James D. Krantz, CRPC®, CFP®

Industry Award Winner

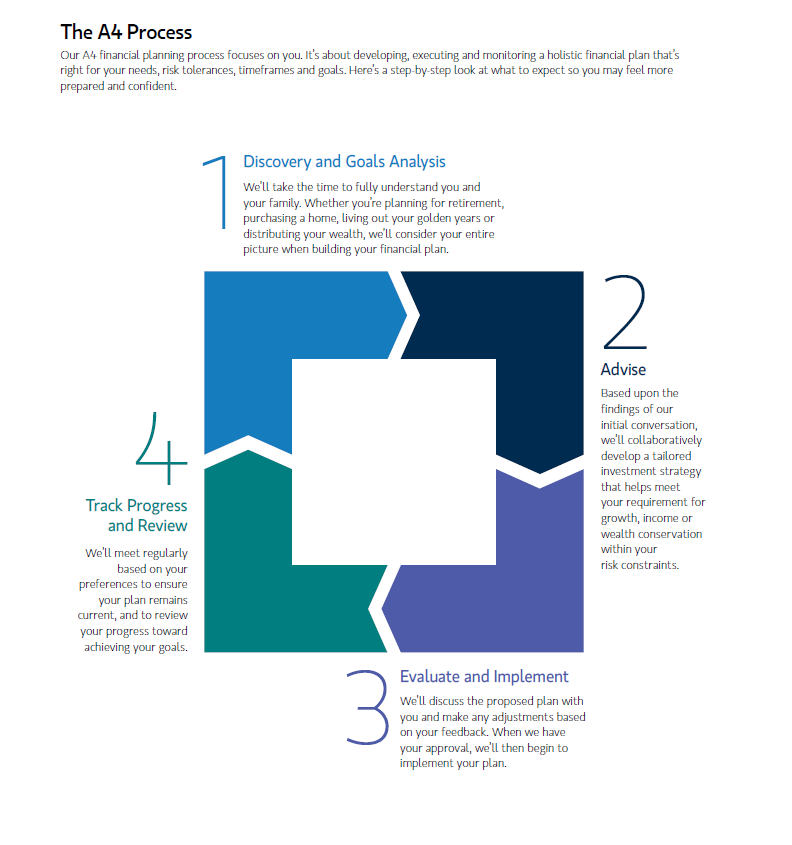

Industry Award WinnerOur A4 financial planning process focuses on you. It's about developing, executing and monitoring a holistic financial plan that's right for your needs, risk tolerances, timeframes and goals. You can count on our team to work with you to create a tailored strategy. Here's a step-by-step look at what to expect so you'll feel more prepared and comfortable.

1) Discovery & Goals Analysis

We'll take the time to fully understand you and your family. Whether you're planning for retirement, purchasing a home, living out your golden years or distributing your wealth, we'll consider your entire picture when building your financial plan. Our mission is to align your actions with your intentions for a more successful outcome. But we need to understand what's most important to you first.

2) Advise

Based upon the findings of our initial conversation, we'll collaboratively develop a tailored investment strategy that meets your requirement for growth, income or wealth conservation within your risk constraints. We'll make the plan flexible enough to adapt to changes in your personal or professional life. The plan may include a broad range of solutions—from investments to insurance to lending to estate planning.

3) Evaluate & Implement

We'll discuss the proposed plan with you, and make any adjustments based on your feedback. When we have your approval, we'll then begin to implement your plan. We can also coordinate with your CPA and estate attorney as necessary to ensure a cohesive and comprehensive strategy.

As part of our onboarding process, we can assist with opening your Morgan Stanley Online account, and show you how to conveniently manage your investments and everyday finances from a single platform.

4) Track Progress & Review

Life evolves and market conditions change. So, it's important to keep the lines of communication open. We'll meet regularly based on your preferences to ensure your plan remains current, and to review your progress towards achieving your goals.

While we consult with a variety of clients, we hear some common questions:

Our team of advisors is adept at handling these and other matters by leaning on our experience, training and understanding. We not only answer these questions, but strive to make clients feel more confident about their future so they can focus on their relationships, careers, causes or other things that bring them fulfillment in life.

Ultra-high net worth individuals

Being affluent offers many advantages. But it frequently adds complexity to your financial world.

Working with our team's Certified Private Wealth Advisor® (CPWA®) or CERTIFIED FINANCIAL PLANNERS® can be ideal for prosperous individuals and families who need support addressing the multi-dimensional challenges of managing significant wealth. The CPWA® certification is an advanced professional credential for advisors who serve high-net-worth clients.

Our CPWA® or CERTIFIED FINANCIAL PLANNERS® can tailor a fully integrated wealth management plan based on your individual needs. It could include strategies to invest assets, transfer wealth, manage risk, maximize philanthropic impact, reduce family conflicts and enhance your lifestyle.

Corporate executives

While your outstanding performance at work has been rewarded through various types of compensation and benefits, you may not have the time or expertise to get the most value from what you've accrued.

At the Avalon Group, we have two team members with the Morgan Stanley Workplace Advisor for Equity Compensation designation. Through their specialized training and education about workplace benefits, they can help you determine how your equity compensation fits into your overall goals and financial strategy. They're well-positioned to advise you on a full suite of workplace benefits, and can address questions about diversification, vesting events, restricted stock units, tax-efficient strategies and more.

Pre-retirees/retirees

Everyone should have a financial plan. But it's especially important for those preparing for retirement or navigating their way through it. Our team features two CERTIFIED FINANCIAL PLANNERS® who've met rigorous certification requirements, and have demonstrated a competency in comprehensive financial planning. Additionally, CFP® professionals must commit to placing their clients' best interests first at all times.

Putting your entire financial life into a clear picture isn't easy. CFP® professionals are trained at doing this, including how to balance your short-term goals with your long-term objectives.