The Channel Marker Group at Morgan Stanley

Michael J Zahn, CFP®Sarkis B ShirinianEsther Fishman, CFP®Joseph M BrownPaul S ShirinianGregory H Shirinian

Direct:

(201) 967-6219(201) 967-6219

Toll-Free:

(800) 927-0237(800) 927-0237

Our Mission Statement

Excellence in helping clients like you with your personalized investment and financial strategies

Our Story & Services

The Channel Marker Group is a team with over 100 years of combined industry experience, within a global investment powerhouse. We would like to get to know you, learn about your specific circumstances and preferences, review what steps you’ve already taken regarding your finances, discuss your near-term concerns and establish realistic long-term goals. Then we will align the copious resources at Morgan Stanley with your needs to execute a personalized strategy intended to help you meet your financial goals.

Awards

- 2026 Forbes Best-In-State Wealth Management Team - Source: Forbes.com (Awarded Jan 2026) Data compiled by SHOOK Research LLC based for the period 3/31/24–3/31/25.

- 2025 Forbes Best-In-State Wealth Management Team - Source: Forbes.com (Awarded Jan 2025) Data compiled by SHOOK Research LLC based for the period 3/31/23–3/31/24.

- 2024 Forbes Best-In-State Wealth Management Teams - Source: Forbes.com (Awarded Jan 2024) Data compiled by SHOOK Research LLC based on time period from 3/31/22 – 3/31/23

Services Include

- Professional Portfolio ManagementFootnote1

- 401(k) Rollovers

- Retirement PlanningFootnote2

- Financial PlanningFootnote3

- Wealth ManagementFootnote4

- Asset Management

- Estate Planning StrategiesFootnote5

- Trust AccountsFootnote6

- Corporate Retirement PlansFootnote7

- Structured ProductsFootnote8

- Alternative InvestmentsFootnote9

- Life InsuranceFootnote10

- Cash Management and Lending ProductsFootnote11

- AnnuitiesFootnote12

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Our Standard of Care

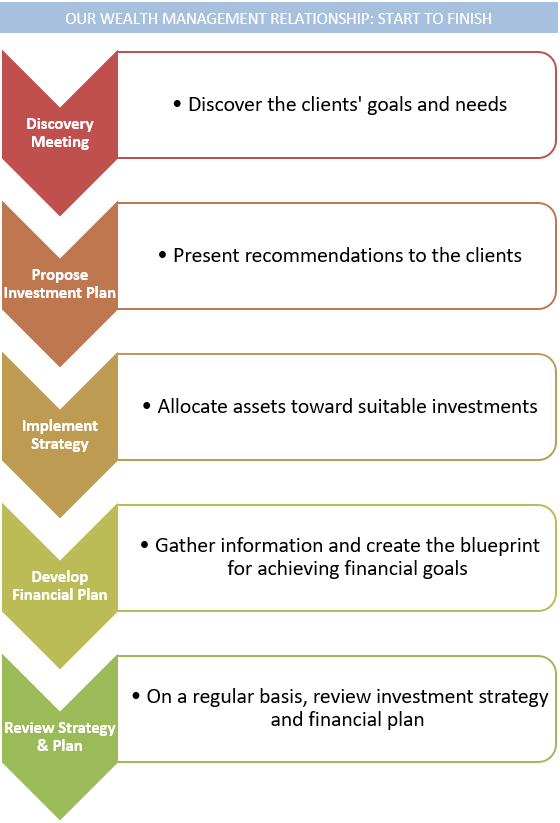

Our Personal Financial Planning Process begins with an introductory meeting or call to get to know each other. We listen in order to understand your needs and investment preferences. We discuss your risk tolerance and identify your financial goals.

We also review your statements and documents to see what steps you’ve already taken.

Your relationship with us will follow a customized blueprint, which we refer to as a Financial Plan, to help you achieve your financial objectives.

We hope to communicate with you regularly to monitor any changes in your financial picture and their impact on your future. Discussions may include estate planning, insurance coverage, cash management and lending needs and employee benefits.

We also review your statements and documents to see what steps you’ve already taken.

Your relationship with us will follow a customized blueprint, which we refer to as a Financial Plan, to help you achieve your financial objectives.

We hope to communicate with you regularly to monitor any changes in your financial picture and their impact on your future. Discussions may include estate planning, insurance coverage, cash management and lending needs and employee benefits.

The Channel Marker Group's Standard of Care revolves around the following three pillars:

Goal-Based Wealth Management

• Understanding a client’s life priorities

• Identifying family values

• Setting legacy goals

• Enhancing inter-generational communication

• Assessing client’s risk tolerance

• Periodic review meetings with clients, by phone or in person

• Identifying family values

• Setting legacy goals

• Enhancing inter-generational communication

• Assessing client’s risk tolerance

• Periodic review meetings with clients, by phone or in person

Intellectual Capital

• Our team of experienced Financial Advisors offers various investment strategies and a comprehensive skillset

• Morgan Stanley offers a wealth of investment research and financial tools

• Family wealth advisors assist in the transition of assets to the next generation

• Morgan Stanley offers a wealth of investment research and financial tools

• Family wealth advisors assist in the transition of assets to the next generation

Personalized Advice

• Advice will be based on a personalized Financial Plan that adapts to a client’s changing life goals

• Investments will be selected for client’s needs

• Any financial related questions can be addressed: Retirement, Social Security, pension, estate planning, purchasing a home

• Besides investments, we can offer you banking and lending, long term care insurance and life insurance

• Investments will be selected for client’s needs

• Any financial related questions can be addressed: Retirement, Social Security, pension, estate planning, purchasing a home

• Besides investments, we can offer you banking and lending, long term care insurance and life insurance

Our Personal Financial Planning Process

Our Personal Financial Planning Process starts with an introductory meeting or call. We listen in order to understand your needs and explain the Financial Planning Process.

The next step is a discussion to identify financial goals, investment preferences, and risk tolerance in addition to reviewing statements and documents.

Throughout implementation of your plan we will map out employee and employer contributions, liquidity events, various forms of insurance coverage and provide holistic asset allocation analysis for all accounts.

Your relationship with us will follow a customized blueprint to help you achieve your objectives. We recommended strategies that include asset allocation changes, savings, and benefit adjustments in order to adapt to your dynamic life.

As your Financial Advisors, we keep a high degree of communication with you to monitor any adjustments and their impact on your financial plan.

The next step is a discussion to identify financial goals, investment preferences, and risk tolerance in addition to reviewing statements and documents.

Throughout implementation of your plan we will map out employee and employer contributions, liquidity events, various forms of insurance coverage and provide holistic asset allocation analysis for all accounts.

Your relationship with us will follow a customized blueprint to help you achieve your objectives. We recommended strategies that include asset allocation changes, savings, and benefit adjustments in order to adapt to your dynamic life.

As your Financial Advisors, we keep a high degree of communication with you to monitor any adjustments and their impact on your financial plan.

Our Investment Strategy

The Channel Marker Group at Morgan Stanley follows a specific investment structure for our Managed Portfolios:

• Disciplined Strategy

The Channel Marker Group believes that investors seeking capital appreciation require a disciplined strategy to investing. Our objectives are to help you retain your capital, obtain a reasonable rate of return and stay ahead of inflation and taxes throughout all market cycles. As a team, we aim to assume less risk, depending on your goals, and match if not outperform a benchmark that is applicable to your needs.

• Diversification

We curate and develop our portfolios around positions that we believe show growth potential. The team considers price, value, volatility as well as the multitude of analytical properties that go into researching individual securities. Our focus on portfolio diversification is meant to protect your assets during downturns in the market and take advantage of upturns while not over exposing into specific areas.

• Security Selection

The Channel Marker Group uses the resources at Morgan Stanley and outside investment managers to select various stocks and exchange-traded funds for our managed portfolios. The analysts at Morgan Stanley and these various firms analyze indicators including beta, projected growth, yield, earnings and cash flow. The companies that our analysts focus on may have a benefit to one strategy, but may not be included in every investment approach.

• Reallocation

Depending on the strategy chosen to best suit your needs, investments are sold and purchased depending on a variety of factors and at the direction of Morgan Stanley analyst recommendations. Reallocation, rebalancing and continued supervision over these portfolios keeps them in line with your financial goals adapting to market conditions actively. If a suitable alternative allocation is necessary based on changing life circumstances, we work with you to rearrange your plan of action.

• Market Shifts

The Channel Marker Group’s investment plans are based on the active engagement we have with our analysts and outside resources to reallocate positions accordingly. Political events, interest rate changes and other popular discussions that may cause panic for transactional investors do not affect our focus to achieve a portfolio’s end strategy. Some exchange-traded funds and stocks may differ in performance to the popular market benchmarks in specific periods but with time, diversification, a disciplined strategy and constant management we seek to gain comparable returns based on your financial plan.

• Disciplined Strategy

The Channel Marker Group believes that investors seeking capital appreciation require a disciplined strategy to investing. Our objectives are to help you retain your capital, obtain a reasonable rate of return and stay ahead of inflation and taxes throughout all market cycles. As a team, we aim to assume less risk, depending on your goals, and match if not outperform a benchmark that is applicable to your needs.

• Diversification

We curate and develop our portfolios around positions that we believe show growth potential. The team considers price, value, volatility as well as the multitude of analytical properties that go into researching individual securities. Our focus on portfolio diversification is meant to protect your assets during downturns in the market and take advantage of upturns while not over exposing into specific areas.

• Security Selection

The Channel Marker Group uses the resources at Morgan Stanley and outside investment managers to select various stocks and exchange-traded funds for our managed portfolios. The analysts at Morgan Stanley and these various firms analyze indicators including beta, projected growth, yield, earnings and cash flow. The companies that our analysts focus on may have a benefit to one strategy, but may not be included in every investment approach.

• Reallocation

Depending on the strategy chosen to best suit your needs, investments are sold and purchased depending on a variety of factors and at the direction of Morgan Stanley analyst recommendations. Reallocation, rebalancing and continued supervision over these portfolios keeps them in line with your financial goals adapting to market conditions actively. If a suitable alternative allocation is necessary based on changing life circumstances, we work with you to rearrange your plan of action.

• Market Shifts

The Channel Marker Group’s investment plans are based on the active engagement we have with our analysts and outside resources to reallocate positions accordingly. Political events, interest rate changes and other popular discussions that may cause panic for transactional investors do not affect our focus to achieve a portfolio’s end strategy. Some exchange-traded funds and stocks may differ in performance to the popular market benchmarks in specific periods but with time, diversification, a disciplined strategy and constant management we seek to gain comparable returns based on your financial plan.

Team Articles

Check out the team's articles that cover a variety of topics frequently discussed with clients:

What's Your Financial Plan?Team Events

Previous Events

INVESTING 101: Finances for Women - February 27th from 7-8 PM

Complimentary Zoom seminar hosted by the The Channel Marker Group, email Gregory.Shirinian@morganstanley.com for more information

Understanding Your 401(k) - November 2nd from 7-8 PM

Complimentary Zoom seminar hosted by the The Channel Marker Group, email Gregory.Shirinian@morganstanley.com for more information

Strategies for Volatile Markets - July 19th at 12:30 & 5:30 PM

Complimentary Zoom seminars hosted by the The Channel Marker Group, email Gregory.Shirinian@morganstanley.com for more information

Seminar on Social Security - May 19th from 6:45-8 PM

Complimentary Zoom seminar hosted by the The Channel Marker Group, email Gregory.Shirinian@morganstanley.com for more information

Seminar on Social Security - March 10th from 6:45-8 PM

Complimentary Zoom seminar hosted by the The Channel Marker Group, email Gregory.Shirinian@morganstanley.com for more information

Firm Events

Past Events

Go Red Women’s Leadership Virtual Experience

In special recognition of the Go Red for Women® campaign, we are pleased to invite you to the livestream of the Morgan Stanley Wealth Management 16th annual Go Red Women’s Leadership event, hosted in partnership with the American Heart Association – Westchester Chapter.

Date: Friday, February 7th, 2025

Date: Friday, February 7th, 2025

Wealth Education for the Next Generation: Health is Wealth with Dr Kim Henderson

Health is wealth. Join us Monday, September 9 at 4PM ET for the next session of our Wealth Education for the Next Generation series. Learn more about cultivating healthy habits, healthcare, investing in preventative care and more.

Date: Monday, September 9th, 2024

Date: Monday, September 9th, 2024

A Guide to Maximizing Social Security and Managing Healthcare Costs in Retirement

Learn strategies that can help maximize your Social Security benefits and how to manage your healthcare costs in retirement.

Date: September 10th, 2024

Date: September 10th, 2024

Protecting Your Assets in the Digital Age with Rachel Wilson

Join us on Thursday, June 20th at 5PM ET for Protecting Your Assets in the Digital Age, a conversation with Rachel Wilson, Chief Data Officer of Morgan Stanley Wealth Management.

Rachel will discuss cybersecurity trends, how Morgan Stanley protects our clients, and how you can protect yourself by taking advantage of complimentary Identity and Credit Protection from Experian® offered through a Morgan Stanley CashPlus Brokerage Account.

Date: Thursday, June 20th, 2024

Rachel will discuss cybersecurity trends, how Morgan Stanley protects our clients, and how you can protect yourself by taking advantage of complimentary Identity and Credit Protection from Experian® offered through a Morgan Stanley CashPlus Brokerage Account.

Date: Thursday, June 20th, 2024

Exploring Investments: Stocks, Bonds, and Beyond

Our fourth session explored the fundamentals of investing, from understanding market dynamics, defining asset classes such as stocks and bonds and other investment vehicles, as well as discussed asset allocation and diversification, this session provided valuable insights to kickstart your investment journey.

Date: Monday, July 1, 2024

Date: Monday, July 1, 2024

Cybersecurity

Our third session of this series explored the skills that are important to safeguard your online identity and assets, from common cyber threats to learning best practices for secure online transactions. This session covered practical strategies to stay safe in today’s digital landscape.

Date: Monday, June 3, 2024

Date: Monday, June 3, 2024

How Artificial Intelligence is Transforming the Future

In this ZOOM seminar we learned how the advancement of artificial intelligence (AI) is transforming the workplace of the future. We addressed key topics that include:

What Exactly is AI?

Latest Advancements: Generative AI, Open AI, Chat GPT

Language and Visual Generation

Real World Applications

Future Business Disruptions

Date: Thursday, May 30th, 2024

What Exactly is AI?

Latest Advancements: Generative AI, Open AI, Chat GPT

Language and Visual Generation

Real World Applications

Future Business Disruptions

Date: Thursday, May 30th, 2024

Lessons on Longevity with Dr. Joseph Coughlin

Dr. Joseph Coughlin, Founder and Director of the Massachusetts Institute of Technology AgeLab, joined Morgan Stanley for a fascinating conversation on his innovative concept of longevity planning. Dr. Coughlin, or as he is most often referred to, “Dr. Joe”, explored how we can better prepare ourselves to live well as we age, including practical aspects such as caregiving, where to live, transportation and social engagement.

Date: Monday, May 20, 2024

Date: Monday, May 20, 2024

Credit and Debt Management

Our second session was aimed at empowering you with essential knowledge on credit and debt management so you can understand how to establish credit, understand credit history, demystify credit scores and navigate the world of lending in order to make informed decisions about your financial future.

Monday, May 6 at 4:00 – 5:00 p.m. ET |

Monday, May 6 at 4:00 – 5:00 p.m. ET |

Introduction to Money & Saving: Building a Strong Financial Foundation

Our first session was an introduction to personal finance with a focus on beginning to build a strong financial foundation. We discussed goal setting, cash flow, budgeting and saving strategies and the power of compounding interest.

Monday, April 1 at 4:00 – 5:00 p.m. ET |

RegisterMonday, April 1 at 4:00 – 5:00 p.m. ET |

Preparing for Retirement with Social Security

As you approach retirement, it is more important than ever to understand the role that Social Security benefits can and should play in your overall retirement income plan.

Topics discussed:

• How Social Security benefits work for you and

your spouse.

• ,When and how to start receiving Social Security

benefits.

• Opportunities to increase your benefits

throughout retirement.

Date: Thursday, February 29th, 2024

Time: 5:30pm EST

Topics discussed:

• How Social Security benefits work for you and

your spouse.

• ,When and how to start receiving Social Security

benefits.

• Opportunities to increase your benefits

throughout retirement.

Date: Thursday, February 29th, 2024

Time: 5:30pm EST

Go Red Women’s Leadership Virtual Experience

In special recognition of the Go Red for Women® campaign, we met on Friday, February 2, for our 15th annual Go Red Women’s Leadership event, hosted in partnership with the American Heart Association – Westchester Chapter. This year’s event featured a “Heart Talk” segment, highlighting tips to help kickstart a healthier lifestyle.

Date: Friday, February 2, 2024

Date: Friday, February 2, 2024

Women Dressing Women

We are thrilled to have extended an exclusive invitation to this one-time live virtual event in collaboration with The Metropolitan Museum of Art on Monday, February 12. This was a unique opportunity to tour The Costume Institute’s Women Dressing Women exhibition with Associate Curator Mellissa Huber.

Date: Monday, February 12

Date: Monday, February 12

Location

61 South Paramus Road

3rd Floor

Paramus, NJ 07652

US

Direct:

(201) 967-6219(201) 967-6219

Toll-Free:

(800) 927-0237(800) 927-0237

Fax:

(201) 670-3410(201) 670-3410

Meet The Channel Marker Group

About Michael J Zahn

With almost 40 years in the financial services industry, Mike has a track record of success developing and maintaining personalized financial strategies for his clients. With expertise in a variety of topics, Mike is not only passionate about serving his clients, but also in helping future generations with financial literacy.

Mike received his Bachelor’s and Master’s degrees from New Jersey City University before beginning his professional career in 1977 as a high school teacher. Mike soon transitioned to the insurance industry, where he worked as an insurance agent. Three years later, Mike became a financial advisor at Merrill Lynch before ultimately settling down at Morgan Stanley in 1984. In his three-plus decades at the firm, Mike has received many recognitions including being named a member of the Masters Club, an exclusive group of decorated FA’s at Morgan Stanley. Mike, who worked as a sole practitioner for 37 years, joined The Channel Marker Group in 2021 along with his Senior Registered CSA, Kerry.

In addition to his portfolio management process and CFP® certification, Mike is also highly versed in structured investments. Mike’s proven process starts with a conversation with each new client to gain a deep understanding of them and their current situation. Afterwards, Mike will take a holistic approach in creating a comprehensive plan to meet his client’s financial goals.

Born and raised in Bergen County, Mike and his wife Cathy currently reside in Franklin Lakes with their Mini Goldendoodle, Parker. Mike and Cathy help support the World Assistance for Cambodia, which builds schools in the country’s rural areas. Additionally, Mike volunteers at the Holly House in Hackensack, NJ which is a home for at risk children. In addition to rooting for his New York Giants and Yankees, Mike spends his free time enjoying new restaurants with his wife and three adult daughters, as well as golfing and scuba diving.

Mike received his Bachelor’s and Master’s degrees from New Jersey City University before beginning his professional career in 1977 as a high school teacher. Mike soon transitioned to the insurance industry, where he worked as an insurance agent. Three years later, Mike became a financial advisor at Merrill Lynch before ultimately settling down at Morgan Stanley in 1984. In his three-plus decades at the firm, Mike has received many recognitions including being named a member of the Masters Club, an exclusive group of decorated FA’s at Morgan Stanley. Mike, who worked as a sole practitioner for 37 years, joined The Channel Marker Group in 2021 along with his Senior Registered CSA, Kerry.

In addition to his portfolio management process and CFP® certification, Mike is also highly versed in structured investments. Mike’s proven process starts with a conversation with each new client to gain a deep understanding of them and their current situation. Afterwards, Mike will take a holistic approach in creating a comprehensive plan to meet his client’s financial goals.

Born and raised in Bergen County, Mike and his wife Cathy currently reside in Franklin Lakes with their Mini Goldendoodle, Parker. Mike and Cathy help support the World Assistance for Cambodia, which builds schools in the country’s rural areas. Additionally, Mike volunteers at the Holly House in Hackensack, NJ which is a home for at risk children. In addition to rooting for his New York Giants and Yankees, Mike spends his free time enjoying new restaurants with his wife and three adult daughters, as well as golfing and scuba diving.

Securities Agent: TX, AL, VT, SC, NY, NV, MD, FL, MI, WA, OR, NJ, NE, MN, LA, KS, AR, WI, NM, MA, IL, GA, CA, PA, IN, MO, DC, OH, ME, VA, TN, RI, MT, CO, AZ, NH, NC, HI, CT, DE; General Securities Representative; Investment Advisor Representative

NMLS#: 1282681

NMLS#: 1282681

About Sarkis B Shirinian

Joined Morgan Stanley and its predecessor companies in 1997

First Vice President-Wealth Management, Senior Portfolio Manager, Financial Advisor

Series 7, 63, 65, Life & Health Insurance Licensed

Chase Manhattan Bank: 1986 - 1996

Vice President, Tax Planning

CPA - Certified Public Accountant

Juris Doctor of Pepperdine University School of Law, does not currently give legal advice

BS in Business Administration: Villanova University

Bilingual - Armenian

American Institute of Certified Public Accountants (AICPA)

Bergen Community College Advisory Board Educational Opportunities Fund

Armenian Churches Sports Association

Villanova University Alumni Association

Sarkis' extensive knowledge in financial planning (retirement, estate, and asset allocation) compliments our team's experience in providing comprehensive financial strategies to every one of our clients. He is firmly committed to long-term relationships and strives to deliver exceptional client service by working attentively to help achieve financial goals.

Before beginning his career as a Financial Advisor in 1997, Sarkis, a Certified Public Accountant (currently non-practicing), served as a Tax Analyst for Chase Manhattan Bank. Prior to that he had spent several years in public accounting as a Tax Manager with Arthur Young and Company.

Sarkis has been married to his wife, Marie-Jeanne, since 1978. He is a father of three and grandfather of three. Sarkis is an active member of Sts. Vartanantz Armenian Apostolic Church. He speaks Armenian and English.

First Vice President-Wealth Management, Senior Portfolio Manager, Financial Advisor

Series 7, 63, 65, Life & Health Insurance Licensed

Chase Manhattan Bank: 1986 - 1996

Vice President, Tax Planning

CPA - Certified Public Accountant

Juris Doctor of Pepperdine University School of Law, does not currently give legal advice

BS in Business Administration: Villanova University

Bilingual - Armenian

American Institute of Certified Public Accountants (AICPA)

Bergen Community College Advisory Board Educational Opportunities Fund

Armenian Churches Sports Association

Villanova University Alumni Association

Sarkis' extensive knowledge in financial planning (retirement, estate, and asset allocation) compliments our team's experience in providing comprehensive financial strategies to every one of our clients. He is firmly committed to long-term relationships and strives to deliver exceptional client service by working attentively to help achieve financial goals.

Before beginning his career as a Financial Advisor in 1997, Sarkis, a Certified Public Accountant (currently non-practicing), served as a Tax Analyst for Chase Manhattan Bank. Prior to that he had spent several years in public accounting as a Tax Manager with Arthur Young and Company.

Sarkis has been married to his wife, Marie-Jeanne, since 1978. He is a father of three and grandfather of three. Sarkis is an active member of Sts. Vartanantz Armenian Apostolic Church. He speaks Armenian and English.

Securities Agent: OR, NH, IN, FL, AL, NJ, MN, LA, GA, OH, MO, SC, PA, NY, WA, NV, IL, DC, NC, MT, HI, AZ, AR, TX, KS, CT, WI, NM, NE, ME, MD, CO, CA, VA, TN, MI, MA, DE, RI; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1279481

NMLS#: 1279481

About Esther Fishman

Esther Fishman is a First Vice President, Portfolio Management Director and Financial Advisor at Morgan Stanley. As a Certified Financial Planner TM (CFP®) with almost 30 years of investing experience, she hand-picks individual investments and builds portfolios tailored to meet the goals of each client. She strives to provide exceptional service through her responsiveness and willingness to spend extra time with each client, which often results in referrals to clients’ families and friends.

While working during the day as an advisor, Esther has taught Finances for Women adult education classes in evenings at many local colleges and schools in New York and New Jersey. Esther enjoys empowering women to manage their own finances.

Esther earned her B.S. degree in Computer Science, summa cum laude, at Brooklyn College. In her former career as a computer programming consultant, she worked on the teams that developed a financial planning program for an international bank, a fraud protection program for a major telecom company, and a computer system for the army and air force.

Married to her childhood sweetheart, Esther has raised 4 children who are now accomplished adults. In her spare time, she enjoys music, art, circle and line dancing, acrylic painting, travel, volunteer work and learning new languages. Esther helps host social dances for adults with special needs, as a member of her town’s Access for All committee. Esther has also volunteered as a Board Member and Treasurer for many nonprofit organizations.

While working during the day as an advisor, Esther has taught Finances for Women adult education classes in evenings at many local colleges and schools in New York and New Jersey. Esther enjoys empowering women to manage their own finances.

Esther earned her B.S. degree in Computer Science, summa cum laude, at Brooklyn College. In her former career as a computer programming consultant, she worked on the teams that developed a financial planning program for an international bank, a fraud protection program for a major telecom company, and a computer system for the army and air force.

Married to her childhood sweetheart, Esther has raised 4 children who are now accomplished adults. In her spare time, she enjoys music, art, circle and line dancing, acrylic painting, travel, volunteer work and learning new languages. Esther helps host social dances for adults with special needs, as a member of her town’s Access for All committee. Esther has also volunteered as a Board Member and Treasurer for many nonprofit organizations.

Securities Agent: NV, AZ, WI, VA, RI, NJ, NC, IL, CA, NH, TN, SC, MT, DC, AR, MA, TX, OH, HI, MD, WA, MI, NM, GA, CT, PA, NE, MO, FL, MN, ME, CO, NY; General Securities Representative; Investment Advisor Representative

NMLS#: 1272934

NMLS#: 1272934

About Joseph M Brown

A veteran in the financial services industry since 1984, Joe (he/him/his) leverages his vast experience and knowledge of the financial markets to help clients achieve their long-term goals and objectives. He began his career with Drexel Burnham Lambert, which was later acquired by Smith Barney and currently known as Morgan Stanley. Joe’s areas of focus include fixed income, specifically municipal bonds, and cash management solutions. He is fully licensed advisor.

Born and raised in New Jersey, Joe graduated from Fairleigh Dickinson University with a degree in Finance. Active in the Bergen County community, Joe volunteers at the Holly House in Hackensack, NJ which is a home for at risk children. When away from the office, Joe enjoys cycling, surfing, ice skating, hiking, golfing, working out and playing tennis.

Born and raised in New Jersey, Joe graduated from Fairleigh Dickinson University with a degree in Finance. Active in the Bergen County community, Joe volunteers at the Holly House in Hackensack, NJ which is a home for at risk children. When away from the office, Joe enjoys cycling, surfing, ice skating, hiking, golfing, working out and playing tennis.

Securities Agent: AZ, AR, WA, VA, TX, MO, MI, ME, FL, AL, TN, SC, OR, NJ, GA, NY, NC, CO, CA, RI, MT, NE, MN, IN, VT, UT, PA, OH, NV, NH, MD, IL, HI, MA, DC, WI, DE, NM, CT; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1290609

NMLS#: 1290609

About Paul S Shirinian

Joined Morgan Stanley and its predecessor companies in 2010

BS - Economics & Finance: University of Hartford Barney School of Business

Series 7, 63 & 65 Licensed

Life & Health Insurance Licensed

Paul has focused his talents in serving the investment needs of his clients. He became a registered representative in 2010 whereupon he joined The Channel Marker Group (formerly The Shirinian Group) at Morgan Stanley. He and The Channel Marker Group serve a range of clients including high net worth families, corporate executives, self-employed professionals and small business owners.

He works with his clients to uncover core values and concerns, and based on this input, works attentively to help them in achieving their financial objectives in the areas of income generation, retirement planning, college funding and professional money management. Paul has broad knowledge in investments, accounting, tax strategies, insurance, and estate planning strategies.

Paul is a lifelong resident of Bergen County where he and his wife Elizabeth still reside. They welcomed their beautiful daughters, Andie Marie in 2017, Joie Katherine in 2019 and Sadie Akabi in 2022. Paul and his family are members of Sts. Vartanantz Armenian Apostolic Church.

BS - Economics & Finance: University of Hartford Barney School of Business

Series 7, 63 & 65 Licensed

Life & Health Insurance Licensed

Paul has focused his talents in serving the investment needs of his clients. He became a registered representative in 2010 whereupon he joined The Channel Marker Group (formerly The Shirinian Group) at Morgan Stanley. He and The Channel Marker Group serve a range of clients including high net worth families, corporate executives, self-employed professionals and small business owners.

He works with his clients to uncover core values and concerns, and based on this input, works attentively to help them in achieving their financial objectives in the areas of income generation, retirement planning, college funding and professional money management. Paul has broad knowledge in investments, accounting, tax strategies, insurance, and estate planning strategies.

Paul is a lifelong resident of Bergen County where he and his wife Elizabeth still reside. They welcomed their beautiful daughters, Andie Marie in 2017, Joie Katherine in 2019 and Sadie Akabi in 2022. Paul and his family are members of Sts. Vartanantz Armenian Apostolic Church.

Securities Agent: AL, AR, VA, TN, SC, NV, GA, DE, CA, AZ, PA, WA, TX, NJ, HI, CT, CO, RI, KY, FL, NH, NE, MN, MA, KS, NY, NC, MI, LA, IL, MO, DC, WI, OR, NM, MT, ME, IN, OH, MD; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1274653

NMLS#: 1274653

About Gregory H Shirinian

Joined Morgan Stanley in 2018

BA in Economics: Villanova University

Series 7, 66, 63 Licensed

Life & Health Insurance Licensed

Since the start of Greg's career his primary priority has been putting his clients first. He became a wealth manager in 2016 specializing in fixed income. In 2018 he joined The Shirinian Group at Morgan Stanley to provide holistic financial planning for their clients.

In his experience, he has found that the most successful relationships are those where your advisor does not simply tell you what you need, but instead works with you to achieve your financial goals. This is the foundation for his success and the reason why the majority of his client relationships are multi-generational. Having a working relationship with Greg allows you to access the experience, intellectual capital and vast resources that his team, The Channel Marker Group, can provide. These abilities put him in a place to provide an unparalleled wealth planning experience.

Greg resides in Wyckoff, New Jersey and is an active member of the Villanova University Alumni Association. Villanova helped direct him toward a career in financial planning and is where he met his wife, Abigail. They welcomed their daughter, Delilah Marie, in 2024. He, along with the rest of his family, belongs to Sts. Vartanantz Armenian Apostolic Church in Ridgefield.

BA in Economics: Villanova University

Series 7, 66, 63 Licensed

Life & Health Insurance Licensed

Since the start of Greg's career his primary priority has been putting his clients first. He became a wealth manager in 2016 specializing in fixed income. In 2018 he joined The Shirinian Group at Morgan Stanley to provide holistic financial planning for their clients.

In his experience, he has found that the most successful relationships are those where your advisor does not simply tell you what you need, but instead works with you to achieve your financial goals. This is the foundation for his success and the reason why the majority of his client relationships are multi-generational. Having a working relationship with Greg allows you to access the experience, intellectual capital and vast resources that his team, The Channel Marker Group, can provide. These abilities put him in a place to provide an unparalleled wealth planning experience.

Greg resides in Wyckoff, New Jersey and is an active member of the Villanova University Alumni Association. Villanova helped direct him toward a career in financial planning and is where he met his wife, Abigail. They welcomed their daughter, Delilah Marie, in 2024. He, along with the rest of his family, belongs to Sts. Vartanantz Armenian Apostolic Church in Ridgefield.

Securities Agent: NY, MD, LA, HI, NH, NC, KS, IL, GA, FL, CT, DC, VA, IN, WA, SC, OR, NV, OH, ME, MA, CA, AL, CO, MI, DE, TX, NM, NJ, AR, WI, TN, NE, MO, PA, AZ, MN, RI, MT; General Securities Representative; Investment Advisor Representative

NMLS#: 1676763

NMLS#: 1676763

About Kerry Drivanos

Kerry has worked in the financial services industry since 1987, and her penchant for helping individuals & families for more than three decades has allowed her to develop a reputation as a respected registered associate.

Kerry began her career with EF Hutton in 1987, and through many mergers and acquisitions the company has evolved into the present day Morgan Stanley. She has been with Mike since 1991, and the two have worked to develop a strong rapport with Mike’s clients ever since. They joined The Channel Marker Group in 2021 and look forward to expanding their professional relationship with the team. Kerry is Series 7 & 63 licensed.

Kerry is cheerful, patient and kind. She is responsible for all administrative duties, but takes the greatest pleasure in getting to know the individuals and families the team services while providing them with professional, concierge-level service. Collaborating with others to find solutions to complex problems has always driven Kerry, and she finds purpose in treating every relationship as a long term endeavor.

A native of Bergen County, Kerry and her late husband raised their family in Hawthorne, NJ where she currently resides with her two sons Stratton and Garrett, her daughter Hunter, and her two Golden Retrievers. When not in the office, Kerry enjoys time with her family and friends, the great outdoors, and DIY projects.

Kerry began her career with EF Hutton in 1987, and through many mergers and acquisitions the company has evolved into the present day Morgan Stanley. She has been with Mike since 1991, and the two have worked to develop a strong rapport with Mike’s clients ever since. They joined The Channel Marker Group in 2021 and look forward to expanding their professional relationship with the team. Kerry is Series 7 & 63 licensed.

Kerry is cheerful, patient and kind. She is responsible for all administrative duties, but takes the greatest pleasure in getting to know the individuals and families the team services while providing them with professional, concierge-level service. Collaborating with others to find solutions to complex problems has always driven Kerry, and she finds purpose in treating every relationship as a long term endeavor.

A native of Bergen County, Kerry and her late husband raised their family in Hawthorne, NJ where she currently resides with her two sons Stratton and Garrett, her daughter Hunter, and her two Golden Retrievers. When not in the office, Kerry enjoys time with her family and friends, the great outdoors, and DIY projects.

About Jose Peralta

Jose Peralta has worked in the financial services industry for over 13 years, where his passion for helping others and educating them about financial literacy has guided his career every step of the way.

Jose began his journey while still in college, working as a bank teller at TD Bank. His drive and aptitude for customer service quickly led to a series of promotions — from banker to senior banker, and ultimately to branch supervisor. Upon graduating from Lehman College with a degree in Accounting, Jose naturally transitioned into wealth management. He served as a Relationship Banker and Manager on Duty at JPMorgan Chase, eventually being promoted to Private Client Banker. His path then took him to Merrill as a Financial Solutions Advisor, followed by a role as a Planning Consultant at Fidelity Investments. In 2025, Jose joined Morgan Stanley as a Registered Client Service Associate with The Channel Marker Group.

Jose holds the Series 6, 7, 63, and 66 licenses, as well as life and health insurance licenses. He is also a Chartered Retirement Planning Counselor℠ (CRPC®). In his current role, Jose supports both clients and advisors with operational needs, while delivering concierge-level service.

Colleagues and clients alike know Jose for his friendly demeanor, patient approach, and attention to detail. Proactive and energetic, he thrives in environments where he can learn, grow, and make meaningful contributions to client success.

Originally from the Dominican Republic, Jose grew up in New York City and now lives in West Milford, NJ with his wife Natasha, their two daughters, and their dog and cat. Outside the office, Jose enjoys spending time with family and friends, listening to audiobooks, watching Mets games, diving into tech trends, and sharing playful moments with his daughters.

Jose began his journey while still in college, working as a bank teller at TD Bank. His drive and aptitude for customer service quickly led to a series of promotions — from banker to senior banker, and ultimately to branch supervisor. Upon graduating from Lehman College with a degree in Accounting, Jose naturally transitioned into wealth management. He served as a Relationship Banker and Manager on Duty at JPMorgan Chase, eventually being promoted to Private Client Banker. His path then took him to Merrill as a Financial Solutions Advisor, followed by a role as a Planning Consultant at Fidelity Investments. In 2025, Jose joined Morgan Stanley as a Registered Client Service Associate with The Channel Marker Group.

Jose holds the Series 6, 7, 63, and 66 licenses, as well as life and health insurance licenses. He is also a Chartered Retirement Planning Counselor℠ (CRPC®). In his current role, Jose supports both clients and advisors with operational needs, while delivering concierge-level service.

Colleagues and clients alike know Jose for his friendly demeanor, patient approach, and attention to detail. Proactive and energetic, he thrives in environments where he can learn, grow, and make meaningful contributions to client success.

Originally from the Dominican Republic, Jose grew up in New York City and now lives in West Milford, NJ with his wife Natasha, their two daughters, and their dog and cat. Outside the office, Jose enjoys spending time with family and friends, listening to audiobooks, watching Mets games, diving into tech trends, and sharing playful moments with his daughters.

Contact Michael J Zahn

Contact Sarkis B Shirinian

Contact Esther Fishman

Contact Joseph M Brown

Contact Paul S Shirinian

Contact Gregory H Shirinian

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Don Janevski

Don Janevski is a Private Banker serving Morgan Stanley Wealth Management offices in New Jersey.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Don began his career in financial services in 2003 and joined Morgan Stanley in 2015 as an Associate Private Banker. Prior to joining the firm, he was a Mortgage Loan Consultant and a Mortgage Product Specialist with Silver Financial Capital Group, as well as a Branch Manager with First Lenders Mortgage.

Don is a graduate of the Montclair State University, where he received a Bachelor of Business Administration in Marketing and Management. He lives in Emerson, NJ with his family. Outside of the office, Don enjoys spending time with family and friends, exercising and painting.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Don began his career in financial services in 2003 and joined Morgan Stanley in 2015 as an Associate Private Banker. Prior to joining the firm, he was a Mortgage Loan Consultant and a Mortgage Product Specialist with Silver Financial Capital Group, as well as a Branch Manager with First Lenders Mortgage.

Don is a graduate of the Montclair State University, where he received a Bachelor of Business Administration in Marketing and Management. He lives in Emerson, NJ with his family. Outside of the office, Don enjoys spending time with family and friends, exercising and painting.

NMLS#: 197095

About Adam Guralnick

Adam Guralnick is a Private Banker serving Morgan Stanley Wealth Management offices in New Jersey.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Adam began his career in financial services in 2002, and joined Morgan Stanley in 2021 as an Associate Private Banker. Prior to joining the firm, he was a Wealth Management Banker at UBS. He also served as a UHNW Associate Private Banker at Citi Private Bank and a Merrill Lynch Banking Advisor.

Adam is a graduate of the University at Buffalo, where he received a Bachelor of Arts in Communication and a Master of Arts in Informatics. He lives in Livingston, New Jersey with his family. Outside of the office, Adam enjoys traveling, sports, and spending time with his family.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Adam began his career in financial services in 2002, and joined Morgan Stanley in 2021 as an Associate Private Banker. Prior to joining the firm, he was a Wealth Management Banker at UBS. He also served as a UHNW Associate Private Banker at Citi Private Bank and a Merrill Lynch Banking Advisor.

Adam is a graduate of the University at Buffalo, where he received a Bachelor of Arts in Communication and a Master of Arts in Informatics. He lives in Livingston, New Jersey with his family. Outside of the office, Adam enjoys traveling, sports, and spending time with his family.

NMLS#: 1114313

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Channel Marker Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

9Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

12Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

9Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

12Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)