Sarah Devereux

Nothing is more important than helping you and your family achieve your financial goals. That's where Morgan Stanley comes in. Together, we help you create a road map to your financial future. From cutting-edge risk management technology and research data, to easy-to-use client dashboards. We leverage our partnership with Morgan Stanley to bolster our own capacities and experience and examine your strategy from every angle. And, most importantly, to help keep you on track toward your goals.

At the same time, while we offer the top-tier resources of a global institution, we center our practice around the four pillars of Midwest values.

Hard Work

Perseverance

Integrity

Friendliness

Our team has deep roots in Decatur. Many of our clients do, too. We've watched their children grow up. In many cases, our families have become good friends. When it comes down to it, that sense of community is really what drives us. We take great pride in being a lifelong resource for our neighbors and their families, and we look forward to helping you and yours for generations to come.

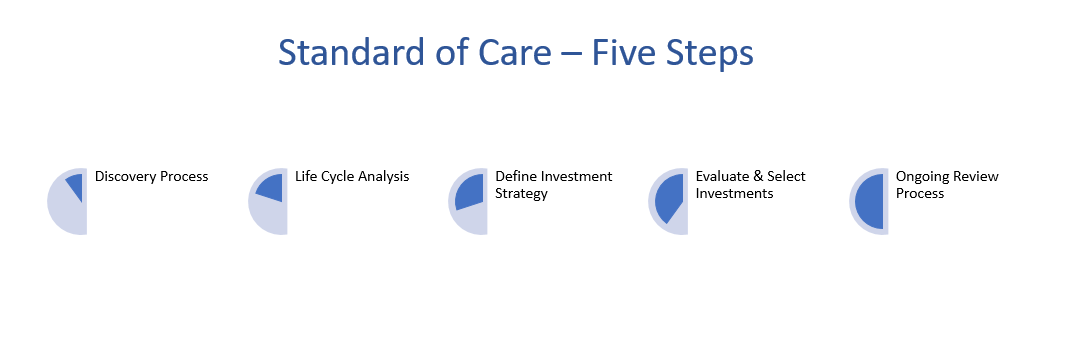

**Discovery Process:**Establishing Financial Objectives - We work with clients to establish a realistic set of objectives based on their financial goals, time horizon, liquidity needs, and tolerance to volatility & risk.

**Life Cycle Analysis:**Building For Tomorrow - Working hand in hand to establish goals based off of where you stand. Whether its working towards retirement, purchasing a home, or investing for the first time, we aim to guide you through building a custom strategy.

**Defining Wealth Strategy:**Customized Strategies - Develop an investment strategy to help produce optimal portfolio performance & seek to generate the highest return potential consistent with the strategy's level of risk.

**Evaluate & Select Investments:**Portfolio Growth - Leverage the global resources of Morgan Stanley to select investments to implement your personal strategy.

**Ongoing Review Process:**Assessment of Wealth Management Needs - Monitor your portfolio to track its performance relative to your stated objectives. Furthermore, modify your portfolio on a discretionary basis as your needs and circumstances change over time.