The Oak Haven Group at Morgan Stanley

Our Mission Statement

Clarity and confidence through every stage of wealth.

A multigenerational team evolving with your needs.

Welcome

About us

At The Oak Haven Group, we believe wealth should create clarity and opportunity- not complexity. Our purpose is to serve as a financial haven for families, founders, and executives, helping them navigate complex financial decisions with clarity and confidence to preserve what matters most.

We are a multigenerational advisory team , that creates highly personalized strategies by combining Morgan Stanley's global resources, with each member bringing deep knowledge and experience in areas such as advanced planning, portfolio construction, alternative investments, equity compensation, and client service. This team-based approach allows us to deliver sophisticated customized strategies while helping to ensure clients and their families are supported today and for decades to come.

We don't just create investment and financial plans- we implement, monitor, and refine them as life evolves and market opportunities change. Backed by Morgan Stanley's industry-leading investment/alternatives platform and global resources, we are relentlessly committed to finding solutions as our clients' needs grow more complex. At Oak Haven, you'll always have a team that evolves alongside you.

Our Mission

We founded The Oak Haven Group on the belief that clients deserve a financial "haven"—a place where complexity becomes clarity and long-term planning feels secure. Our purpose is to help you live the life you envision while building, preserving, and transitioning wealth across generations.

Contact Us Today

Phone: 973.236.3536

Email: Christopher.Ridente@morganstanley.com

- 401(k) Rollovers

- Cash Management and Lending ProductsFootnote1

- Comprehensive Wealth Planning

- Professional Portfolio ManagementFootnote2

- 529 PlansFootnote3

- Pre-Liquidity Planning

- Stock Option PlansFootnote4

- Business PlanningFootnote5

- Retirement & Pension Plans

- Alternative InvestmentsFootnote6

- Hedging Strategies

- Consolidated Reporting

- Philanthropy Management

- Family Governance & Wealth Education

At The Oak Haven Group, we believe wealth should be a source of freedom, not complexity. Our purpose is to create a financial haven for our clients—a place where the noise of markets and the burden of decisions are simplified into clear, confident strategies. We exist so families, founders, and executives can focus on what truly matters: building a life, a legacy, and a future with purpose.

How We Work

- We don't start with products or portfolios, we start with YOU - your story, your family, your values, and your vision drive everything we do. From there, we take a collaborative approach: blending deep discovery, tailored planning, and coordinated execution with your tax and legal advisors.

- We know that clients' lives are always evolving—and so are we. Our team is built to adapt as your needs change, consistently expanding our capabilities and finding creative solutions to complex challenges. Where others see roadblocks, we see opportunities.

- Unlike many wealth management groups, Oak Haven is not a team of generalists. Each team member brings a specialized knowledge—whether it's equity compensation, alternative investments, advanced planning, or client service—so clients receive deep expertise across every aspect of their financial life.

- Planning isn't just something we talk about—it's something we do. We build comprehensive, actionable plans and continuously monitor and adjust them, so they remain relevant as markets shift and families grow.

- Our multigenerational team ensures continuity across decades, so you and your family always have someone you can trust at the table—today, tomorrow, and for generations.

What Makes Us Different

- Specialized Knowledge– Every team member has an area of focus, helping to ensure depth of knowledge rather than broad generalization.

- Dynamic & Evolving – We consistently expand our offering as client needs evolve, always looking for solutions that fit.

- Planning in Action – Beyond creating plans, we implement, monitor, and refine them—bringing accountability to the process.

- Investment Leadership – Senior Portfolio Managers and Alternative Investment Directors provide access to sophisticated strategies normally reserved for institutions.

- Alternatives Leadership – Backed by Morgan Stanley's industry-leading alternatives platform, we aim to deliver unique access and resources .

- Personalized Guidance with Global Resources – Clients benefit from Morgan Stanley's institutional strength combined with boutique-level personalization.

- Continuity Across Generations – A multigenerational team built with intention, helping to ensure clients and their families are supported for decades.

Our Promise- Your Financial Haven Starts Here

We are more than advisors. We are —relentlessly committed to helping you achieve clarity, confidence, and continuity. At Oak Haven, you'll always have a team evolving alongside you, ready to provide solutions no matter how complex your financial world becomes.

Location

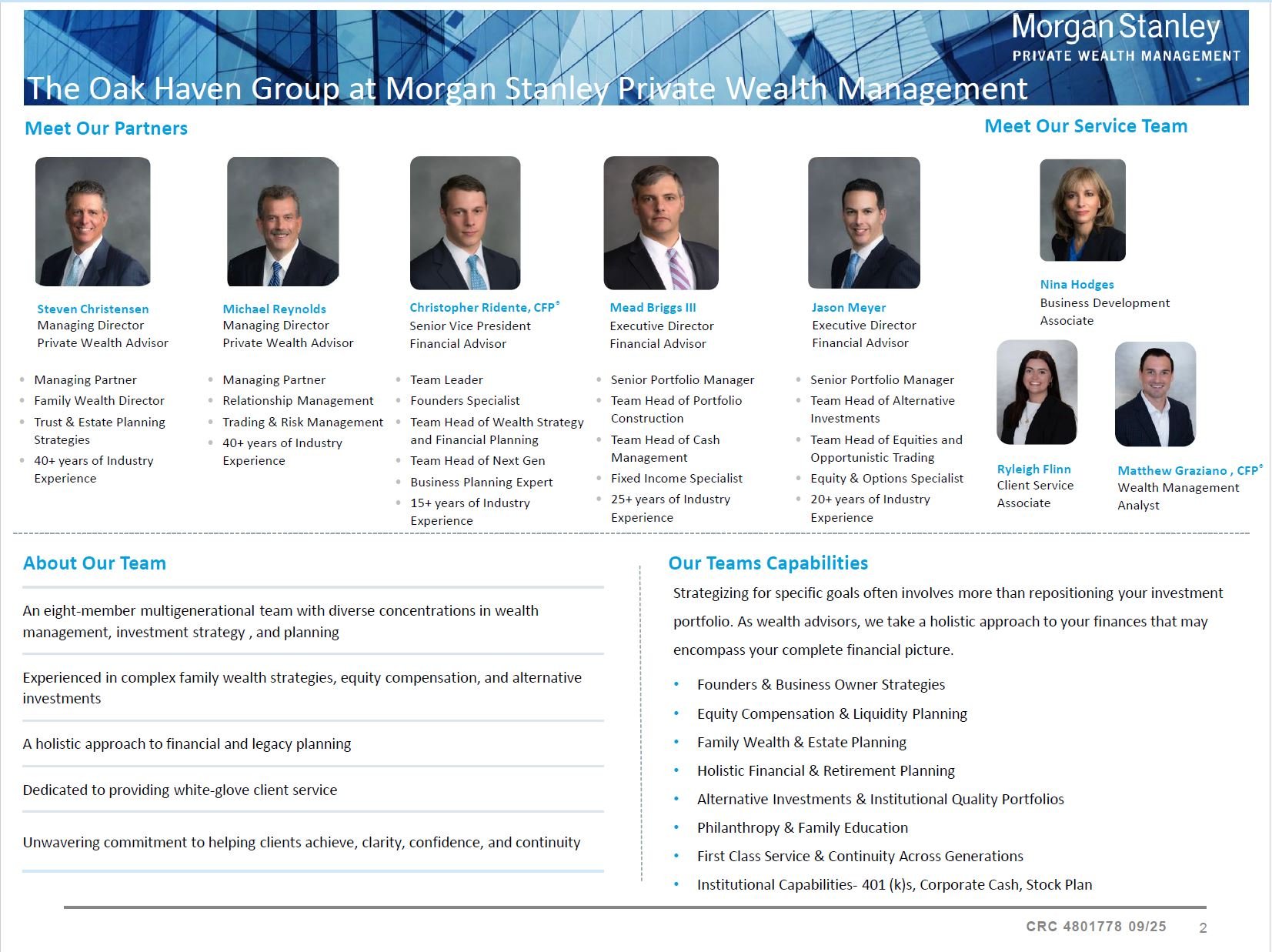

Meet The Oak Haven Group

About Steve Christensen

Managing Director

Private Wealth Advisor

Family Wealth Director

Steve has worked in the financial service industry for 40 years. He and his team provide investment and planning advice to families, private business owners, corporate executives, and financial industry executives. As a Morgan Stanley Family Wealth Director, Steve has experience with pre-transaction planning, trust and estate planning strategies, retirement planning, philanthropy, lending, and tax planning strategies. Steve and his team strive to provide family office resources to their clients with a problem- solving approach coupled with the highest level of client service and confidentiality.

Before joining Morgan Stanley, Steve spent 24 years at J.P. Morgan in their Investment Bank and Private Bank. As a Managing Director in J.P. Morgan’s Private Bank, Steve advised high net worth families, private business owners, financial professionals, corporate executives, and endowments and foundations. Prior to joining the Private Bank, Steve was a Managing Director in the Investment Bank’s investment-grade debt capital markets group. He has extensive knowledge in fixed income capital markets, interest rate derivatives and corporate finance. His prior experience includes commercial paper origination, municipal finance, high yield and commercial lending.

Steve graduated from the University of Pennsylvania with a B.A. in International Relations. While at Penn, he was captain of the varsity crew team and was selected as a member of The Friar’s Senior Honor Society. Steve was a member of the 1976 and 1980 Olympic Rowing Teams and the 1979 Pan American and World Championships Rowing Teams. His 1980 Olympic eight-oared crew was inducted into the Rowing Hall of Fame in 1991.

Steve lives in Summit, NJ with his wife Sarah, and their dog Tavi. They have three grown boys in the assisted living, insurance, and fashion industries, respectively.

steve.christensen@morganstanleypwm.com

973-236-3579

NMLS#: 822093

About Michael Reynolds

Managing Director — Wealth Management

Private Wealth Advisor

With 40 years of experience in the financial services industry, Michael is highly qualified to provide customized wealth management advice to both individuals and institutional clients. As an MD- Private Wealth Advisor, Michael and his team serve the unique needs of high net worth clients by developing a comprehensive understanding of each family’s unique situation and long-term goals. His experience covers a broad spectrum of client’s needs including investment management, retirement, life insurance, philanthropy, estate and tax strategies. He also offers access to cash management, credit and lending solutions. Michael leads a team that focuses intently on building long term relationships, striving to provide premium client service and ultimately producing first-class overall results.

Before joining Morgan Stanley, Michael spent 30 years at J.P. Morgan in their Investment Bank and Private Bank. As a managing director in J.P. Morgan’s Private Bank, Michael advised high net worth families on investments management, lending, banking, tax and estate planning. His previous experience includes finance and accounting, fixed income, equity and FX trading, risk management and advisory work for corporations and private client banking. Michael has traveled extensively throughout the world and worked in London for five years. He holds a finance and accounting degree from the University of Scranton, where he was also captain of the varsity golf team. Michael lives in Bernardsville, New Jersey with his wife, Terri, and children, Katherine and David.

Michael.J.Reynolds@morganstanleypwm.com

973-236-3580

NMLS#: 821869

About Christopher Ridente

Christopher Ridente, CFP®

Senior Vice President

Founders Specialist

Alternative Investments Director

Financial Advisor

As Team Leader of Oak Haven Group at Morgan Stanley, Chris Ridente is responsible for the strategic vision of the team as well as helping guide families, business owners, and executives through their most important financial decisions with clarity and confidence.

Chris is a CERTIFIED FINANCIAL PLANNER™, Alternative Investments Director, and one of Morgan Stanley’s select Founders Specialists, an exclusive designation recognizing his experience in advising entrepreneurs from the early stages of growth through strategic exits and legacy planning. His leadership at Oak Haven Group reflects his commitment to building a multi-generational team that provides clients with deep resources, multiple points of contact, and continuity for decades to come.

With more than 15 years of experience, Chris focuses on business strategy, advanced wealth planning, investment planning, and multi-generational estate planning strategies. He has been recognized by Forbes as one of America’s Top Next-Gen Wealth Advisors Best-In-State (2023–2025) and is a multi-year member of Morgan Stanley’s Pacesetter’s Club.

Prior to joining Morgan Stanley, Chris advised ultra-high-net-worth families on asset allocation and portfolio strategy as part of J.P. Morgan’s Private Bank. He graduated with honors from Wagner College, where he captained the Division I lacrosse team.

Chris lives in Bernardsville, New Jersey, with his wife, Alyssa, and their two sons. Away from the office, he enjoys golf, skiing, traveling, and spending time with family and friends.

Christopher Ridente, CFP®

Phone: 973.236.3536

Cell: 201.396.8582

Christopher.Ridente@morganstanley.com

Named to the 2025 Forbes Top Next-Gen Wealth Advisors Best-In-State Ranking- 2023, 2024, 2025

Source: Forbes.com (Awarded Aug 2025). Data compiled by SHOOK Research LLC based on time period from 3/31/24 – 3/31/25.

Awards Disclosures

Morgan Stanley Wealth Management Pacesetter’s Club members must meet a number of criteria including performance, conduct and compliance standards, revenue, length of experience and assets under supervision. Pacesetter’s Club membership is no guarantee of future performance.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do no provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts, estate planning, charitable giving, philanthropic planning or other legal matters.

Morgan Stanley Smith Barney LLC. Member SIPC.

CRC 4857825 10/25

NMLS#: 1747312

About Mead Briggs

Executive Director

Financial Advisor

Senior Portfolio Manager

Alternative Investments Director

Mead Briggs brings over 23 years of asset allocation and portfolio management experience to the service of his clients. In his current role, Mead is responsible for advising high net worth individuals, foundations and senior executives on a range of financial matters including asset allocation, portfolio construction, equities, fixed income and alternative investments. Prior to joining Morgan Stanley, Mead worked 13 years at J.P. Morgan Private Bank and for five years with Bankers Trust Private Banking which later became Deutsche Bank Private Bank. He provided investment advice to high net worth individuals, families and institutions. He also worked as an Institutional Fixed Income salesman for two primary dealers with a focus on taxable instruments.

Mead is an active coach for his three children and recently concluded an eight year board position on the Long Hill Baseball and Softball Association. In 2021, he was nominated and continues to serve as Chairman of the Long Hill Beautification Committee.

Mead served as the vice chairman of the Long Hill Township Planning Board for nine years and was a member of two subcommittees. He was elected to the township committee of Long Hill Township and served as deputy mayor. Mead worked in several capacities including Planning and liaison, Finance Committee, Chairman of the Board of Health and liaison to the Fire Department and First Aid Squad.

Mead earned his master’s in business administration with a minor in accounting from the Stern School of Business, NYU. He also earned his Bachelor of Science in business administration with a major in finance and minor in sociology from Bucknell University. He attended Kent School in Kent, Connecticut for his high school education.

mead.briggs@morganstanley.com

973-236-3563

NMLS#: 837207

About Jason Meyer

Executive Director

Financial Advisor

Portfolio Manager

Jason Meyer brings over 24 years of experience within asset allocation, portfolio strategy, equity research and trading. In his current role, Jason is responsible for advising high net worth individuals, foundations and senior executives on a range of financial matters including asset allocation, portfolio construction, equities, fixed income and alternative investments.

Prior to joining Morgan Stanley, Jason was an executive director and global investment specialist within J.P. Morgan Private Bank, helping design and implement portfolio solutions for high net worth families. He began his career at Brown Brothers Harriman as an equity options trader, and spent numerous years at both UBS, as an equity relationship manager, and at Merrill Lynch, as a portfolio strategist.

Mr. Meyer graduated from Rutgers University, where he earned his Bachelor of Science majoring in labor relations and minoring in economics.

jason.meyer1@morganstanley.com

973-236-3564

NMLS#: 837299

About Nina Hodges

Business Development Associate

Financial Planning Specialist*

* This role cannot solicit or provide investment advice

A 25-year veteran of the financial services industry, Nina Hodges provides a broad range of support services that help to create an outstanding service experience for clients of the Group.

Nina began her career at Salomon Brothers, where she worked as a sales assistant on an equity sales and trading desk. She moved on to J.P. Morgan, where she spent the next 18 years in various capacities. These included positions as a sales assistant on a trading desk and a college recruiting assistant in the human resources department. Prior to joining Morgan Stanley Wealth Management, Nina spent the last five years of her career in J.P. Morgan's Private Wealth Management group as a client service representative working with high-net-worth clients and their families.

nina.hodges@morganstanley.com

973-236-3534

About Matthew J. Graziano

Wealth Management Analyst

Financial Planning Specialist*

*This role cannot solicit or provide investment advice

Matt Graziano is a skilled financial professional with over five years of experience in the financial services industry. He began his career as an Insurance Agent and Field Underwriter, gaining hands-on experience in client advisory roles at Northwestern Mutual and Family First Life. In 2022, he joined Morgan Stanley, where he currently serves as a Wealth Management Analyst and Financial Planning Specialist, supporting clients in developing and implementing personalized financial strategies.

Matt holds the CERTIFIED FINANCIAL PLANNER® (CFP®) designation and earned a Certificate in Financial Planning from Northwestern University. He is committed to helping individuals and families navigate the complexities of wealth management with clarity and confidence.

Matt earned his Bachelor of Science majoring in Business Management and minoring in Economics from the University of Delaware, where he completed his undergraduate studies after beginning his collegiate career at the University of Utah as a member of the school’s inaugural NCAA Division I Men’s Lacrosse team.

Originally from Mendham, New Jersey, Matt was raised in a large family alongside his five siblings. He now lives in Hoboken, NJ. Outside of the office, he enjoys staying active, golfing, and spending time with his family and friends.

About Ryleigh Flinn

Ryleigh has joined The Oak Haven Group as a Client Service Associate and is dedicated to assisting our clients to provide an excellent service experience. Ryleigh was born and raised in Morristown and continues to reside there. Her interests are reading, volunteering, and spending time with her three siblings and parents.

Contact Steve Christensen

Contact Michael Reynolds

Contact Christopher Ridente

Contact Mead Briggs

Contact Jason Meyer

Portfolio Insights

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley