The Brown and Brown Wealth Management Group at Morgan Stanley

Our Mission Statement

Welcome to our site, we look forward to hearing from you soon

The Brown and Brown Wealth Management Group at Morgan Stanley provides comprehensive portfolio and wealth management strategies to individuals, families and business owners by offering retirement planning, portfolio management and superior client service.

As your Financial Advisors, we can help you define and strive to meet your goals by delivering a vast array of resources to you in the way that is most appropriate for how you invest and what you want to achieve.

Working together we can help you preserve and grow your wealth. You'll have access to some of the world's most seasoned and respected investment professionals, a premier trading and execution platform and a full spectrum of investment choices.

We work with our clients to help grow wealth organically through building strong relationships with families, friends and the community. Our clients are the foundation of our practice.

- Trust ServicesFootnote1

- 401(k) Rollovers

- Retirement PlanningFootnote2

- Sustainable InvestingFootnote3

- Professional Portfolio ManagementFootnote4

- Long Term Care InsuranceFootnote5

- Fixed IncomeFootnote6

- Executive Financial ServicesFootnote7

- Municipal BondsFootnote8

- Financial PlanningFootnote9

- Cash Management and Lending ProductsFootnote10

- Trust AccountsFootnote11

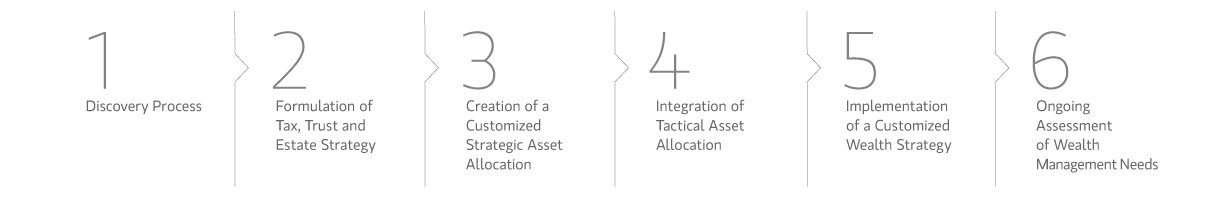

Approach

Location

Meet The Brown and Brown Wealth Management Group

About David Brown

Mr. Brown’s goal is to strive to provide every client with a superior level of service and responsiveness; to help match the client’s investment needs to the most appropriate investments in light of the client’s risk tolerance and return expectations, and to provide this service on a fair and competitive basis. Helping clients understand risk and helping them appreciate the risk/return trade-offs as it relates to portfolio performance is an important part of the investment process and guides every investment decision made on behalf of Mr. Brown’s clients. His investment process is designed to try to produce the best risk-adjusted returns for the client while attempting to minimize the potential for negative surprises and/or failed expectations on behalf of the client.

David and Georganne divide their time between the western suburbs of Chicago and Naples, FL with their daughter Madison and enjoy working with and supporting various charitable foundations and community organizations including Feed My Starving Children, Salvation Army, United Way, Wheaton Bible Church and Covenant Church of Naples.

Thanks to the trust his clients have placed in him, and the support of his Team, David Brown has been ranked as one of the Forbes Best-In-State Wealth Advisors in 2025.

Source: Forbes.com. Data compiled by SHOOK Research LLC based on the 12-month time period concluding in June of the year prior to issuance of the award.

NMLS#: 1255664

About Georganne Brown

Mrs. Brown focuses on comprehensive retirement planning by utilizing a research based approach to asset allocation, portfolio construction and manager selection. She also specializes in environmentally responsible and sustainable investment solutions, tax efficient income generating strategies and estate and trust planning services.

Georganne and her husband David have one daughter, Madison. She enjoys spending time with family, is an avid reader, runner, loves to cook, play golf and travel.

NMLS#: 1321565

About Maria Bulat

In her spare time Maria likes to read, travel and spend time with family and friends. She currently lives in Naples with her husband Len.

Series 7, 31 & 66 Registered

About Jarrod James

Jarrod lives in the NW suburbs with his wife JT and two sons Cole and Bode. He enjoys golf, fishing and wine.

Contact David Brown

Contact Georganne Brown

The Power of Partnerships

About Stacey Herring

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Stacey began her career in financial services in 1994, and joined Morgan Stanley in 2014. Prior to joining the firm, she was a Mortgage Sales Manager at SunTrust Bank and a Senior Mortgage Loan Officer for over 17 years at Fifth Third Bank. Stacey is a graduate of Florida State University, where she received a Bachelor of Science in Business Marketing and a Minor in Communications.

Stacey currently serves on the Women’s Foundation of Collier County Board of Directors, as well as Junior Achievement of SWFL’s Advisory Board. In addition, Stacey has chaired many community endeavors, serving Naples Community Hospital, PACE Center for Girls of Collier County, and Youth Haven. She is a graduate of the Naples Chamber of Commerce’s Leadership Collier program, awarded Gulfshore Business Magazine’s “40 Under 40 Award”, and in 2013 was awarded the Glass Slipper Award by The Education Foundation, Champions for Learning. In 2014, Stacey was named a Woman of Initiative by the Community Foundation of Collier County for her philanthropy, dedication, and commitment to children’s causes.

About Hannah Sledd

Hannah began her career in financial services in 2012 and we are happy that she is rejoining Morgan Stanley. Hannah began her work as an independent advisor in Atlanta, working with top financial firms including E*TRADE and JP Morgan before joining Morgan Stanley. She has a vast array of experiences, including working on an elite trading desk, assisting advisors in the development and implementation of financial plans for their high-net-worth clientele, leading an international mergers and acquisitions team and working as a financial advisor.

Hannah is a graduate of the University of Alabama where she earned a bachelor’s degree in finance with a concentration in investment management, and currently holds the CERTIFIED FINANCIAL PLANNER™ designation. Hannah currently lives in Nashville, TN. When not in the office, Hannah enjoys pilates, travelling, and teaching yoga.

DISCLOSURE:

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

© 2023 Morgan Stanley Smith Barney LLC. Member SIPC.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Know What to Do if You Think You've Been Hacked

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

4Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

5Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

6Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

8Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

9Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

10Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley