-7855(239) 449-7855

Toll-Free:

(800) 237-8686(800) 237-8686

Industry Award Winner

Industry Award WinnerOur Mission Statement

Understanding the unique needs of high net worth clients like you

Family Wealth Directors

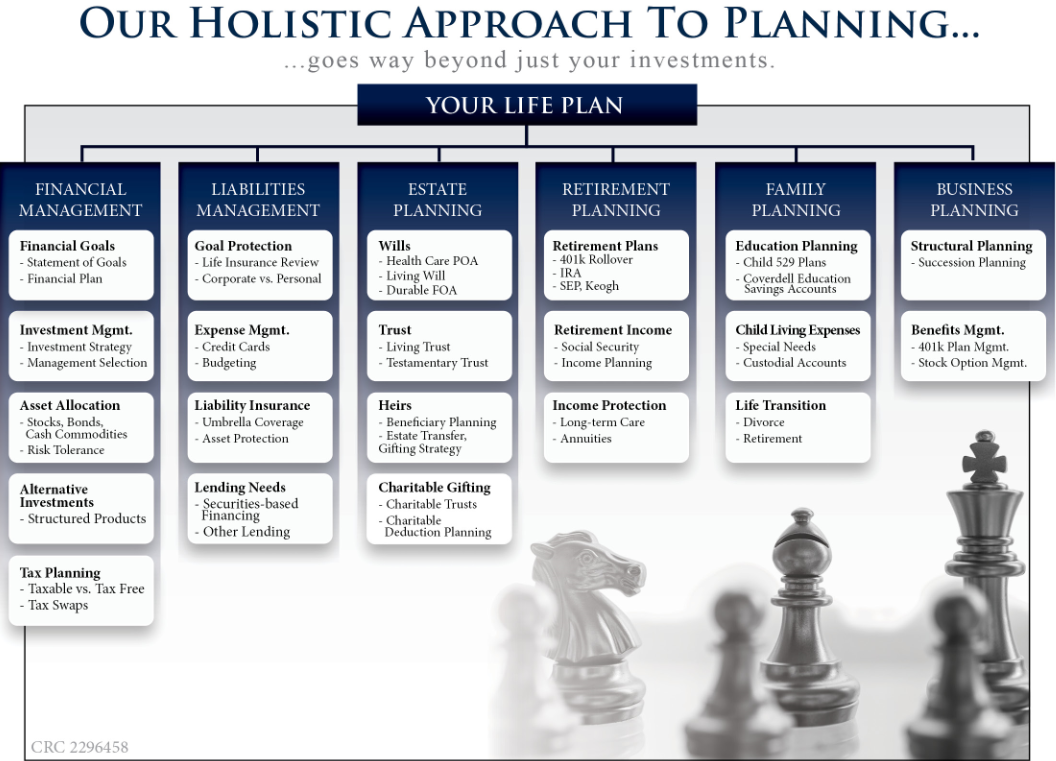

The Coplin Wealth Management Group at Morgan Stanley is a boutique financial advisory team that acts as a family office for ultra-high net worth clients. It focuses on delivering personalized answers for complex financial situations that often come with sizeable estates. Through holistic financial planning, exceptional client service, and customized investment strategies, the team strives to provide each client with an optimal wealth management experience.

As a multi-skilled team, they offer a full range of services including life insurance, estate planning strategies, 401K, endowment, employee stock options management, tax-efficient investment solutions and customized traditional asset allocation-based portfolios. Its nimble, widespread talent base also has a depth of experience in private equity and hedge funds. In constructing tailor-made portfolios, the team draws upon the full breadth of the Morgan Stanley tools and resources to provide clients with solutions to meet their investment and estate planning objectives.

The Coplin Wealth Management Group is the only Morgan Stanley group in Southwest Florida to be exclusively comprised of two CERTIFIED FINANCIAL PLANNER™ professionals, two Portfolio Managers, one Insurance Planning Director, and one Family Wealth Director. With the assistance of an experienced and licensed Group Director, Ashley, and a Client Service Associate, Michell, the group provides each client with outstanding day-to-day service and care.

In managing client’s portfolios, The Coplin Wealth Management Group at Morgan Stanley lives by the motto “it is not just about what you earn, but what you keep that matters” and emphasizes the importance of tax efficiency and net returns.

As a multi-skilled team, they offer a full range of services including life insurance, estate planning strategies, 401K, endowment, employee stock options management, tax-efficient investment solutions and customized traditional asset allocation-based portfolios. Its nimble, widespread talent base also has a depth of experience in private equity and hedge funds. In constructing tailor-made portfolios, the team draws upon the full breadth of the Morgan Stanley tools and resources to provide clients with solutions to meet their investment and estate planning objectives.

The Coplin Wealth Management Group is the only Morgan Stanley group in Southwest Florida to be exclusively comprised of two CERTIFIED FINANCIAL PLANNER™ professionals, two Portfolio Managers, one Insurance Planning Director, and one Family Wealth Director. With the assistance of an experienced and licensed Group Director, Ashley, and a Client Service Associate, Michell, the group provides each client with outstanding day-to-day service and care.

In managing client’s portfolios, The Coplin Wealth Management Group at Morgan Stanley lives by the motto “it is not just about what you earn, but what you keep that matters” and emphasizes the importance of tax efficiency and net returns.

Services Include

- Wealth ManagementFootnote1

- Endowments and FoundationsFootnote2

- Estate Planning StrategiesFootnote3

- Executive Financial ServicesFootnote4

- Lending Products

- Life InsuranceFootnote5

- Long Term Care InsuranceFootnote6

- Professional Portfolio ManagementFootnote7

- Alternative InvestmentsFootnote8

- AnnuitiesFootnote9

- Exchange Traded FundsFootnote10

- Fixed IncomeFootnote11

- Philanthropic Services

- Trust AccountsFootnote12

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Location

8889 Pelican Bay Blvd

Ste 300

Naples, FL 34108

US

Direct:

(239) 449-7855(239) 449-7855

Toll-Free:

(800) 237-8686(800) 237-8686

Meet The Coplin Wealth Management Group

About Steven M. Coplin

Steven Coplin is Senior Portfolio Manager, Family Wealth Director, and Founder and leader of The Coplin Wealth Management Group. With 30 years of experience in the financial industry, Steven has created a streamlined Wealth Management approach that caters to the wide-ranging and complex financial needs of high and ultra-high net-worth individuals, families, and institutions. In addition to providing highly customized financial solutions, Steven builds globally diversified portfolios with a goal of producing competitive risk-adjusted performance based on each client's unique goals.

Steven is also one of the few advisors to have earned the distinction of Family Wealth Director, allowing him direct access to Morgan Stanley’s Family Wealth Advisory Services. In managing client's portfolios, Steven lives by the motto "it is not just about what you earn, but what you keep that matters" and emphasizes the importance of tax efficiency and net returns.

A big fan of various sports and music, Steven plays guitar and is a recording artist who released his first album on apple music and Spotify in summer of 2018. He loves to travel and spend time with his wife and four children.

Steven also supports the Naples Senior Center and St. Jude Children’s Hospital.

Steven is also one of the few advisors to have earned the distinction of Family Wealth Director, allowing him direct access to Morgan Stanley’s Family Wealth Advisory Services. In managing client's portfolios, Steven lives by the motto "it is not just about what you earn, but what you keep that matters" and emphasizes the importance of tax efficiency and net returns.

A big fan of various sports and music, Steven plays guitar and is a recording artist who released his first album on apple music and Spotify in summer of 2018. He loves to travel and spend time with his wife and four children.

Steven also supports the Naples Senior Center and St. Jude Children’s Hospital.

Securities Agent: NC, AK, AL, AZ, CA, CO, CT, DC, FL, GA, ID, IL, IN, KS, KY, MA, MD, ME, MI, MN, MO, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WY, DE; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1279000

CA Insurance License #: 4128177

NMLS#: 1279000

CA Insurance License #: 4128177

About Ryan M. Sherman

Ryan M. Sherman has been in the financial industry for over 15 years. As a Financial Advisor, Portfolio Manager and Dedicated Equity Plan Specialist, Ryan has a disciplined approach to managing portfolios with his main focus on studying trends that shape the investment environment, drive the economy and ultimately impact clients' performance.

Delivering extensive up-to-date research and information, Ryan works closely with the team to create customized investment strategies, portfolios and solutions and is responsible for continuously monitoring investment performance.

Ryan is also a CERTIFIED FINANCIAL PLANNER™ and Certified Exit Planning Advisor, and focuses on creating comprehensive financial plans for ultra-high net worth clients and business owners, concentrating on risk management, investments, tax planning and estate planning.

Prior to joining Morgan Stanley, Ryan spent two years in Vienna, Austria doing humanitarian work. Born and raised in Florida, Ryan moved to Naples with his wife, Heather, in 2010. During his free time, Ryan enjoys playing with his 6 year old son Owen and 2 year old son Miles, as well as boating, fishing and college football.

Delivering extensive up-to-date research and information, Ryan works closely with the team to create customized investment strategies, portfolios and solutions and is responsible for continuously monitoring investment performance.

Ryan is also a CERTIFIED FINANCIAL PLANNER™ and Certified Exit Planning Advisor, and focuses on creating comprehensive financial plans for ultra-high net worth clients and business owners, concentrating on risk management, investments, tax planning and estate planning.

Prior to joining Morgan Stanley, Ryan spent two years in Vienna, Austria doing humanitarian work. Born and raised in Florida, Ryan moved to Naples with his wife, Heather, in 2010. During his free time, Ryan enjoys playing with his 6 year old son Owen and 2 year old son Miles, as well as boating, fishing and college football.

Securities Agent: WY, WI, WA, VT, VA, UT, TX, TN, SD, SC, RI, PA, OR, OK, DE, FL, GA, ID, IL, IN, AK, AL, AZ, CA, CO, CT, KS, KY, MA, MD, ME, MI, MN, MO, NC, NH, NJ, NM, NV, NY, DC, OH; General Securities Representative; Investment Advisor Representative

NMLS#: 1278614

NMLS#: 1278614

About Caroline A. Coplin

As a Financial Planning Specialist, Caroline has focused her talents on providing strategies dealing with education planning, liability management, retirement planning, and asset allocation. She is committed to helping clients understand the interconnected nature of investments, insurance, retirement and estate planning and in helping them accomplish the financial goals they have set for themselves.

As a Financial Advisor member of The Coplin Wealth Management Group at Morgan Stanley, Caroline works closely with Steven and Ryan in the design and implementation of customized wealth management strategies and is responsible for ensuring the efficiency of the practice. Caroline was named a Southwest Florida Five Star Wealth Manager by Gulfshore Life Magazine every year for the past seven years (2015-2021).

Caroline has an MBA in Finance and a BS degree with a major in Finance from Florida Gulf Coast University. She has obtained her Series 7, 66 & 31 licenses as well as her insurance license, is a CERTIFIED FINANCIAL PLANNER™ professional, and has met the CFP Board's education, examination and experience requirements.

Caroline is originally from the south of France and moved to Naples, FL in the year 2000. In her spare time, Caroline enjoys spending time with her family, traveling, cooking and bike riding.

As a Financial Advisor member of The Coplin Wealth Management Group at Morgan Stanley, Caroline works closely with Steven and Ryan in the design and implementation of customized wealth management strategies and is responsible for ensuring the efficiency of the practice. Caroline was named a Southwest Florida Five Star Wealth Manager by Gulfshore Life Magazine every year for the past seven years (2015-2021).

Caroline has an MBA in Finance and a BS degree with a major in Finance from Florida Gulf Coast University. She has obtained her Series 7, 66 & 31 licenses as well as her insurance license, is a CERTIFIED FINANCIAL PLANNER™ professional, and has met the CFP Board's education, examination and experience requirements.

Caroline is originally from the south of France and moved to Naples, FL in the year 2000. In her spare time, Caroline enjoys spending time with her family, traveling, cooking and bike riding.

Securities Agent: WY, WI, WA, VA, UT, TX, TN, SD, SC, RI, OH, NY, NM, OK, NJ, NH, OR, NC, MO, MN, MI, ME, MD, MA, KY, PA, KS, IN, VT, IL, ID, GA, FL, DC, AZ, AK, AL, CO, CA, DE, CT, NV; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1278688

CA Insurance License #: 4128175

NMLS#: 1278688

CA Insurance License #: 4128175

About Lynette J. Susi

Lynette is a Financial Planning Specialist and Financial Advisor with the Coplin Wealth Management Group. Her career in finance was inspired by the 2008 financial crisis, when her family sustained devastating losses due to a lack of proper financial guidance. With over 11 years of experience in the financial industry, she understands what is required to be successful in long range planning and the importance of financial integrity for clients and their families.

Lynette’s focus is crafting financial plans for clients using a holistic approach by factoring in tax, legal, and risk considerations. Upon identifying opportunities to enhance a client’s existing financial affairs, Lynette works with the team in implementing wide range investment and wealth management strategies designed for high net worth individuals.

Lynette is an avid runner and triathlete, and volunteers at the local animal shelter in her spare time.

Lynette’s focus is crafting financial plans for clients using a holistic approach by factoring in tax, legal, and risk considerations. Upon identifying opportunities to enhance a client’s existing financial affairs, Lynette works with the team in implementing wide range investment and wealth management strategies designed for high net worth individuals.

Lynette is an avid runner and triathlete, and volunteers at the local animal shelter in her spare time.

Securities Agent: FL, WA, NY, MO, IN, CT, AL, WI, OR, OH, KS, DE, CO, AK, CA, WY, TX, KY, IL, GA, TN, NC, MN, DC, PA, NH, MS, ME, VA, OK, NV, NJ, MD, AZ, VT, ID, UT, SD, SC, RI, MI, NM, MA; General Securities Representative; Investment Advisor Representative

NMLS#: 834009

CA Insurance License #: 4128176

NMLS#: 834009

CA Insurance License #: 4128176

About Ashley M. Gegenwarth

Ashley Gegenwarth drives and guides the team’s operations on a day-to-day basis, seeking to ensure Morgan Stanley’s platform is maximized to best serve its clients. She also provides administrative oversight support to clients, their families, and to the Financial Advisors and Support Professionals of The Coplin Wealth Management Group. She works closely with the Financial Advisors on the execution of the team’s strategic business plan.

Ashley joined Morgan Stanley in December 2016 as a Registered Service Associate and was promoted to Southwest Florida’s Complex Administrator in 2019. In addition to Registered Service Associate and Complex Administrator, she has served as a Client Service Associate Coach and has represented the Southwest Florida Complex in the Firm’s sponsored Leadership Readiness Program. Before joining Morgan Stanley, she started as a Registered Client Service Associate at Raymond James in 2013.

Ashley earned a Bachelor’s degree in Finance with a concentration in Financial Analysis and Management from Florida Gulf Coast University in May 2016. She was born in York, Pennsylvania and raised in Naples, Florida where she currently resides. In her free time, she enjoys boating, live music, traveling to a new destination each year, an infrared Pilates class, and most of all, spending time with her Cocker Spaniel Husky mix named Forrest.

Ashley is Series 7, 66, and FL 2-15 insurance licensed.

Ashley joined Morgan Stanley in December 2016 as a Registered Service Associate and was promoted to Southwest Florida’s Complex Administrator in 2019. In addition to Registered Service Associate and Complex Administrator, she has served as a Client Service Associate Coach and has represented the Southwest Florida Complex in the Firm’s sponsored Leadership Readiness Program. Before joining Morgan Stanley, she started as a Registered Client Service Associate at Raymond James in 2013.

Ashley earned a Bachelor’s degree in Finance with a concentration in Financial Analysis and Management from Florida Gulf Coast University in May 2016. She was born in York, Pennsylvania and raised in Naples, Florida where she currently resides. In her free time, she enjoys boating, live music, traveling to a new destination each year, an infrared Pilates class, and most of all, spending time with her Cocker Spaniel Husky mix named Forrest.

Ashley is Series 7, 66, and FL 2-15 insurance licensed.

About Biagio Delboccio

Biagio started his career at Morgan Stanley as an Intern in 2023. After graduating from the University of South Florida with a Bachelor's degree in Finance, Biagio rejoined Morgan Stanley in August 2024 as a Client Service Associate. Now a Registered Client Service Associate, Biagio works alongside the Coplin Wealth Management Group to support daily operations and drive excellence in customer support. Prior to Morgan Stanley, Biagio held a role at Allstate in the insurance division.

Born and raised in Naples, FL, Biagio is a true Southwest Florida local. He is a classically trained pianist who has been playing since the age of 4. In his free time, he also loves to play the guitar, read, travel, and spend time with his friends and family.

Biagio is Series 7, 66, and FL 2-15 insurance licensed.

Born and raised in Naples, FL, Biagio is a true Southwest Florida local. He is a classically trained pianist who has been playing since the age of 4. In his free time, he also loves to play the guitar, read, travel, and spend time with his friends and family.

Biagio is Series 7, 66, and FL 2-15 insurance licensed.

Contact Steven M. Coplin

Contact Ryan M. Sherman

Contact Caroline A. Coplin

Contact Lynette J. Susi

Awards and Recognition

Forbes Best-In-State Wealth Management Teams

2023-2026 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded 2023-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Forbes Best-In-State Wealth Advisors

2021-2025 Forbes Best-In- State Wealth Advisors Source: Forbes.com (Awarded 2021-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Stacey Herring

Stacey Herring is a Private Banker serving Morgan Stanley Wealth Management offices in Florida.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Stacey began her career in financial services in 1994, and joined Morgan Stanley in 2014. Prior to joining the firm, she was a Mortgage Sales Manager at SunTrust Bank and a Senior Mortgage Loan Officer for over 17 years at Fifth Third Bank. Stacey is a graduate of Florida State University, where she received a Bachelor of Science in Business Marketing and a Minor in Communications.

Stacey currently serves on the Women’s Foundation of Collier County Board of Directors, as well as Junior Achievement of SWFL’s Advisory Board. In addition, Stacey has chaired many community endeavors, serving Naples Community Hospital, PACE Center for Girls of Collier County, and Youth Haven. She is a graduate of the Naples Chamber of Commerce’s Leadership Collier program, awarded Gulfshore Business Magazine’s “40 Under 40 Award”, and in 2013 was awarded the Glass Slipper Award by The Education Foundation, Champions for Learning. In 2014, Stacey was named a Woman of Initiative by the Community Foundation of Collier County for her philanthropy, dedication, and commitment to children’s causes.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Stacey began her career in financial services in 1994, and joined Morgan Stanley in 2014. Prior to joining the firm, she was a Mortgage Sales Manager at SunTrust Bank and a Senior Mortgage Loan Officer for over 17 years at Fifth Third Bank. Stacey is a graduate of Florida State University, where she received a Bachelor of Science in Business Marketing and a Minor in Communications.

Stacey currently serves on the Women’s Foundation of Collier County Board of Directors, as well as Junior Achievement of SWFL’s Advisory Board. In addition, Stacey has chaired many community endeavors, serving Naples Community Hospital, PACE Center for Girls of Collier County, and Youth Haven. She is a graduate of the Naples Chamber of Commerce’s Leadership Collier program, awarded Gulfshore Business Magazine’s “40 Under 40 Award”, and in 2013 was awarded the Glass Slipper Award by The Education Foundation, Champions for Learning. In 2014, Stacey was named a Woman of Initiative by the Community Foundation of Collier County for her philanthropy, dedication, and commitment to children’s causes.

NMLS#: 434321

About Hannah Sledd

Hannah Sledd is a vice president and financial planning director serving Morgan Stanley’s Wealth Management offices in Southwest Florida. She is responsible for helping financial advisors with their clients’ and prospects’ financial planning needs.

Hannah began her career in financial services in 2012 and we are happy that she is rejoining Morgan Stanley. Hannah began her work as an independent advisor in Atlanta, working with top financial firms including E*TRADE and JP Morgan before joining Morgan Stanley. She has a vast array of experiences, including working on an elite trading desk, assisting advisors in the development and implementation of financial plans for their high-net-worth clientele, leading an international mergers and acquisitions team and working as a financial advisor.

Hannah is a graduate of the University of Alabama where she earned a bachelor’s degree in finance with a concentration in investment management, and currently holds the CERTIFIED FINANCIAL PLANNER™ designation. Hannah currently lives in Nashville, TN. When not in the office, Hannah enjoys pilates, travelling, and teaching yoga.

DISCLOSURE:

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

© 2023 Morgan Stanley Smith Barney LLC. Member SIPC.

Hannah began her career in financial services in 2012 and we are happy that she is rejoining Morgan Stanley. Hannah began her work as an independent advisor in Atlanta, working with top financial firms including E*TRADE and JP Morgan before joining Morgan Stanley. She has a vast array of experiences, including working on an elite trading desk, assisting advisors in the development and implementation of financial plans for their high-net-worth clientele, leading an international mergers and acquisitions team and working as a financial advisor.

Hannah is a graduate of the University of Alabama where she earned a bachelor’s degree in finance with a concentration in investment management, and currently holds the CERTIFIED FINANCIAL PLANNER™ designation. Hannah currently lives in Nashville, TN. When not in the office, Hannah enjoys pilates, travelling, and teaching yoga.

DISCLOSURE:

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

© 2023 Morgan Stanley Smith Barney LLC. Member SIPC.

About Mark Jansen

Mark Jansen is a Family Office Resources Generalist for Morgan Stanley’s Family Office Resources, covering the Southeast Region. In this capacity, Mark provides specialized expertise to Financial Advisors and their UHNW clients across a broad range of family wealth management issues including; family governance and wealth education, strategic estate and financial planning, philanthropy management and lifestyle advisory. Mark has over 30 years of experience advising wealthy families, business owners, and their children.

Most recently, Mark worked with New York Life in their Advanced Planning Group working with agents and their UHNW clients advising them on estate and legacy planning, business buy sell planning, and succession planning. Prior to New York Life, Mark held similar Advanced Planning Consulting roles in several National financial organizations. He originally started his career in the financial services industry in the tax department of the public accounting firm Grant Thornton. He is known for taking complex ideas and making them easy to understand. Frequently speaking to groups and individuals on estate and business planning, he brings a conversational style that helps to clarify the complex nature of these topics.

Mark received a Bachelor of Science degree from St. John’s University in Collegeville MN, received his JD degree Cum Laude from the University of Minnesota and his CPA license while working at Grant Thornton. He holds a Series 7, 24 and 63 securities licenses. He currently lives in Richmond Virginia with his wife and occasionally one of their 6 children.

Most recently, Mark worked with New York Life in their Advanced Planning Group working with agents and their UHNW clients advising them on estate and legacy planning, business buy sell planning, and succession planning. Prior to New York Life, Mark held similar Advanced Planning Consulting roles in several National financial organizations. He originally started his career in the financial services industry in the tax department of the public accounting firm Grant Thornton. He is known for taking complex ideas and making them easy to understand. Frequently speaking to groups and individuals on estate and business planning, he brings a conversational style that helps to clarify the complex nature of these topics.

Mark received a Bachelor of Science degree from St. John’s University in Collegeville MN, received his JD degree Cum Laude from the University of Minnesota and his CPA license while working at Grant Thornton. He holds a Series 7, 24 and 63 securities licenses. He currently lives in Richmond Virginia with his wife and occasionally one of their 6 children.

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Wealth Management

From Our Team

Building Value from Values

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Coplin Wealth Management Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

6Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

7Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

8Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

9Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10An investment in an exchange-traded fund (ETF) involves risks similar to those of investing in a broadly based portfolio of equity securities traded on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The investment return and principal value of ETF investments will fluctuate, so that an investor’s ETF shares, if or when sold, may be worth more or less than the original cost.

Investors should carefully consider the investment objectives, risks, charges and expenses of an exchange-traded fund (ETF) before investing. The prospectus contains this and other information about the ETF. To obtain a prospectus, contact your Financial Advisor or visit the ETF company’s website. Please read the prospectus carefully before investing.

11Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

12Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

6Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

7Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

8Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

9Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10An investment in an exchange-traded fund (ETF) involves risks similar to those of investing in a broadly based portfolio of equity securities traded on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The investment return and principal value of ETF investments will fluctuate, so that an investor’s ETF shares, if or when sold, may be worth more or less than the original cost.

Investors should carefully consider the investment objectives, risks, charges and expenses of an exchange-traded fund (ETF) before investing. The prospectus contains this and other information about the ETF. To obtain a prospectus, contact your Financial Advisor or visit the ETF company’s website. Please read the prospectus carefully before investing.

11Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

12Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025), 4763067 (9/2025)