Robert Alden McLalan

Senior Vice President,

Financial Advisor,

Portfolio Management Director

Direct:

(650) 358-1812(650) 358-1812

Toll-Free:

(800) 666-3936(800) 666-3936

My Mission Statement

Establish & Define Trusted Portfolio Management Strategies for Individuals, Families and Special Needs Family Members.

My Story

As a Senior Portfolio director, with 40 years of securities industry experience, I have committed a significant part of my practice to helping families implement a financial plan. Planning is one challenge but understanding how to approach the various markets in which to invest in another. In my view, establishing a circle of protection for yourself and family with a variety of investments consistent with the plan are very important steps in having a sound financial plan. The plan provides the frame but the picture is made up of its investments.

This is why, as a Financial Advisor, I focus my intellectual capacity to helping individuals and families implement the plan that they choose with portfolio management strategies. By sharing knowledge and insights collected from many years of portfolio management I foster a dialogue to keep the investments in concert with the plan.

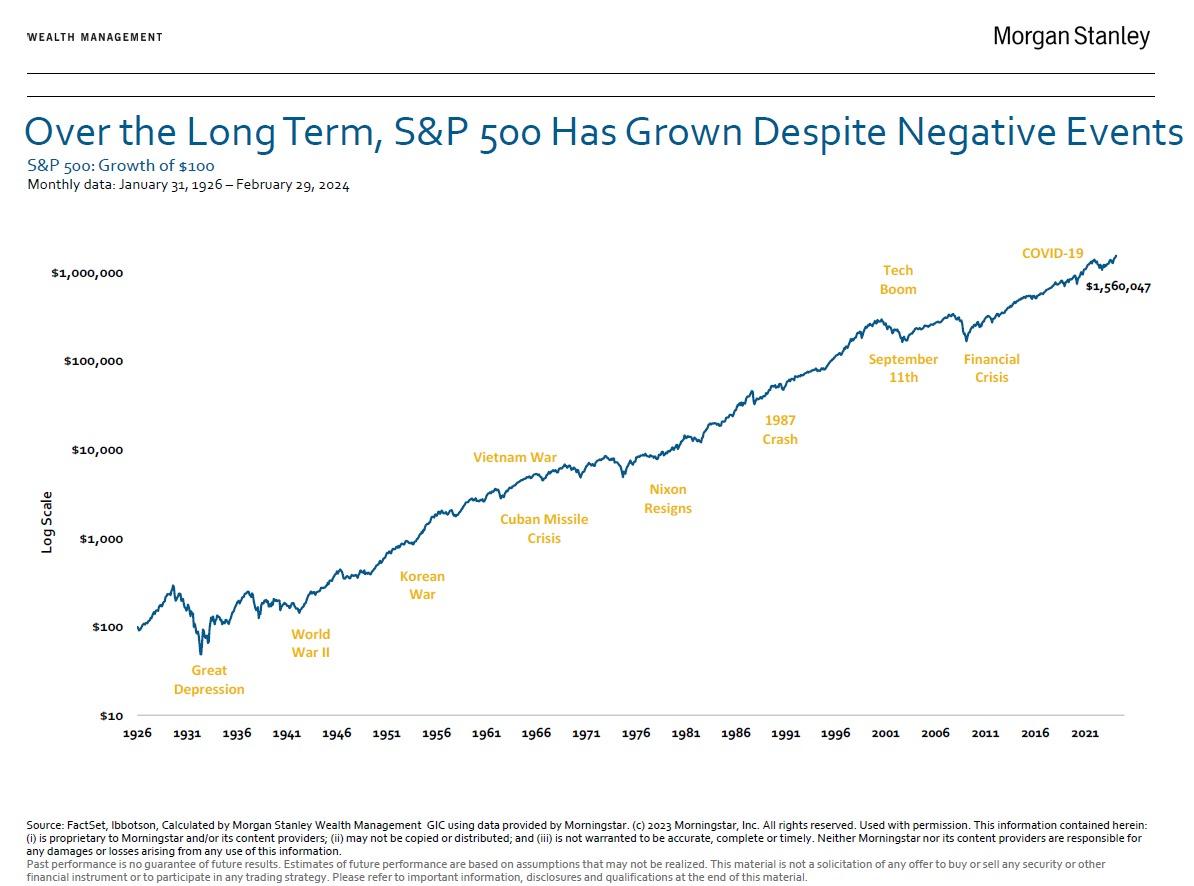

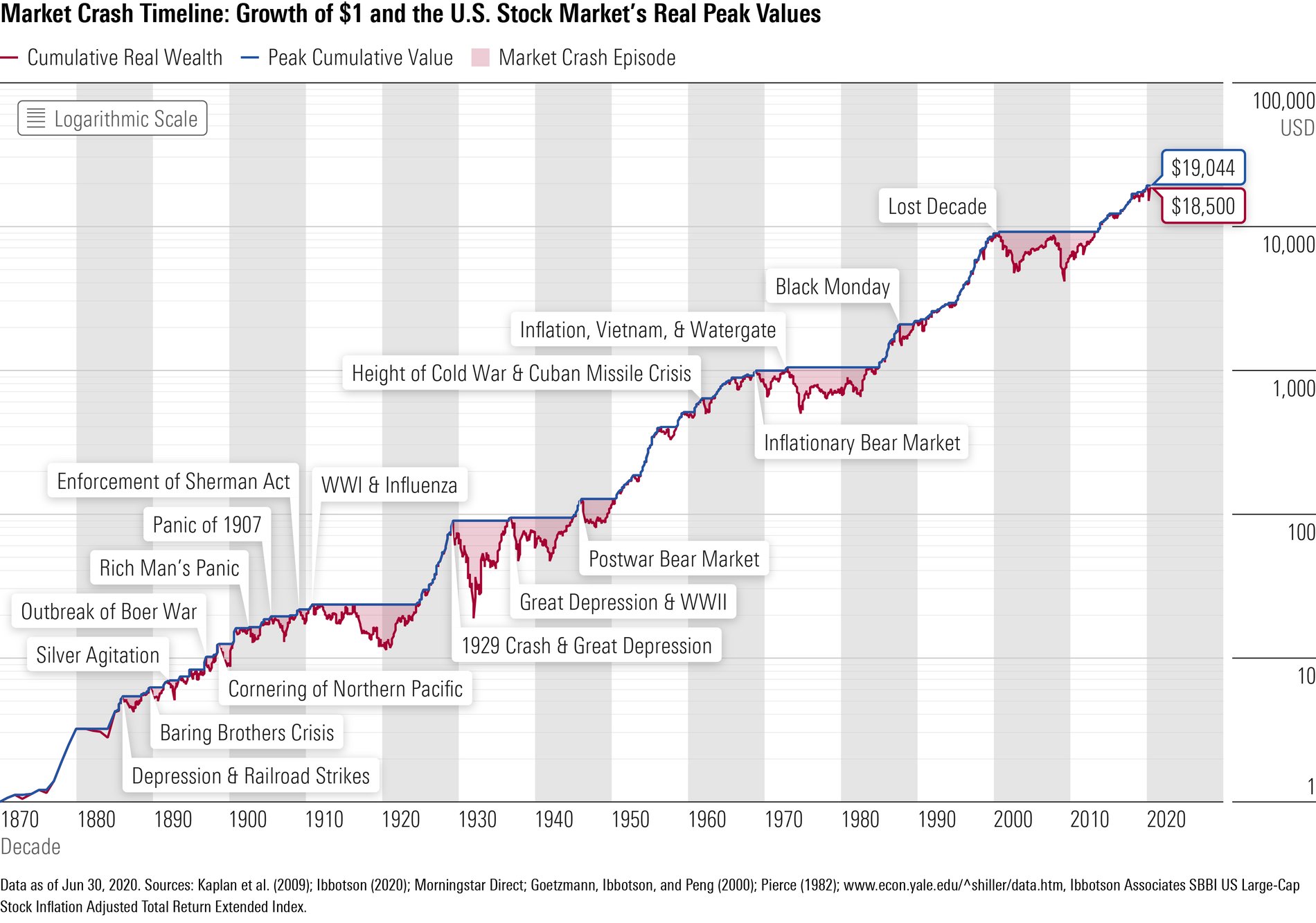

While time does change our lives so does the market. Like life the investment markets can deliver unexpected challenges, it is important to remember that managing a portfolio is not nearly as difficult as managing the future. So whether you are looking for resources or a professional to shepherd you and your family through each life stage, always remember - The first step is reaching out.

This is why, as a Financial Advisor, I focus my intellectual capacity to helping individuals and families implement the plan that they choose with portfolio management strategies. By sharing knowledge and insights collected from many years of portfolio management I foster a dialogue to keep the investments in concert with the plan.

While time does change our lives so does the market. Like life the investment markets can deliver unexpected challenges, it is important to remember that managing a portfolio is not nearly as difficult as managing the future. So whether you are looking for resources or a professional to shepherd you and your family through each life stage, always remember - The first step is reaching out.

Securities Agent: OK, MD, MN, NC, NV, NY, OR, TX, UT, VA, VT, WA, AZ, CA, CO, FL, GA, IL, MA, MI, MT, HI, AR, WI, SD; General Securities Representative; Investment Advisor Representative

NMLS#: 1435711

NMLS#: 1435711

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

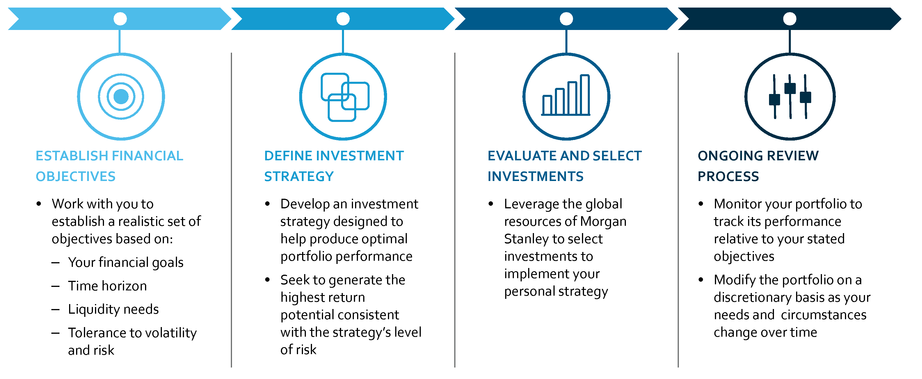

Establishing Financial Objectives

Working together we will establish realistic objectives that properly address your financial goals, time horizon, liquidity needs, tolerance to risk and market volatility that will become the framework of your portfolio strategy.

Define Investment Strategy

Keeping performance in mind, we will define a strategy that focuses on the highest level return, while also monitoring your exposure to risk and volatility in the markets.

Evaluate and Select Investments

With Morgan Stanley’s Global Investment Resources, I will work with you to leverage the proper investment(s) that can provide the best pathway to achieving your portfolio’s strategic goals.

Ongoing Review Process

Importantly, my commitment to you does not end once we have successfully implemented your portfolio strategy. Through diligent monitoring of your portfolio, I will track your performance to ensure it reflects the objectives you selected. Moreover, when needed, I will modify your strategy as required through your discretionary instructions.

**How I can help you:**

Character. Value. discipline. I practice these principals in all that I do.

I manage client money in a portfolio of mid cap to large cap U.S companies. I keep the portfolio down to about 25\-35 positions. Liquidity is important for me so if believe I can't get out quickly, I won't buy it. Markets are volatile and though I don't trade the back and forth of market action I will sell if a position gets too deep under its original purchase price. Buying is easy: selling is much harder. Rational reasoning is part of the buying decision but does not alter the direction of a stock when it is falling. I know that to achieve my goals, I must be right about what is going to happen and when. I select each stock that goes into the portfolio so call me if you have any questions about any aspect of your account.

**What makes me knowledgeable:**

I have over 40 years of implementation of plans into equities and fixed income. I have been through the ups and downs of the market and can help clients navigate this space efficiently and effectively. As a former Marine and growing up in a Marine Corp family, I maintain a disciplined and strategic approach to investing. If a stock is working against the strategy: it goes. I have no personal relationship to any strategy or security.

After serving three years in the Marine Corps, I went on and graduated from UC Berkeley. I am a prolific reader and developed the ability to take complex financial concepts and translate them into a language clients can understand.

**Getting to know me:**

I have spent much of my life caring for my sister who was born with Down Syndrome. That experience led me onto boards for 15 years that dealt with special needs children and people who live on the margins of society. I try to live my life with purpose. I am also an author and narrator of my stories for a radio show. You can find my stories at ouramericannetwork.org.

Character. Value. discipline. I practice these principals in all that I do.

I manage client money in a portfolio of mid cap to large cap U.S companies. I keep the portfolio down to about 25\-35 positions. Liquidity is important for me so if believe I can't get out quickly, I won't buy it. Markets are volatile and though I don't trade the back and forth of market action I will sell if a position gets too deep under its original purchase price. Buying is easy: selling is much harder. Rational reasoning is part of the buying decision but does not alter the direction of a stock when it is falling. I know that to achieve my goals, I must be right about what is going to happen and when. I select each stock that goes into the portfolio so call me if you have any questions about any aspect of your account.

**What makes me knowledgeable:**

I have over 40 years of implementation of plans into equities and fixed income. I have been through the ups and downs of the market and can help clients navigate this space efficiently and effectively. As a former Marine and growing up in a Marine Corp family, I maintain a disciplined and strategic approach to investing. If a stock is working against the strategy: it goes. I have no personal relationship to any strategy or security.

After serving three years in the Marine Corps, I went on and graduated from UC Berkeley. I am a prolific reader and developed the ability to take complex financial concepts and translate them into a language clients can understand.

**Getting to know me:**

I have spent much of my life caring for my sister who was born with Down Syndrome. That experience led me onto boards for 15 years that dealt with special needs children and people who live on the margins of society. I try to live my life with purpose. I am also an author and narrator of my stories for a radio show. You can find my stories at ouramericannetwork.org.

Location

411 Borel Ave

Suite 220

San Mateo, CA 94402

US

Direct:

(650) 358-1812(650) 358-1812

Toll-Free:

(800) 666-3936(800) 666-3936

Fax:

(650) 358-1859(650) 358-1859

Wealth Management

Global Investment Office

Portfolio Insights

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Ready to start a conversation? Contact Robert Alden McLalan today.

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)