About Ryland Hubbard

Ryland "Ry" Hubbard is a CERTIFIED FINANCIAL PLANNER ™ (CFP®) who joined Morgan Stanley as Senior Vice President and Financial Advisor in August 2017. He served as Morgan Stanley Branch Manager for the Roanoke, Virginia, office from September, 2019 to July, 2025. Ry joined the financial industry in 1984, shortly after earning his BA in Economics from the University of Tennessee. He worked at Merrill Lynch's Roanoke, Virginia, office as a Financial Advisor, previously working as the branch manager, prior to joining Morgan Stanley.

Born in Atlanta, Georgia, Ry moved to Roanoke, Virginia, at a young age, and still resides there today with his wife, Kelly. They have two adult children, Dr. Zach Hubbard and Jake Hubbard, along with their golden retriever, Otter. Ryland is an active member of his local community, where he has served in a number of leadership positions, including the former President of The West End Center for Youth and the Executive Board of the Virginia Foundation for Research and Economic Education. In his free time, he enjoys relaxing under the warm sun at the beach!

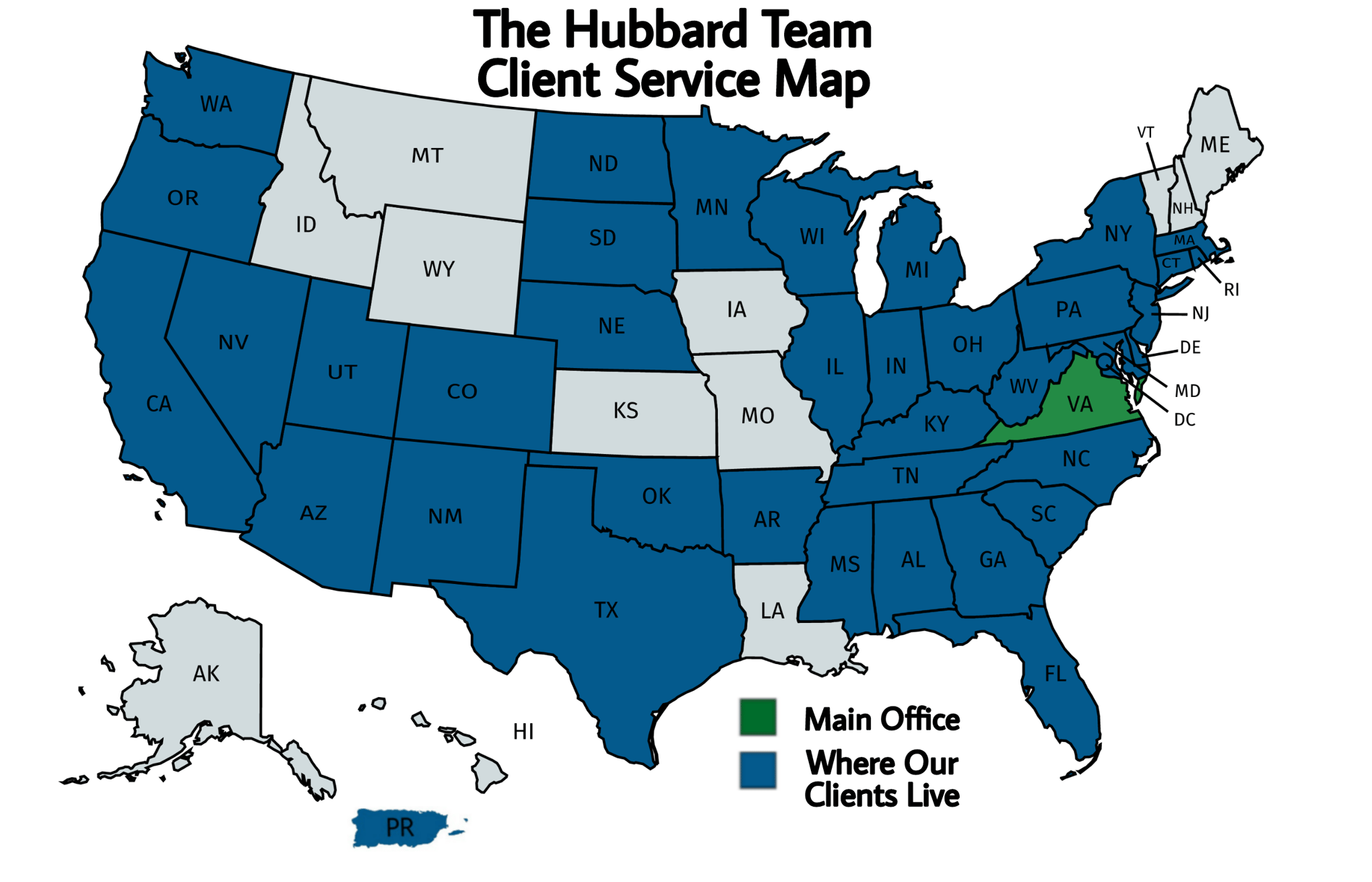

Securities Agent: AL, NY, NE, NV, OK, NJ, IL, MA, OH, AR, AK, RI, TN, TX, PR, VA, WV, WI, CO, DE, WA, GA, FL, CT, IN, KY, LA, PA, MN, MO, ND, MD, CA, UT, SD, SC, NM, NC, MT, MS, MI, IA, DC, AZ, VI, KS, WY, HI, ID, ME, NH, OR, VT; BM/Supervisor; General Securities Representative; Investment Advisor Representative

NMLS#: 638872