Cedric Alexander

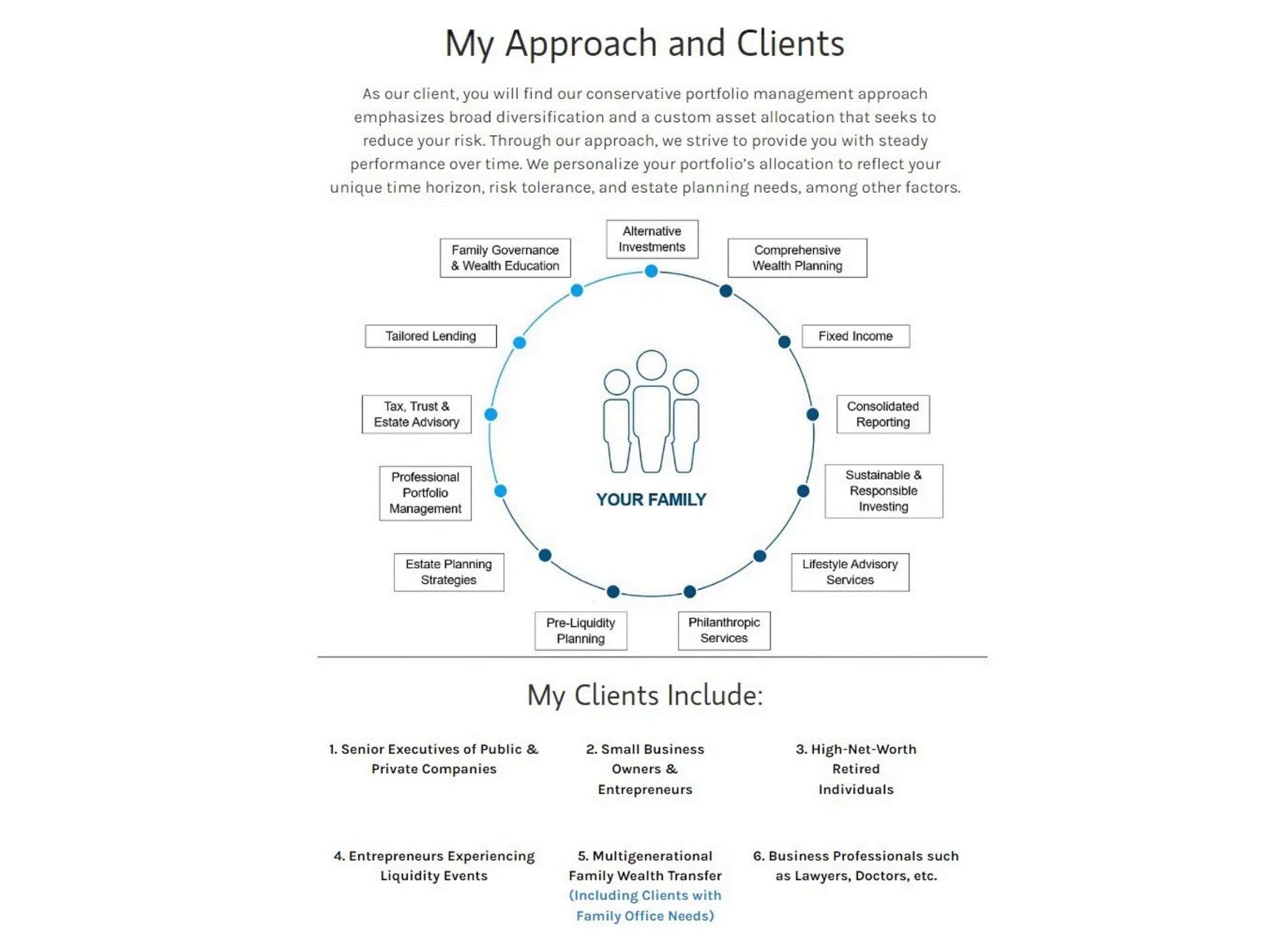

Investing the time to learn more about you and your family, your assets and liabilities, and the risk exposures, enables us to formulate strategies and customize the relationship to your needs.

Working with your tax and legal advisors, we help analyze your income and estate tax circumstance to identify and tailor planning techniques that may be used to address your objectives.

Your customized asset allocation reflects risk, opportunities, and taxation across multiple entities, while integrating your investing and estate plans.

Short-term adjustments seek to capitalize on temporary market distortions. Before making adjustments, we analyze the impact of taxes and trading costs on potential returns.

After comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform.

Ongoing evaluation to assess your progress toward achieving your financial goals as planned. We continuously monitor your portfolio's performance and adjust strategies as needed to address changes in your circumstances or shifts in the financial markets.