Industry Award Winner

Industry Award WinnerOur Mission Statement

Excellence of Service

Integrity in our Actions

Comprehensive Strategies

Commitment to Giving Back

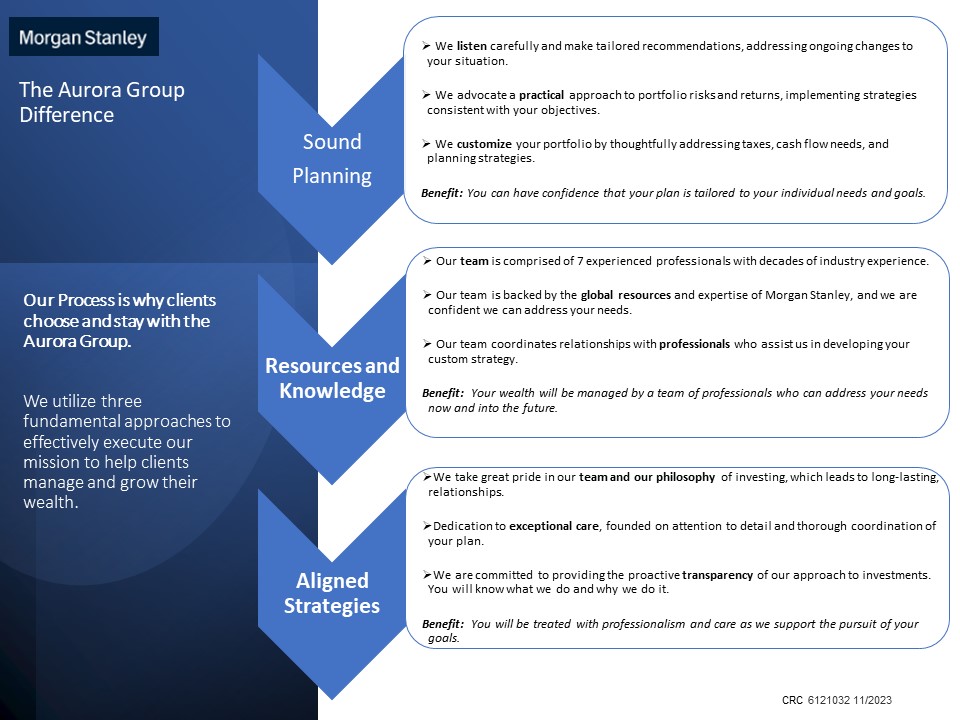

The Aurora Group Approach

When a major life event happens to you or a family member, how far down the list of phone calls is your Financial Advisor? Buying a new home, selling a business, an early retirement, an engagement, inheriting from a family member, a job promotion or expecting your first child or grandchild these are the types of major life events that occur in our lives. It is when these moments occur to our clients that the Aurora Group takes great pride in being one of the first phone calls they make. That is because they know we are their problem solvers.

Our team will work diligently to find a potential solution for the challenges any life event might bring to your financial present and future. With over 130 years of combined experience, The Aurora Group can become an indispensable resource to you. We service an array of clients across the country including: ultra-high & high net worth families, business executives, foundations, emerging wealth individuals, small business owners and physicians. Our goal is to be your problem solvers so that you can spend more of your time running your business, being with your family or just living your life.

We will give you an elevated experience that is specific to your needs. Six professionals work in tandem to make sure that each client is presented with tailored strategies to help reach their long & short term goals. Across our book of business, every client receives one common resource: First Class Service.

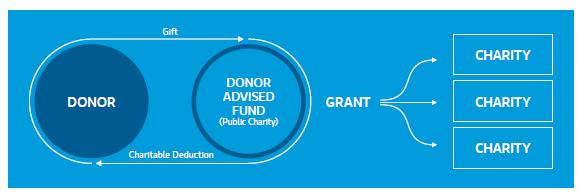

Through a holistic approach, we proactively manage your investments. We first work to understand your financial situation, investment values, objectives (both long & short term), and legacy plan. Starting with a comprehensive Financial Plan, we uncover potential solutions for tax-efficient investment planning, retirement, risk management, asset allocation, Donor Advised Funds, lending & insurance.

We implement the investment selection leveraging the unparalleled global resources of Morgan Stanley: portfolio management strategies, advisory account solutions, a broad range of asset manager choices including Morgan Stanley's Global Investment Committee and access to Morgan Stanley's comprehensive suite of alternative investment strategies.

Multiple members of the team have run marathons, so we know about going the extra mile. Working with The Aurora Group is not just about trusting us with your finances, we are here to work with you and your family for generations to come. The role the next generation plays in your legacy is critical. It is paramount that we work with you to have them understand your financial values and goals. Philanthropy is also a core denominator of the individuals on our team. Many of our clients share this same passion. We value supporting the organizations in our communities where we are proud to raise our families.

To get to know the team further, please review our individual bios.

- Donor Advised Funds

- Retirement PlanningFootnote1

- Alternative InvestmentsFootnote2

- Cash Management and Lending ProductsFootnote3

- Professional Portfolio ManagementFootnote4

- 401(k) Rollovers

- Asset Management

- Trust AccountsFootnote5

- Business PlanningFootnote6

- Wealth ManagementFootnote7

- Financial PlanningFootnote8

- Planning for Education FundingFootnote9

- Executive Financial ServicesFootnote10

- AnnuitiesFootnote11

- 529 PlansFootnote12

Emmanuel Christian School – Scott Brown, Former Board Chair

Bella Vita – Scott Brown, Board Member

The Learning Club of Toledo – Scott Brown, Board Member

Ohio Girls Golf Foundation – Helene D’Andrea, Board Member

Amateur Golf Alliance – Alan Fadel, Chairman of the Board

National Links Trust – Alan Fadel, Board Member

Ohio Golf Association - Alan Fadel, President

Giving to a donor advised fund does not have to be complex or time-consuming. Morgan Stanley Global Impact Funding Trust, Inc. (MS Gift) can work with you to:

• Set aside assets for charitable purposes.

• Generate tax advantages immediately.

• Seek growth of the assets.

• Defer selection of specific charities that will receive your grants.

• Maintain decision-making flexibility on the grant recipient, as well as the size, number and timing of grants.

• Multiply your impact through Impact Pools that invest in companies creating a positive environmental and social impact through their products/services or corporate practices.

A well-planned and thoughtful approach to charitable giving benefits donors and, more importantly, the charities you care about. This is why you may want to consider the advantages of a donor advised fund (DAF) as part of your overall charitable giving strategy.

Location

Meet The Aurora Group

About Scott D. Brown

Scott leads the investment process and securities selection for the group. He utilizes a comprehensive wealth management process to develop actionable plans tailored to individual situations. He is dedicated to thoroughly understanding each client’s financial position, long and short-term goals, and appetite for risk. He uses this information along with the firm’s modern wealth management analytics and risk management tools to formulate customized strategies.

Scott is very involved in the faith-based community both in Toledo and across the country. He proudly serves on the Board of Trustees at the Emmanuel Christian School and is on the board of the Pregnancy Center of Greater Toledo and the Learning Club of Toledo. Scott has been married to his wife Lisa for over 25 years. They have two sons. Connor recently got married and works at Morgan Stanley on a different team. Carter recently graduated Grand Canyon University. The Brown family is very active at the Emmanuel Baptist Church in Toledo.

NMLS#: 907667

About Alan D Fadel

Alan’s achievements in the game are not limited to his playing career. He serves as the Chairman of the Board for the Amateur Golf Alliance, President of the Ohio Golf Association and serves on the board of the National Links Trust. Alan is a dynamic leader of the team’s networking, client relations and acquisition. Alan resides in West Palm Beach, FL with his wife Karen.

About Helene T D'Andrea, MBA

The disciplined approach Helene takes when working with clients is routed in the concept that she is a dedicated Financial Advisor for all of her clients’ financial decisions. With asset preservation as a core principal, she is dedicated to providing highly customized advice, ranging from innovative investment strategies and liability management, to helping optimize insurance and retirement assets. Even for the smallest decision, she will do extensive research to present multiple options to her clients giving them the empowerment to make educated decisions. Helene’s electric personality makes her approachable and allows for clients to feel immediately confident in entrusting her with their financial goals.

Building this relationship with clients is important as it allows her to achieve her goal as a financial advisor - to help guide her clients to and through retirement. It all begins with a personalized financial plan employing a wide array of products and strategies as appropriate for each client. This allows her to diversify their portfolios seeking to optimize growth, while seeking to manage risk and the impact of taxation in an effort to maximize wealth conservation.

Outside of the office, Helene proudly serves on the Board of Directors for the Ohio Girls Golf Foundation to assist young women develop skills on and off the course. She continues to play Golf and is a member of Elyria Country Club where she sits on the membership committee. Helene currently resides in Cleveland, OH with her husband Christopher. They have two children Danielle and CJ.

Disclaimer:

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

NMLS#: 1682635

About John G Mayer

Disclaimer:

Technical analysis is the study of past price and volume trends of a security in an attempt to predict the security's future price and volume trends. Its limitations include but are not limited to: the lack of fundamental analysis of a security's financial condition, lack of analysis of macroeconomic trend forecasts, the bias of the technician's view and the possibility that past participants were not entirely rational in their past purchases or sales of the security being analyzed. Investors using technical analysis should consider these limitations prior to making an investment decision.

About Amira Pedro

About Julianne Plazas White

About Regan Jahns

Regan moved to the Toledo area in 2020 with her husband Matthew and youngest son Miles from central Illinois. She is originally from Blue Mound, Illinois. Her husband is originally from Toledo. Her daughter Ally graduated from The University of Toledo in the spring of 2020 Cum Laude and is now working with another team at Morgan Stanley. Regan’s oldest son, Riley, has been a member of the Illinois Army National Guard since 2018 and deployed to Afghanistan in 2020. He recently joined the Decatur Illinois Police Department. This year Mason, her third child, welcomed a beautiful daughter Lainey to the world. She is the first grandchild. Regan’s youngest son Miles recently started High School and enjoys being on the football team.

Regan's passions are acrylic painting and her taking care of her many plants. She has taught painting classes at local community centers and private parties. She has sold several of her paintings. She enjoys spending time with her family and friends.

Contact Scott D. Brown

Contact Alan D Fadel

Contact Helene T D'Andrea, MBA

Contact John G Mayer

Awards and Recognition

Know What to Do if You Think You've Been Hacked

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

2Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

3Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

4Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

7Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

8Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

11Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

12Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley