Patrick Shields, CEPA®

My Mission Statement

My Story and Services

NMLS#: 684931

Providing Timely Advice For What Really Matters

Charting a course to financial security begin with understanding your values, priorities and aspirations. Working together, we define what is most important to you and your family and then develop the strategies to help get you there. Through each step, we provide objective advice and investment insights to construct a plan that is uniquely yours.

Our process has been carefully refined over the years to create an experience that is rewarding on both a personal and financial level for each of our clients. What is unique about our process is the care in which we do each step.

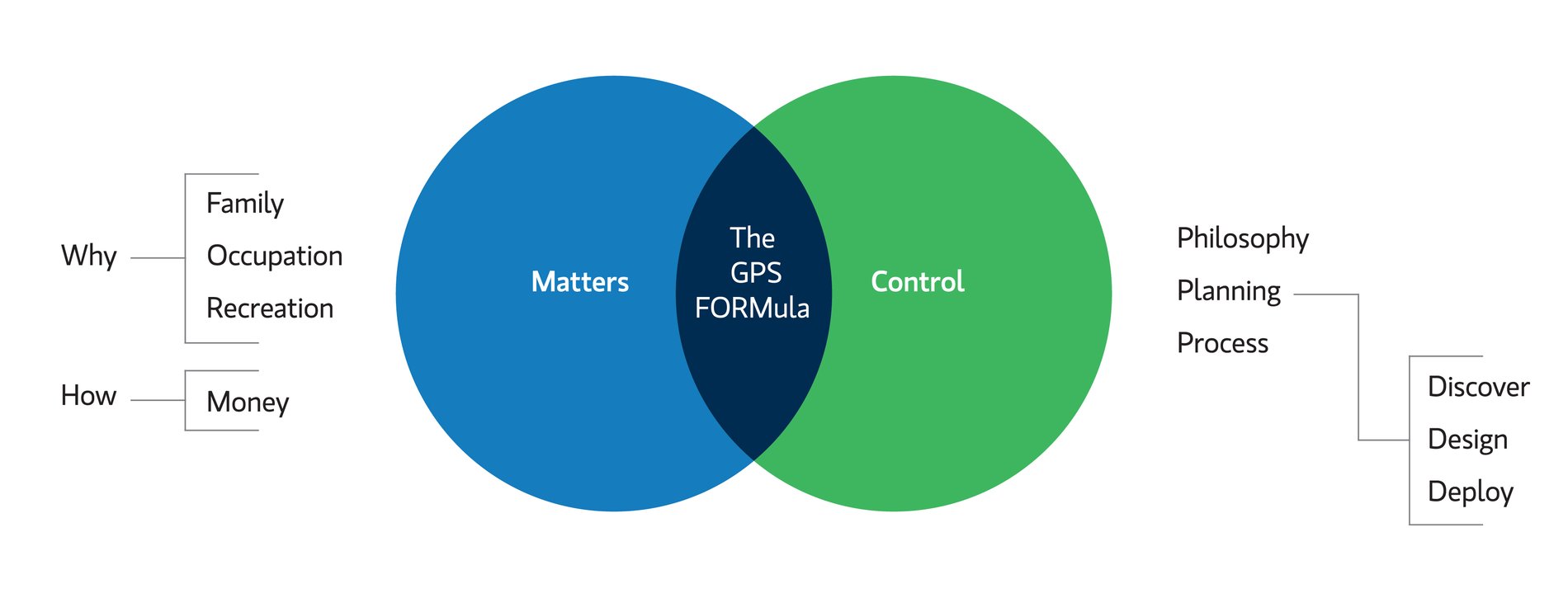

For instance, when we first meet with a client, our conversation may last a few hours. We ask questions, then we listen. Each piece of information leads to more questions so that we can fully understand what MATTERS to them, what we refer to as FORM: Family, Occupation, Recreation and Money. This is the first circle above.

We then discuss the second circle, which we define as CONTROL. We talk about the things that can be controlled through smart and thoughtful actions (e.g., reducing risk through diversification and asset allocation) and those that cannot (e.g., the market's ups and downs).

Where we come in is at the INTERSECTION of these two circles.

After we meet and determine if we are a good fit to work together, we'll share details about our PHILOSOPHY, the importance of PLANNING and our PROCESS (the three Ps), as well as initiate critical activities that include DISCOVERY, DESIGN and DEPLOYMENT (the three Ds).

Over time, we will review these MATTERS and CONTROLS with you on a regular basis. We focus on helping you make more confident decisions in seven critical areas of your financial life:

- Wealth management

- Risk management

- Tax management

- Estate management

- Cash management

- Philanthropy

- Value-added services

Our Comprehensive Wealth Management Servces

From buying a home and sending kids to college to enjoying retirement and leaving a lasting legacy, we are here to answer your financial questions and implement the best strategies. Here are just a few of the questions we help our clients answer every day.

Location

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley