Robert L. Johnson

My Mission Statement

About Us

- Wealth ManagementFootnote1

- Professional Portfolio ManagementFootnote2

- Retirement PlanningFootnote3

- Financial PlanningFootnote4

- Life InsuranceFootnote5

- AnnuitiesFootnote6

- Cash Management and Lending ProductsFootnote7

- Estate Planning StrategiesFootnote8

- Endowments and FoundationsFootnote9

- Divorce Financial AnalysisFootnote10

- Executive Financial ServicesFootnote11

- Business Succession PlanningFootnote12

- 401(k) Rollovers

- Lending Products

- Fixed IncomeFootnote13

- Planning for Education FundingFootnote14

NMLS#: 1395641

CA Insurance License #: 0A55958

Biography

Robert L. Johnson, Managing Director and Wealth Advisor is a Certified Portfolio Manager with Morgan Stanley in Westlake Village, California. He is also the founder of The Robert L Johnson Group at Morgan Stanley, which is a recipient of the prestigious Forbes Best-In-State Wealth Management Teams award* for two years in a row (2024 & 2025). Additionally, Robert was recognized in the Forbes Best-In-State Wealth Advisors ranking* for two years in a row (2024 & 2025).

Robert started his career in the Securities Industry in 1978 after serving as a representative and leader/trainer for the Church of Jesus Christ of Latter-Day Saints in Argentina, South America from 1974 to 1976. After his time in Argentina, he graduated from Brigham Young University with a composite degree in Marketing, Accounting and Economics. While at BYU, he was awarded an academic scholarship, and has since returned as a mentor and speaker in the exclusive Marriott School of Business Executive Lecture Series. While completing his final year at BYU, Robert began his career in the Financial Services Industry as a General Agent, and Registered Representative for Investors Life Insurance Company and North America Management, Inc.

In 1981, he became an Account Executive for Smith Barney Harris Upham Inc. After achieving the number one position in his class, he received several prestigious awards including Pacesetter II, Constellation, Powers Prep, Rain Maker, and Top 100 Club. From 1981 to 2024, he has been awarded the following titles and advancements: Account Executive, Senior Account Executive, Second Vice President, Vice President, First Vice President, Senior Vice President, Executive Director and Managing Director.

In 1988, at Smith Barney's request, he participated in their Executive Sales Leadership Management Training Program. Included therein were qualifications for the New York Stock Exchange Series 8 Supervisory License, as well as opportunities in Smith Barney Firm Management. In 1991, Mr. Johnson was one of the firm's first representatives to take part in Smith Barney's proprietary-discretionary securities Portfolio Advisory Program. He completed formal portfolio management training and received the Certified Portfolio Manager designation during this period. In addition, he was given the assignment of serving as one of Smith Barney's exclusive Middle Markets Consultants, specializing in the development and supervision of municipal and institutional accounts.

Robert provides comprehensive financial planning advice while managing a diverse clientele with his current responsibilities centered in Private Portfolio Management for high-net-worth individuals and institutions. He has been a member of the Senior Consultants Council. His principal business emphasis is on discretionary fee basis portfolio management, and he has been awarded Master's, President's, and Chairman's Council membership from 1994 to present time.

On a personal note, Robert is married with three sons. He has enjoyed an active lifelong participation in various martial arts and has earned the rank of third-degree black belt. He is also a qualified SCCA and NHRA competitive driver, which was accomplished while participating in various motorsports. His interest in the motorsports includes classic auto restoration, and the ownership and restoration of an NCRS Top-Flight award winning 1966 Corvette 427, as well as a magazine featured 1973 Plymouth Road Runner.

Robert and his team continually strive for excellence and look forward to having the opportunity of serving and assisting you in achieving your wealth management goals. He can be reached at (800) 618-2075 or robert.johnson@morganstanley.com and is located at 100 N. Westlake Blvd. #200 Westlake Village, CA 91362.

2024 & 2025 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded 2024, 2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award. (https://www.morganstanley.com/disclosures/awards-disclosure/)

2024 & 2025 Forbes Best-In-State Wealth Advisors - Robert L. Johnson

Source: Forbes.com (Awarded 2024 & 2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award. For criteria & methodology, go to (https://www.morganstanley.com/disclosures/awards-disclosure)

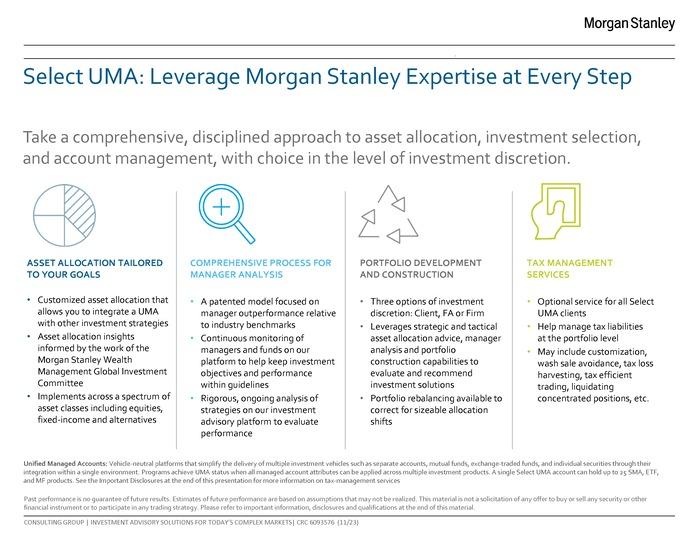

Unified Managed Accounts

Simplify your life with multiple investment products, comprehensive manager oversight and account management in one single account.

Unified Managed Accounts (UMAs) allow you to take a comprehensive, disciplined approach using a single account structure. An overlay portfolio manager coordinates all activity including asset allocation, investment selection and disciplined re-balancing. All investment products- such as SMAs, mutual funds and exchange-traded funds (ETFs) – within a single account structure.

Financial Planning With The Robert L. Johnson Group

As Financial Planning Specialists, Robert W. and Miles Johnson have chosen to undergo the continuing education requirements to understand the fundamentals of wealth accumulation and wealth management so that we can better serve our clients, from high-net-worth individuals to mid-career professionals and nonprofit organizations, to seniors that are near or in retirement. Using Morgan Stanley's Goals Planning System, we can work with you to implement a plan to help achieve your financial and personal goals at any stage of life.

Morgan Stanley's Goals Planning System (GPS) is an innovative platform that leverages Morgan Stanley's intellectual capital and sophisticated institutional capabilities to help clients reach their goals.

- Discover: Start a conversation to uncover your goals and understand your entire financial picture.

- Advise: Work with you to assess various scenarios and advise you on the appropriate strategies designed to meet those goals.

- Implement: Look across multiple accounts/products to identify the combination to help meet spending needs and invest tax-efficiently.

- Track Progress: Periodic review of your financial situation with the ability to make adjustments according to your needs, life events and changing market conditions.

- Business Owners (including family businesses)

- Corporate Executives

- High-Net-Worth Young Investors

- Mid-Career Professionals and Their Families

- Nonprofit Organizations

- Seniors Near or In Retirement

Location

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

5Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

6Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

7Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

12Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

13Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

14When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley