About Morry Zolet

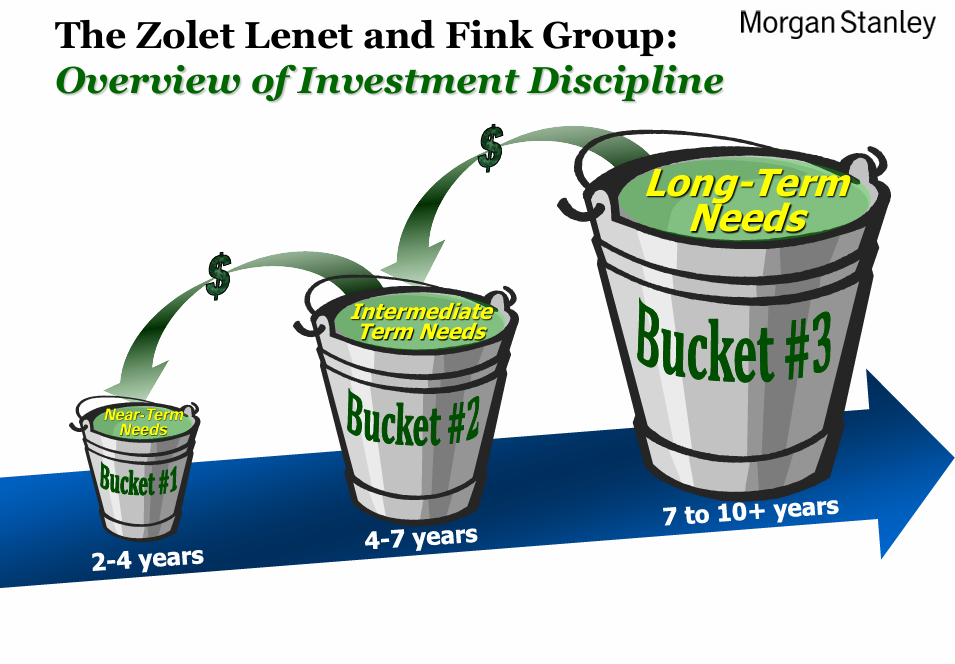

A founding partner of The Zolet Lenet Fink Group at Morgan Stanley, Morry brings over three decades of experience to the complex investing and wealth structuring needs of his team’s trusted and valued clients. Morry came into the industry just before the 1987 crash and has witnessed the collapse of the dotcom bubble, weathered the global financial crisis and guided his clients through the evolutionary changes of the COVID epidemic. Living through these learning experiences has seasoned Morry and has sharpened his abilities to adapt to changes and apply strategies that continue to serve his clients and their families in this ever-changing world.

Morry began his career with Ferris, Baker Watts, Inc., rising to become a member of the firm’s Retail Advisory Board and a Senior Vice President. During this time, Morry also taught investment courses at the Johns Hopkins University Odyssey program. In addition, Morry was a Wall Street commentator on WBAL TV in Baltimore, as well as a panelist on PBS's "Wall Street Week." He joined Morgan Stanley in their Lutherville office in April 2000 and is now a Managing Director.

His exceptional work has earned him numerous accolades, including recognition by Baltimore Business Journal as one of Greater Baltimore’s “40 Under 40” most influential business leaders in 1997, Barron's as one of the Top 1,000 Financial Advisors in the Country in 2009, Forbes' Best-In-State Wealth Advisors ranking in 2020, 2021, 2022 and 2023, and Forbes Best in State Teams 2023 and 2024.

Morry graduated from the University of Maryland at College Park as a Dean’s List member with a BS degree in Finance. He earned the CERTIFIED FINANCIAL PLANNER® designation from the College of Financial Planning in Denver, CO and is a qualified Family Wealth Director.

Morry has always made it his mission to give back to his community. He currently serves on the Board of Governors for the Associated Jewish Charities, Past Chair of Investment Committee for the Associated. Morry is the Chair of the Governance Committee for the Port Discovery Children’s Museum and current Board Member and is a Trustee of the Hy Zolet Family Foundation where they provide Baltimore City High School Student Athletes, scholarships to 4-year colleges.

Morry is a lifelong resident of Maryland and currently resides in Owings Mills with his wife Lisa and they have three daughters, Alyson, Lindsay, and Cara. In his free time, Morry loves spending quality time with his family, friends, and his dog Cooper. His hobbies include traveling, golfing, working out, pickleball and going to the Theater.

Direct Phone: 410-583-4844

Email: morry.a.zolet@morganstanley.com

Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2024) Data compiled by SHOOK Research LLC based for the period from 3/31/22-3/31/23.

Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2023) Data compiled by SHOOK Research LLC based on time period from 3/31/21-3/31/22.

2020-2022 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2020-2022). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Barron's Top 1,000 Financial Advisors: State-by-State

Source: Barron's.com (Awarded Feb 2009) Data compiled by Barron's based on time period from Sept 2007 - Sept 2008.

Securities Agent: WV, VT, TN, OH, MD, IN, NV, CT, WY, UT, OR, MI, LA, CO, NM, VA, NJ, WA, ME, DE, CA, OK, MA, DC, AZ, AL, NY, NH, MT, FL, PR, NC, IL, GA, WI, SC, MO, TX, PA, KY, AK; General Securities Representative; Investment Advisor Representative

NMLS#: 1265239

CA Insurance License #: 4210901

Industry Award Winner

Industry Award Winner