About Christopher Butler

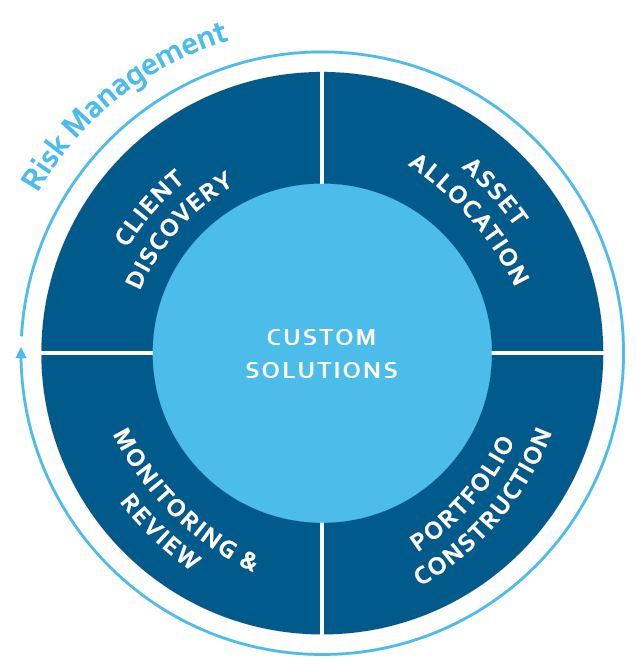

As a fully licensed investment professional for more than 35 years, Chris implements wealth accumulation and wealth preservation strategies for high net worth individuals utilizing a consultative, fee based approach. His clients range from retirees, business owners, corporate 401k plans and foundations; to investors seeking to grow their portfolios for retirement. Leveraging the intellectual capital and vast resources of Morgan Stanley, Chris develops customized solutions for clients’ needs. He is also firmly committed to long term relationships and strives to deliver exceptional client service.

As an alumnus of the University of Southern California with a Bachelor of Science degree in Investment Finance, Chris continues to expand his learning. Chris resides in Hermosa Beach, CA with his family. His interests include music (he is an avid rock guitarist and enjoys playing in local bands) & loves watching his son Michael play varsity football and lacrosse for Mira Costa High School and traveling back east to Connecticut to see his son Nik play Division 1 Lacrosse at Quinnipiac University. He is also an active member of USC’s Cardinal and Gold program which provides scholarships for student athletes,

Securities Agent: NM, AZ, HI, NY, MO, CT, MI, DC, WI, MD, ID, TN, OH, NC, VA, GA, SD, KS, IA, WA, MS, FL, CA, AR, WY, UT, TX, PA, IN, CO, AL, SC, NV, OR, NJ, MA, MT; General Securities Representative; Investment Advisor Representative

NMLS#: 1507459