About Scott L Kleiner

With over 30 years of wealth management experience, Scott is very familiar with the complex challenges of managing significant wealth. He brings that understanding to a select group of highly accomplished families and individuals, helping them customize a plan to address their specific needs and pursue their aspirations. His goal is to serve as a close and trusted advisor who is always available to help clients make confident, well-informed decisions.

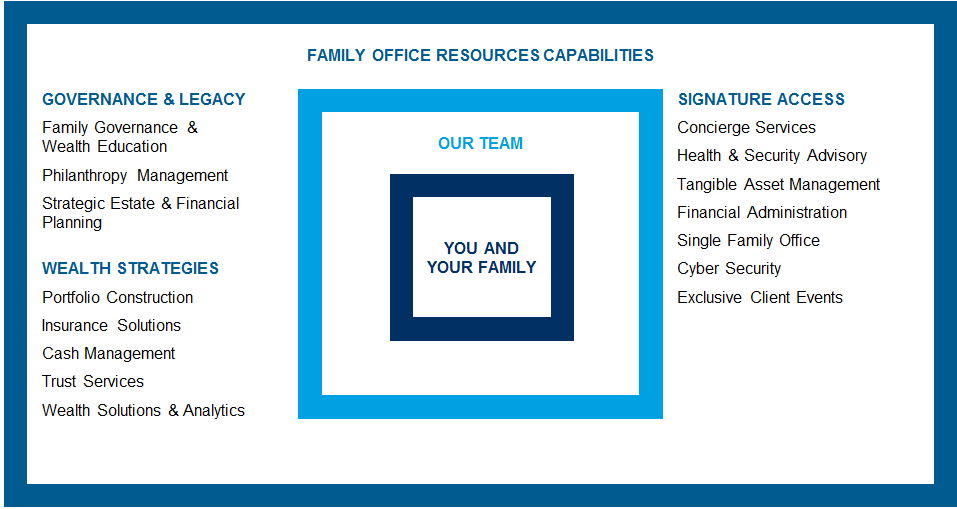

Scott leads one of the only 250 teams that comprise Morgan Stanley Private Wealth Management, (as of 01/2024) a division of the firm that focuses exclusively on the planning, governance, liability management and investing needs of families with $20 million plus in investable assets. Combining the impressive resources of Morgan Stanley, a global financial services firm, with the individualized services of an investment boutique, Scott and his team offer their client access to an exclusive suite of services geared to the needs of ultra-high net worth families, their businesses and charitable entities.

In 2014 and 2016, the Financial Times named Scott as one of the 400 Top Financial Advisers. In their words, “Top advisers take a holistic view of a client’s financial needs, looking beyond just investments … keeping their clients focused on long-term financial goals, rather than on the latest tweet.” He has also been recognized by Forbes as a Best-In-State Wealth Advisor in 2020, 2021, 2022, and 2024.

The skills and thought process he gained through decades of work in the credit markets informs and enhances his approach to investing in all asset classes, enabling him to offer a distinctive investment perspective to his clients.

Scott began his wealth advisory career in 1986 with Drexel, Burnham, a predecessor firm of Morgan Stanley, shortly after receiving his Bachelor of Arts degree in Classics from Beloit College. He has regularly volunteered at a local breakfast program that serves NYC’s less fortunate for the past 30 years, and serves on the Board of Heights and Hills, a Brooklyn social services agency that promotes successful aging in the community.

Disclaimers:

2020, 2021, 2022, 2024 Forbes Best-In-State Wealth AdvisorsSource: Forbes.com (Awarded 2020,2021,2022,2024).Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2014 & 2016 Financial Times 400 Top Financial Advisors Source: ft.com. Data compiled by the Financial Times based the following time periods: Awarded 2016; data 9/30/13 -9/30/15 Awarded 2014; data 9/30/12 -9/30/13

Securities Agent: ID, NC, RI, FL, CT, CA, PA, VA, TN, OR, MT, IA, VT, AL, OH, NV, MD, MA, NM, IL, NJ, ND, AZ, WY, SD, NH, DE, AK, KY, NY, MI, UT, NE, GA, CO, TX, SC, OK, KS, HI, DC, WA, MO; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1282841

Industry Award Winner

Industry Award Winner