Leon Henderson, Jr.

My Mission Statement

Meet Leon Henderson, Jr.

Managing Director | Senior Portfolio Management Director | Global Sports & Entertainment Director

For nearly three decades, Leon has guided ultra-high-net-worth individuals, families, and institutions through the complexities of global investing. As a Managing Director at Morgan Stanley, he delivers institutional-grade resources and bespoke strategies that can help empower clients to preserve, grow, and protect their wealth.

Leon focuses on large-cap core equity portfolio management with a clear philosophy: help grow returns, preserve principal. Known for his clarity and calm in volatile markets, he distills complex financial data into meaningful guidance, always putting client interests first.

As a Global Sports & Entertainment Director, Leon also serves athletes and public figures whose careers involve unique challenges, such as fluctuating income, early peaks, and heightened public scrutiny. Clients appreciate not just his discretion and strategic insights—but his genuine understanding of their world.

Leon began his career at Goldman Sachs after earning his MBA from Harvard Business School. He holds a degree in Architecture from Howard University, where he learned that sound design, like investing, requires disciplined planning, analytical rigor, and creative thinking.

A Buffalo native and the son of educators, Leon brings the same discipline to client relationships that he once brought to athletics and architecture. Outside of work, he supports the arts, serves on multiple civic and alumni boards, and is a proud fan of the Buffalo Bills and Los Angeles Clippers.

───────────────────────────────────────

Our Philosophy

We are a boutique wealth management practice within Morgan Stanley, advising a select group of ultra-high-net-worth individuals and institutions across the U.S. and abroad. With over 30 years of experience across multiple market cycles, our strength lies in translating global financial insight into actionable strategies tailored to your unique vision.

Our foundation is built on Trust, Service, Process, and Performance. These values guide how we build enduring relationships, provide disciplined investment management, and serve as lifelong advisors through each stage of your financial journey.

We are proud to work with clients from all walks of life, from multigenerational families to global entertainers, who choose us not just for our experience, but for our integrity, discretion, and enduring commitment to their success.

───────────────────────────────────────

Insightful Reading

This Private Wealth Management Placemat outlines the comprehensive capabilities our team provides, including investment management, estate planning solutions, tailored lending solutions, and philanthropic services. It's designed to help clients understand how we support their long-term financial goals.

About PWM

- Manage investments with an unwavering focus on your financial strategy and personal goals

- Create comprehensive, multigenerational wealth management plans based on your needs, challenges and the values that guide your life and legacy

- Simplify financial complexity to help you achieve clarity and control

- Approximately 300 teams specialized in assisting individuals and families with $20MM+ in investable assets

- Over $1.2 trillion in AUM

- Comprising 26% of the Barron’s Top 100 Financial Advisors list for 2025

- Direct access to ultra high net worth experts in philanthropy, family dynamics, wealth transfer, lifestyle advisory and other areas of interest to ultra high net worth families

Approach

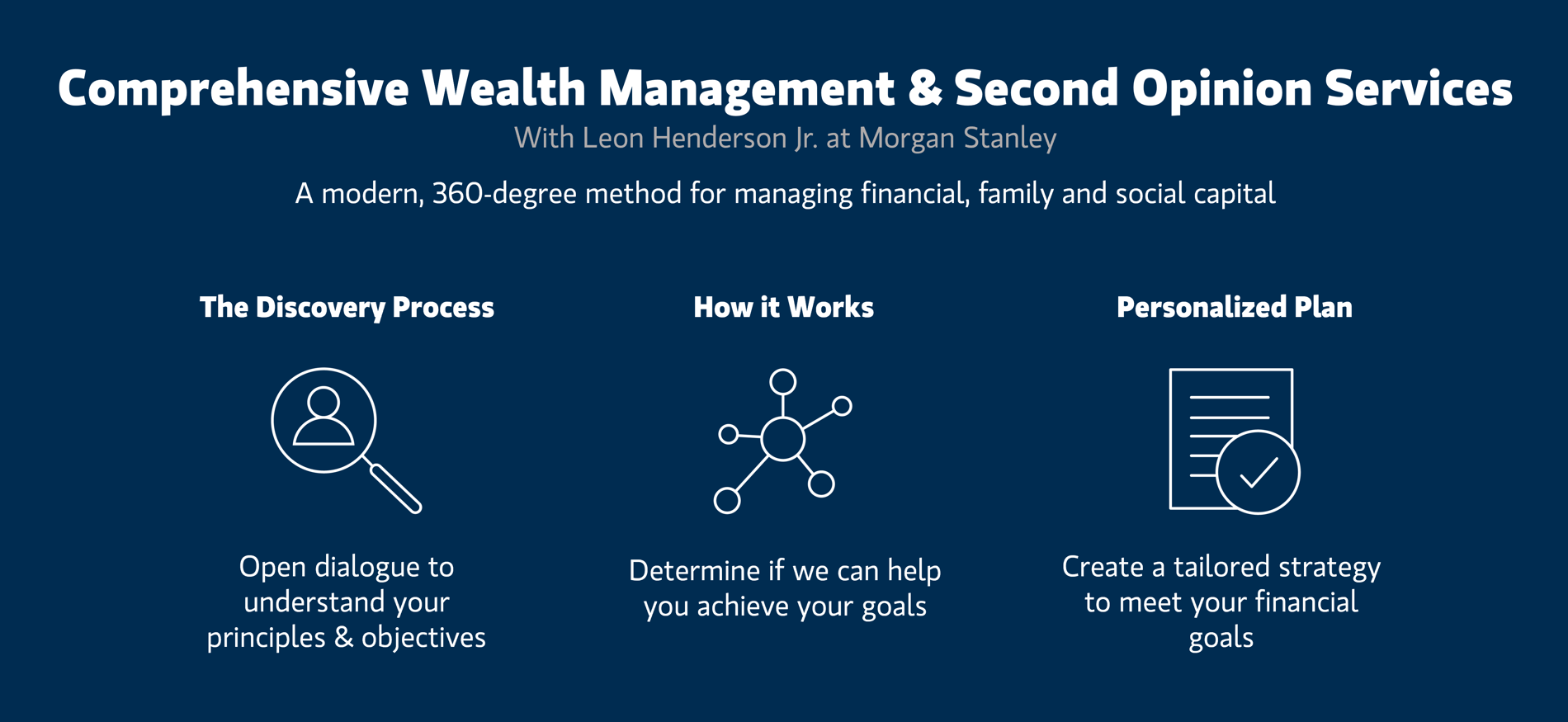

Second Opinion Services

If we are a good fit, we will draw on deep, specialized experience to tailor a personalized plan to address your complex and evolving multigenerational financial goals and family mission.

Location

OPEN UP A WORLD OF POSSIBILITIES WITH MORGAN STANLEY ONLINE

Portfolio Insights

Private Wealth Management Podcast

- Intergenerational Planning

- Philanthropic Giving

- Non-Traditional Assets

- Managing Family Wealth

Managing Significant Wealth

- Investment Management

- Wealth Transfer & Philanthropy

- Cash Management & Lending

- Family Governance & Wealth Education

- Lifestyle Advisory

- Business Services

Insights and Outcomes

Wealth Management for Athletes and Entertainers

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

2Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria.

3Asset Allocation does not assure a profit or protect against loss in declining financial markets.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The securities/instruments, investments and investment strategies discussed on this website may not be suitable for all investors. The appropriateness of a particular investment or investment strategy will depend on an investor's individual circumstances and objectives. The views and opinions expressed on this website may not necessarily reflect those of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). This website and its associated content are intended for U.S. residents only.

Morgan Stanley and its Private Wealth Advisors do not provide tax or legal advice. Visitors to this website should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Private Wealth Advisers may only transact business in states where they are registered or excluded or exempted from registration. Transacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where Morgan Stanley Private Wealth Advisers are not registered or excluded or exempt from registration.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

See the Financial Advisors Biographies for Registration and Licensing information.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Investment Management Consultants Association, Inc. owns the marks CIMA®, Certified Investment Management Analyst® (with graph element)®, and Certified Investment Management Analyst® .

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Life insurance, disability income insurance, and long-term care insurance are offered through Morgan Stanley Smith Barney LLC's licensed insurance agency affiliates.

Lifestyle Advisory Services: Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Awards Disclosures | Morgan Stanley