The Bellwether Group at Morgan Stanley

Aimee Cogan, CFP®, CIMA®Richard Williams, CFAScott RockwellKathy FrancolettiRochelle A Nigri, QPFCPaul C. Alexander, CRPC®

Direct:

(941) 363-8515(941) 363-8515

Toll-Free:

(800) 237-9441(800) 237-9441

Our Mission Statement

Providing guidance to assist uniquely successful individuals and families create the lifestyles they desire, today and tomorrow.

Our Story

The Bellwether Group is a team of seven Financial Advisors and four support staff at Morgan Stanley. Unlike the typical financial advisor with hundreds of clients, we devote the full talents and resources of our team to serving the needs of fewer than 100 families allowing us to provide a premium level of service tailored to each of our client's unique individual needs.

Our clients' priorities are our own. The Bellwether Group leverages our decades of experience along with the resources of the full Morgan Stanley firm to create comprehensive wealth management strategies tailored to your unique goals. This is and always has been our mission throughout our careers, and we look forward to meeting you to discuss how we can collaborate on a financial plan aimed at the future you want for yourself and your family.

We have a dedicated and highly talented Portfolio Management team who will assist you, the ultimate decision-maker, in determining the appropriate asset allocation decisions based on your goals and needs. Our Portfolio Managers have the technical and analytical skills to do the primary research and due diligence for each and every investment recommendation we make. Through carefully crafted portfolios, we emphasize diversification, tax efficiencies, risk mitigation, capital preservation and long-term growth. We proudly promote all the services and resources that we offer, and we welcome the opportunity to offer this same level of excellence to you and your family.

Our clients' priorities are our own. The Bellwether Group leverages our decades of experience along with the resources of the full Morgan Stanley firm to create comprehensive wealth management strategies tailored to your unique goals. This is and always has been our mission throughout our careers, and we look forward to meeting you to discuss how we can collaborate on a financial plan aimed at the future you want for yourself and your family.

We have a dedicated and highly talented Portfolio Management team who will assist you, the ultimate decision-maker, in determining the appropriate asset allocation decisions based on your goals and needs. Our Portfolio Managers have the technical and analytical skills to do the primary research and due diligence for each and every investment recommendation we make. Through carefully crafted portfolios, we emphasize diversification, tax efficiencies, risk mitigation, capital preservation and long-term growth. We proudly promote all the services and resources that we offer, and we welcome the opportunity to offer this same level of excellence to you and your family.

Services Include

- Wealth ManagementFootnote1

- Professional Portfolio ManagementFootnote2

- Retirement PlanningFootnote3

- Alternative InvestmentsFootnote4

- Estate Planning StrategiesFootnote5

- Trust AccountsFootnote6

- Business Succession PlanningFootnote7

- Philanthropic ManagementFootnote8

- Financial PlanningFootnote9

- Life InsuranceFootnote10

- Municipal BondsFootnote11

- Precious MetalsFootnote12

- Divorce Financial AnalysisFootnote13

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Location

2 North Tamiami Trail

Ste 1100

Sarasota, FL 34236

US

Direct:

(941) 363-8515(941) 363-8515

Toll-Free:

(800) 237-9441(800) 237-9441

Meet The Bellwether Group

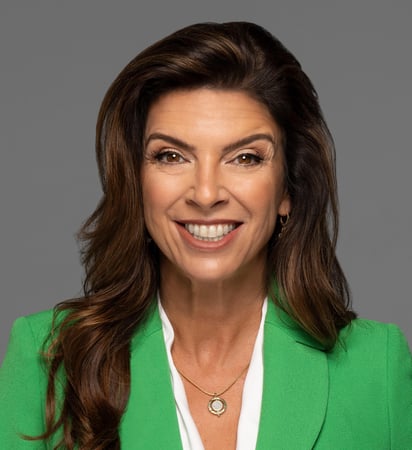

About Aimee Cogan

Aimee D. Cogan is Managing Director, Senior Investment Management Consultant, Financial Advisor and Co-Founder of the Bellwether Group. With over 30 years of experience in banking and the financial services industry, Aimee provides comprehensive wealth management for high net worth clients. She focuses on the team’s separately managed accounts, alternative investments, foreign currencies and precious metals.

Following her childhood love of math, Aimee earned a B.S. degree in Finance from the University of Florida. She started at SunTrust Bank, where she spent 12 years as a Private Client Financial Advisor. Committed to continuing education, Aimee is a Certified Financial Planner™ and a Certified Investment Management Analyst®. In addition, Aimee has earned the Family Wealth Director designation from the firm, a status achieved because of her sophisticated approach to the complex financial needs of affluent families.

Aimee’s talents have been recognized both nationally and regionally. She has been ranked within Barron's Top 100 Women Financial Advisors (2011-2014, 2016-2018, 2021), Barron's Top 1,200 Financial Advisors (2012-2024), Forbes Best-In-State Wealth Advisors (2019-2025), Forbes Top Women Wealth Advisors (2019-2026), Forbes Best-In-State Wealth Management Teams (2023-2026), and Forbes Best-In-State Women Advisors (2023-2025). Aimee has served as a member of Morgan Stanley’s Financial Advisors Council and has been Chair of Morgan Stanley’s Consulting Group Council.

She and her family support the Ringling College of Art and Design, Asolo Repertory Theater, Forty Carrots, Child Protection Center, and Girls Inc. When away from the office, she enjoys traveling & boating with her family.

Disclosures:

2016-2018, 2021-2022 Barron's Top 100 Women Financial Advisors

Source: Barrons.com (Awarded June 2016-2018, 2021-2022). Data compiled by Barron's based on 12-month period concluding in Mar of the year the award was issued.

2016-2021, 2023-2024 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2016-2021, 2023-2024). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

2019 - 2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2019 - 2024). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2016-2018, 2021-2022 Barron's Top 100 Women Financial Advisors

Source: Barrons.com (Awarded June 2016-2018, 2021-2022). Data compiled by Barron's based on 12-month period concluding in Mar of the year the award was issued.

2022 -2026 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded 2022 - 2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

Following her childhood love of math, Aimee earned a B.S. degree in Finance from the University of Florida. She started at SunTrust Bank, where she spent 12 years as a Private Client Financial Advisor. Committed to continuing education, Aimee is a Certified Financial Planner™ and a Certified Investment Management Analyst®. In addition, Aimee has earned the Family Wealth Director designation from the firm, a status achieved because of her sophisticated approach to the complex financial needs of affluent families.

Aimee’s talents have been recognized both nationally and regionally. She has been ranked within Barron's Top 100 Women Financial Advisors (2011-2014, 2016-2018, 2021), Barron's Top 1,200 Financial Advisors (2012-2024), Forbes Best-In-State Wealth Advisors (2019-2025), Forbes Top Women Wealth Advisors (2019-2026), Forbes Best-In-State Wealth Management Teams (2023-2026), and Forbes Best-In-State Women Advisors (2023-2025). Aimee has served as a member of Morgan Stanley’s Financial Advisors Council and has been Chair of Morgan Stanley’s Consulting Group Council.

She and her family support the Ringling College of Art and Design, Asolo Repertory Theater, Forty Carrots, Child Protection Center, and Girls Inc. When away from the office, she enjoys traveling & boating with her family.

Disclosures:

2016-2018, 2021-2022 Barron's Top 100 Women Financial Advisors

Source: Barrons.com (Awarded June 2016-2018, 2021-2022). Data compiled by Barron's based on 12-month period concluding in Mar of the year the award was issued.

2016-2021, 2023-2024 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2016-2021, 2023-2024). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

2019 - 2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2019 - 2024). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2016-2018, 2021-2022 Barron's Top 100 Women Financial Advisors

Source: Barrons.com (Awarded June 2016-2018, 2021-2022). Data compiled by Barron's based on 12-month period concluding in Mar of the year the award was issued.

2022 -2026 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded 2022 - 2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

Securities Agent: TX, CO, RI, ME, CT, WV, WA, NJ, PR, MN, GA, DC, UT, MD, SC, NC, MI, KY, FL, CA, OR, NY, NM, WI, DE, WY, OK, OH, MA, IL, SD, PA, AZ, VA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1290495

NMLS#: 1290495

About Richard Williams

Richard T. Williams III, CFA is a Senior Vice President, Financial Advisor, Senior Portfolio Management Director, and Co-Founder of The Bellwether Group at Morgan Stanley. With over 30 years of experience in the financial services industry, he focuses on fundamental analysis, equity research, and portfolio asset allocation. He also manages the Bellwether Tactical Core Value Portfolio and provides strategic guidance on taxable bond investments and portfolio hedging. Rich is recognized by Morgan Stanley as an Alternative Investments Director based on his knowledge and experience with hedge funds, private equity and private credit.

Rich’s love of the stock market began at age 13 when he used the money he earned from mowing lawns to purchase his first stock. After his graduation from the University of Florida with a B.S. in History, he entered the financial services industry in 1991. He rose to become a Vice President, Client Consultant for Manning and Napier Advisors, Inc; a large, Rochester, NY based, institutional investment advisor. After moving back home to Sarasota, he spent seven years as one of Wachovia Wealth Management’s top private bankers. In 2005 he moved to Merrill Lynch to start the Sarasota office for their Private Banking and Investment Group as Vice President. After the financial crisis forced Merrill Lynch to be acquired by Bank of America, he decided to joined Morgan Stanley in 2009.

With a strong belief in financial education, Rich has earned the Chartered Financial Analyst® (CFA) designation, thus acquiring advanced analytical and portfolio management skills, along with enhanced investment strategies. Rich conducts an in-depth analysis of each investment he chooses for his clients’ financial plans. This analysis is ongoing as he regularly makes adjustments to adapt to changing market conditions.

Rich is a member of the CFA Institute and the CFA Tampa Bay Society. He is a former Chairman of the Board of the Wellness Community, and a past Board Member and Treasurer of Forty Carrots Family Center, a nonprofit dedicated to strengthening families through educational programs. Currently, Rich serves on the Board of The Field Club and is Treasurer of The Field Club foundation. He enjoys, tennis, boating and travel with his wife Kristen and their three children.

Rich’s love of the stock market began at age 13 when he used the money he earned from mowing lawns to purchase his first stock. After his graduation from the University of Florida with a B.S. in History, he entered the financial services industry in 1991. He rose to become a Vice President, Client Consultant for Manning and Napier Advisors, Inc; a large, Rochester, NY based, institutional investment advisor. After moving back home to Sarasota, he spent seven years as one of Wachovia Wealth Management’s top private bankers. In 2005 he moved to Merrill Lynch to start the Sarasota office for their Private Banking and Investment Group as Vice President. After the financial crisis forced Merrill Lynch to be acquired by Bank of America, he decided to joined Morgan Stanley in 2009.

With a strong belief in financial education, Rich has earned the Chartered Financial Analyst® (CFA) designation, thus acquiring advanced analytical and portfolio management skills, along with enhanced investment strategies. Rich conducts an in-depth analysis of each investment he chooses for his clients’ financial plans. This analysis is ongoing as he regularly makes adjustments to adapt to changing market conditions.

Rich is a member of the CFA Institute and the CFA Tampa Bay Society. He is a former Chairman of the Board of the Wellness Community, and a past Board Member and Treasurer of Forty Carrots Family Center, a nonprofit dedicated to strengthening families through educational programs. Currently, Rich serves on the Board of The Field Club and is Treasurer of The Field Club foundation. He enjoys, tennis, boating and travel with his wife Kristen and their three children.

Securities Agent: WV, SC, NM, CA, GA, SD, DC, WA, PA, OK, OH, NY, IL, RI, MN, CT, CO, UT, NC, MA, FL, DE, ME, KY, VA, WI, TX, PR, MD, OR, AZ, WY, NJ, MI; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1290429

NMLS#: 1290429

About Scott Rockwell

Scott Rockwell is a Senior Vice President, Financial Advisor, and Co-Founder of The Bellwether Group at Morgan Stanley. With over 31 years of experience in banking and the financial services industry, Scott concentrates on technical analysis, portfolio asset allocation, risk management, municipal bonds and taxable bond investments. He manages the group’s Small Cap Growth, Dividend Growth and discretionary fixed income portfolios. He coordinates the team’s Executive Financial Services (restricted stock/Rule 144) clients and is an Insurance Planning Director and an Alternative Investments Director.

Scott is a graduate of The Ohio State University with a B.S. in Business Administration and Finance. He spent eleven years at Bank of America, with over six years as a Commercial Relationship Manager and nearly five years as Senior Vice President in the Private Banking Division. His focus was on middle-market companies, high net worth individuals, and municipal finance. After three years as a Private Wealth Advisor at Merrill Lynch, Scott came to Morgan Stanley in 2009 and co-founded The Bellwether Group with Aimee Cogan and Rich Williams.

With more than three decades of financial experience, Scott works with his team to research, analyze and implement investment solutions that are appropriate for his client's specific goals and objectives. His experience in municipal bonds can be valuable for high net worth and ultra-high net worth individuals and families.

Actively involved in his community, Scott has served as Board President and Treasurer for the Easter Seals of South West Florida, the Easter Seals of Southwest Florida Foundation, and as a Board Member of the Manatee County YMCA. He enjoys all sports and has volunteered as a youth lacrosse, football, and baseball coach over the years. He most recently served for 4 years as an assistant lacrosse coach with Cardinal Mooney Catholic High School. Scott resides in Sarasota with his wife Crystal and two children.

Scott is a graduate of The Ohio State University with a B.S. in Business Administration and Finance. He spent eleven years at Bank of America, with over six years as a Commercial Relationship Manager and nearly five years as Senior Vice President in the Private Banking Division. His focus was on middle-market companies, high net worth individuals, and municipal finance. After three years as a Private Wealth Advisor at Merrill Lynch, Scott came to Morgan Stanley in 2009 and co-founded The Bellwether Group with Aimee Cogan and Rich Williams.

With more than three decades of financial experience, Scott works with his team to research, analyze and implement investment solutions that are appropriate for his client's specific goals and objectives. His experience in municipal bonds can be valuable for high net worth and ultra-high net worth individuals and families.

Actively involved in his community, Scott has served as Board President and Treasurer for the Easter Seals of South West Florida, the Easter Seals of Southwest Florida Foundation, and as a Board Member of the Manatee County YMCA. He enjoys all sports and has volunteered as a youth lacrosse, football, and baseball coach over the years. He most recently served for 4 years as an assistant lacrosse coach with Cardinal Mooney Catholic High School. Scott resides in Sarasota with his wife Crystal and two children.

Securities Agent: ME, MN, MA, KY, WI, OH, CO, PR, OR, NM, DE, OK, AZ, WY, WV, TX, SC, NY, MI, IL, SD, NJ, NC, GA, DC, VA, FL, MD, CA, UT, CT, WA, RI, PA; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1295597

NMLS#: 1295597

About Kathy Francoletti

Kathy Francoletti is a Senior Vice President, Family Wealth Advisor and Financial Advisor with The Bellwether Group at Morgan Stanley. With more than 45 years in the banking and financial services industries, Kathy focuses on comprehensive wealth management for individuals and business owners.

Kathy entered the banking industry in 1978 with a predecessor of Wells Fargo Bank. Her banking career included experience in banking and lending as well as investment management and trust services. After joining Morgan Stanley in 2011, Kathy earned the prestigious Family Wealth Advisor designation. This certification allows her to help clients manage the complexities of philanthropy and estate planning from a family and multi-generational perspective. She holds the Securities Series 7, 63, 65 and Florida Life and Variable Annuity Licenses.

An active member of her community, Kathy has volunteered for many years with a focus on serving women and children’s services. During her career she served as President of the boards of the Women’s Resource Center and Girls Inc. of Sarasota County to name a few. Currently she volunteers with Easter Seals of Southwest Florida. Kathy and her husband, Tom, live in Cape Haze, where they enjoy spending time with their quadruplet grandchildren.

Kathy entered the banking industry in 1978 with a predecessor of Wells Fargo Bank. Her banking career included experience in banking and lending as well as investment management and trust services. After joining Morgan Stanley in 2011, Kathy earned the prestigious Family Wealth Advisor designation. This certification allows her to help clients manage the complexities of philanthropy and estate planning from a family and multi-generational perspective. She holds the Securities Series 7, 63, 65 and Florida Life and Variable Annuity Licenses.

An active member of her community, Kathy has volunteered for many years with a focus on serving women and children’s services. During her career she served as President of the boards of the Women’s Resource Center and Girls Inc. of Sarasota County to name a few. Currently she volunteers with Easter Seals of Southwest Florida. Kathy and her husband, Tom, live in Cape Haze, where they enjoy spending time with their quadruplet grandchildren.

Securities Agent: DC, PR, UT, KY, WY, TX, GA, OR, MN, MD, AZ, WV, NM, MI, IL, CT, VA, RI, OK, DE, WA, SC, NJ, NC, CO, OH, NY, MA, FL, CA, WI, PA, ME; General Securities Representative; Investment Advisor Representative

NMLS#: 545462

NMLS#: 545462

About Rochelle A Nigri

Rochelle Nigri, QPFC ® is a Financial Advisor with The Bellwether Group at Morgan Stanley, with over 18 years of experience as an advocate for clients with companies in finance, retail, media and philanthropy. She focuses on tailored Wealth Planning, Retirement Solutions, Investment Management, Divorce Financial Analysis, and Cash Management. Rochelle joined the team in 2014 as a Marketing Associate responsible for marketing, public relations, business development and client relations. Her career as an advocate for clients has been developed over 2 generations: first as a runway & print model in New York, Florida, and Italy, and then returning to her academic roots she honed her Relationship Management career over 10 years at Saks Fifth Avenue, Dolce PR, and SRQ MEDIA Group. Rochelle earned her B.A. from the University of South Florida with a double concentration in Economics and International Relations, and a minor in Business. She holds the securities Series 7, 63, 65, 31, and Florida Life, Health and Variable Insurance licenses.

With a strong belief in financial education, Rochelle has earned a Qualified Plan Financial Consultant ® (QPFC) designation, thus demonstrating her knowledge, experience, and commitment to working with retirement plans. Plan advisors who earn their QPFC ® demonstrate the professional focus required to provide support to help plan sponsors manage their fiduciary roles and responsibilities.

Rochelle has been named to the Morgan Stanley’s Pacesetter’s Club, a global recognition program for Financial Advisors who, early in their career, have demonstrated the highest professional standards and first-class client service. She serves on Morgan Stanley’s Southwest Florida Diversity & Inclusion Advisory Council. An advocate for Financial Literacy Rochelle has presented on multiple Financial Savvy and Wealth Planning panels, including to the Black Wealth Summit, Official Black Wall Street, the National Council of Negro Women (Hudson Valley Section), graduates of West Point, and Delta Sigma Theta Sorority, Inc. (Westchester Alumnae Chapter).

Committed to being connected to the community, Rochelle volunteers for causes devoted to the arts, education, and the welfare of children and families. She has been recognized by the Sarasota Young Professionals Group with its YPG Leadership Circle Award in 2010, and SRQ Magazine in its Leadership Circle in 2019, 2020 & 2021. Rochelle presently serves on The Van Wezel Foundation Board of Directors, is former Events Chair of the Sarasota Young Professionals Group, and has served on the Advisory Board of Directors for the Make-A-Wish Foundation, and Girls Inc. of Sarasota County. She has co-chaired and served on committees to provide awareness and raise funds for over 20 charities in Sarasota. Among the organizations she presently supports are The Van Wezel/Sarasota Performing Arts Center Foundation, Girls Inc., Visible Men Academy, and SPARCC Safe Place & Rape Crisis Center.

With a strong belief in financial education, Rochelle has earned a Qualified Plan Financial Consultant ® (QPFC) designation, thus demonstrating her knowledge, experience, and commitment to working with retirement plans. Plan advisors who earn their QPFC ® demonstrate the professional focus required to provide support to help plan sponsors manage their fiduciary roles and responsibilities.

Rochelle has been named to the Morgan Stanley’s Pacesetter’s Club, a global recognition program for Financial Advisors who, early in their career, have demonstrated the highest professional standards and first-class client service. She serves on Morgan Stanley’s Southwest Florida Diversity & Inclusion Advisory Council. An advocate for Financial Literacy Rochelle has presented on multiple Financial Savvy and Wealth Planning panels, including to the Black Wealth Summit, Official Black Wall Street, the National Council of Negro Women (Hudson Valley Section), graduates of West Point, and Delta Sigma Theta Sorority, Inc. (Westchester Alumnae Chapter).

Committed to being connected to the community, Rochelle volunteers for causes devoted to the arts, education, and the welfare of children and families. She has been recognized by the Sarasota Young Professionals Group with its YPG Leadership Circle Award in 2010, and SRQ Magazine in its Leadership Circle in 2019, 2020 & 2021. Rochelle presently serves on The Van Wezel Foundation Board of Directors, is former Events Chair of the Sarasota Young Professionals Group, and has served on the Advisory Board of Directors for the Make-A-Wish Foundation, and Girls Inc. of Sarasota County. She has co-chaired and served on committees to provide awareness and raise funds for over 20 charities in Sarasota. Among the organizations she presently supports are The Van Wezel/Sarasota Performing Arts Center Foundation, Girls Inc., Visible Men Academy, and SPARCC Safe Place & Rape Crisis Center.

Securities Agent: RI, AR, VA, CA, FL, DE, TX, PR, NJ, GA, AZ, WI, MN, CO, SC, MD, KY, IL, AL, OR, DC, CT, NM, NC, MI, MA, WA, UT, OH, NV, PA, ME, WY, WV, OK, NY; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1653122

NMLS#: 1653122

About Paul C. Alexander

Paul understands that wealth management is more than just access to the wide range of financial services and strategies at Morgan Stanley—it is how those services and strategies are developed and tailored to help you achieve your financial goals.

Paul has been in the financial industry for more than seventeen years and had the pleasure of joining The Bellwether Group in 2022. He graduated from the University of South Florida with a Bachelor's degree in Psychology, and holds the professional designation of CRPC® (Chartered Retirement Planning Counselor SM) awarded by the College for Financial Planning. Additionally, Paul holds his series 6, 7, 63, 66, SIE, and his Life/Health, Annuity, and Long Term Care insurance licenses.

Paul is a qualified Portfolio Manager who, in addition to providing traditional advice and guidance, can help clients pursue their objectives by building and managing his own personalized or defined strategies, which may incorporate individual stocks and bonds, model portfolios, and third-party investment strategies. When servicing clients through the firm’s Investment Advisory Program, a Portfolio Manager may manage his strategies on a discretionary basis.

His areas of expertise include retirement planning strategies for individuals and businesses, and wealth management for high-net-worth families. His clients include everyone from corporate executives and business owners to farmers and retirees. Paul believes asset allocation, portfolio rebalancing, and regular reviews are the essential foundation in helping his clients pursue their investment goals.

Paul and his wife, Sarah, reside in The Oaks Club where he serves on both the finance and master plan advisory committees. Paul and Sarah have three beautiful children, Peter, Marshall and their late daughter, Lilly. In his free time, he likes to travel to new places, play golf, and go to the gym.

Paul has been in the financial industry for more than seventeen years and had the pleasure of joining The Bellwether Group in 2022. He graduated from the University of South Florida with a Bachelor's degree in Psychology, and holds the professional designation of CRPC® (Chartered Retirement Planning Counselor SM) awarded by the College for Financial Planning. Additionally, Paul holds his series 6, 7, 63, 66, SIE, and his Life/Health, Annuity, and Long Term Care insurance licenses.

Paul is a qualified Portfolio Manager who, in addition to providing traditional advice and guidance, can help clients pursue their objectives by building and managing his own personalized or defined strategies, which may incorporate individual stocks and bonds, model portfolios, and third-party investment strategies. When servicing clients through the firm’s Investment Advisory Program, a Portfolio Manager may manage his strategies on a discretionary basis.

His areas of expertise include retirement planning strategies for individuals and businesses, and wealth management for high-net-worth families. His clients include everyone from corporate executives and business owners to farmers and retirees. Paul believes asset allocation, portfolio rebalancing, and regular reviews are the essential foundation in helping his clients pursue their investment goals.

Paul and his wife, Sarah, reside in The Oaks Club where he serves on both the finance and master plan advisory committees. Paul and Sarah have three beautiful children, Peter, Marshall and their late daughter, Lilly. In his free time, he likes to travel to new places, play golf, and go to the gym.

Securities Agent: DE, WV, OH, MN, SD, NJ, GA, SC, RI, NY, AL, WI, WA, PR, IN, AZ, VA, TX, OR, CT, OK, MA, NC, ME, DC, CO, WY, PA, CA, KY, UT, NM, NH, MI, MD, IL, FL; General Securities Representative; Investment Advisor Representative

NMLS#: 521115

NMLS#: 521115

About David White

David began his professional career in commercial real estate. His successful model of acquiring undervalued property, generating rental income, and selling for a profit became a foundation of his investment philosophy.

He utilized his expertise and connections in real estate to transition into wealth management, where he has been for 20+ years. His highly disciplined approach has helped create wealth and generate income for clients looking to transition from earning to more time spent on leisure and philanthropy. He has earned the designation Senior Portfolio Manager.

David is a member of the Investment committee, and chair of the Advancement committee for The Out-of-Door Academy; a Cum Laude Society School distinction for the top 1% of secondary schools nationally. A native of Dayton, Ohio, he resides in Lakewood Ranch with his wife, Stacy, and two children. He enjoys golf, skiing, and travelling to Idaho.

Securities Agent: FL, WY, WV, VA, SC, PA, OH, NV, NM, NJ, NC, KY, IL, ID, GA, CT, CO; General Securities Representative; Investment Advisor Representative

He utilized his expertise and connections in real estate to transition into wealth management, where he has been for 20+ years. His highly disciplined approach has helped create wealth and generate income for clients looking to transition from earning to more time spent on leisure and philanthropy. He has earned the designation Senior Portfolio Manager.

David is a member of the Investment committee, and chair of the Advancement committee for The Out-of-Door Academy; a Cum Laude Society School distinction for the top 1% of secondary schools nationally. A native of Dayton, Ohio, he resides in Lakewood Ranch with his wife, Stacy, and two children. He enjoys golf, skiing, and travelling to Idaho.

Securities Agent: FL, WY, WV, VA, SC, PA, OH, NV, NM, NJ, NC, KY, IL, ID, GA, CT, CO; General Securities Representative; Investment Advisor Representative

Securities Agent: KY, UT, MN, MI, MD, ID, AL, SC, GA, RI, NV, AZ, TX, NY, NC, IL, WI, OK, NM, NJ, DE, DC, CT, PA, OH, VA, OR, FL, CO, WV, WA, CA, PR, ME, MA, WY; General Securities Representative; Investment Advisor Representative

About Christopher Wilkinson

Christopher Wilkinson serves as the Business Development Associate for the Bellwether Group at Morgan Stanley. He holds securities licenses including the Series 7 and 66, as well as the Life and Variable Annuity Insurance license and a Financial Planning Specialist Designation. He focuses his efforts on helping the Bellwether Group deliver the full firm capabilities to all our clients, as well as directing all operational and organizational services for the team. Chris earned his B.A. in Economics from The University of Florida with a Minor in Business Administration. He is Bilingual (Spanish) and enjoys reading and working out.

About Melanie Barber

Melanie Barber is a Portfolio Associate with the Bellwether Group at Morgan Stanley. She holds securities licenses including 7, 9, 10, 31, 63, 65 and the Life and Variable Annuity Insurance license. She focuses on analytical reporting and client services. Melanie earned her B.S. in business management from Florida Gulf Coast University and resides on Longboat Key with her husband, Mark, and their daughter, Abigail and son, Logan. They enjoy boating and traveling around the world.

About Liz Grissom

Liz Grissom is a Wealth Management Associate with the Bellwether Group. She holds security licenses including the Series 7, 31, 63, 65 and the Life and Variable Annuity Insurance license. She focuses on financial planning assistance and client servicing. Liz earned her B.S. in Finance from Villanova University and lives in Sarasota with her husband Ashley. Liz spent her first 18 years overseas, is an avid golfer and enjoys making candy in her spare time.

About Lindsay S. Mertzlufft

Lindsay was born and raised in Ann Arbor, Michigan. She attended Colorado State University and spent several years in Denver working in retail management. She relocated to Sarasota in 2000, where she met her husband, David, and together they have two daughters.

Lindsay brings over a decade of experience in medical marketing, event planning, and sales. In 2025, she joined Bellwether team as a Client Service Associate. Her strong background in marketing and sales, combined with her client-focused approach, makes her a valuable asset to the Bellwether team.

Outside of the office, Lindsay enjoys running, pickleball, travel, skiing, and spending time with her family.

Lindsay brings over a decade of experience in medical marketing, event planning, and sales. In 2025, she joined Bellwether team as a Client Service Associate. Her strong background in marketing and sales, combined with her client-focused approach, makes her a valuable asset to the Bellwether team.

Outside of the office, Lindsay enjoys running, pickleball, travel, skiing, and spending time with her family.

Contact Aimee Cogan

Contact Richard Williams

Contact Scott Rockwell

Contact Kathy Francoletti

Contact Rochelle A Nigri

Contact Paul C. Alexander

Hear From Our Clients

Testimonial(s) are solicited by Morgan Stanley Wealth Management Canada and provided by current client(s) at the time of publication. No compensation of any kind was provided in exchange for the client testimonial(s) presented. Client testimonials may not be representative of the experience of other clients and are not a guarantee of future performance or success.

3846129 9/24

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Bellwether Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

8Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

9Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

12Physical precious metals are non-regulated products. Precious metals are speculative investments, which may experience short-term and long-term price volatility. The value of precious metals investments may fluctuate and may appreciate or decline, depending on market conditions. If sold in a declining market, the price you receive may be less than your original investment. Unlike bonds and stocks, precious metals do not make interest or dividend payments. Therefore, precious metals may not be appropriate for investors who require current income. Precious metals are commodities that should be safely stored, which may impose additional costs on the investor. The Securities Investor Protection Corporation (“SIPC”) provides certain protection for customers’ cash and securities in the event of a brokerage firm’s bankruptcy, other financial difficulties, or if customers’ assets are missing. SIPC protection does not apply to precious metals or other commodities.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

8Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

9Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

12Physical precious metals are non-regulated products. Precious metals are speculative investments, which may experience short-term and long-term price volatility. The value of precious metals investments may fluctuate and may appreciate or decline, depending on market conditions. If sold in a declining market, the price you receive may be less than your original investment. Unlike bonds and stocks, precious metals do not make interest or dividend payments. Therefore, precious metals may not be appropriate for investors who require current income. Precious metals are commodities that should be safely stored, which may impose additional costs on the investor. The Securities Investor Protection Corporation (“SIPC”) provides certain protection for customers’ cash and securities in the event of a brokerage firm’s bankruptcy, other financial difficulties, or if customers’ assets are missing. SIPC protection does not apply to precious metals or other commodities.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Testimonial(s) solicited by Morgan Stanley and provided by current client(s) at the time of publication. No compensation of any kind was provided in exchange for the client testimonial(s) presented. Client testimonials may not be representative of the experience of other clients and are not a guarantee of future performance or success.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)

Verified Client

Verified Client