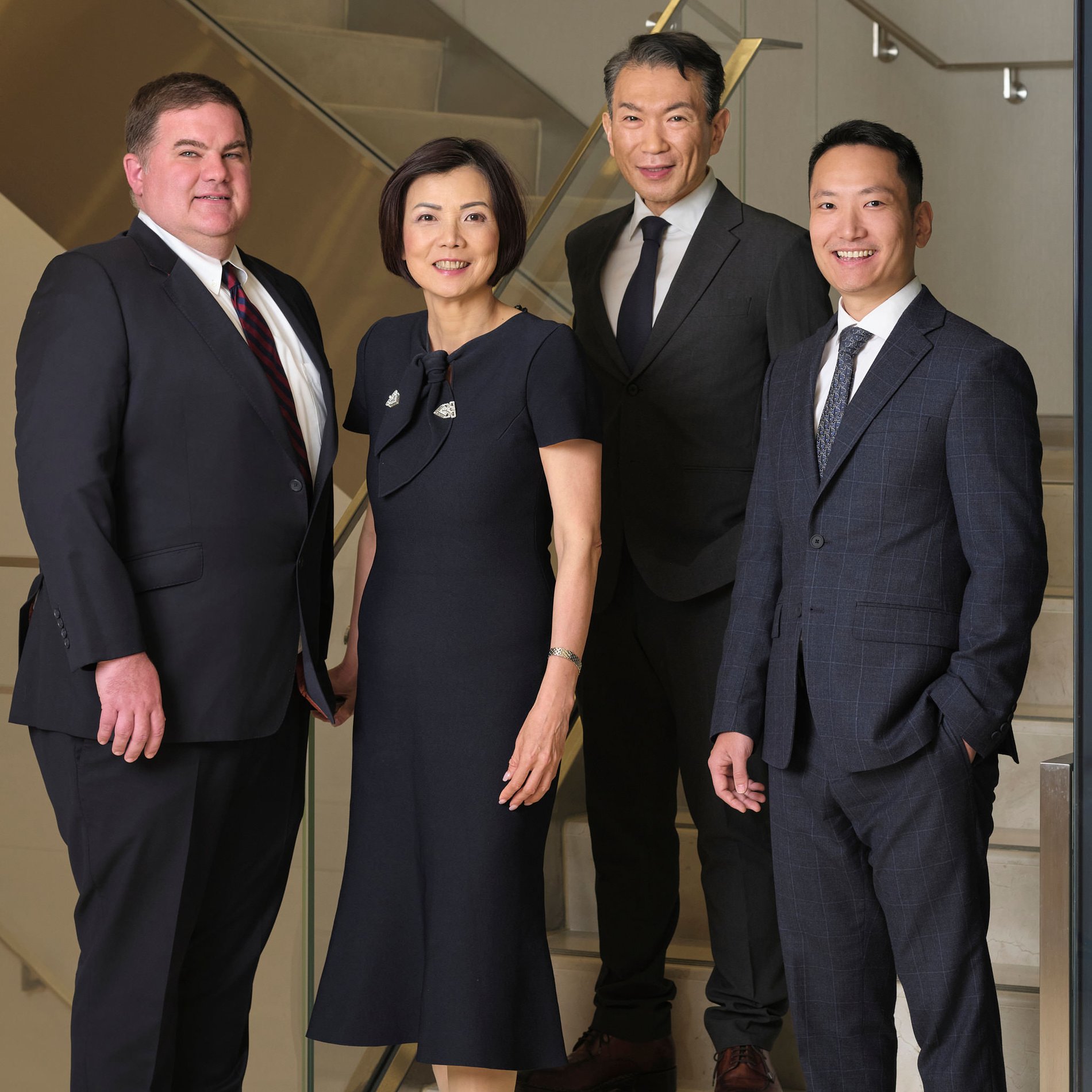

About Haiman Cai

Haiman joined Morgan Stanley in 1997 and focuses primarily on the wealth management needs of ultra high net worth Chinese entrepreneurs with cross-border holdings and multinational family ties as well as successful Asian American founders and corporate executives. Prior to joining Private Wealth Management, she advised institutional clients in Asian ex-Japan Equities in both New York and London. She began her career as an Investment Banking analyst at Goldman Sachs in debt capital markets both in New York and Hong Kong. Haiman holds a Bachelor of Science in Accounting from Canisius College and a joint MBA/M.A. in International Relations from the University of Pennsylvania Wharton School’s Lauder Program. Haiman is a native of Shanghai, China and is fluent in Mandarin and German. She is ranked as a 2022, 2023, and 2024 Forbes Best-In-State Top Women Wealth Advisor.

2022, 2023, 2024, 2025 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (2022, 2023, 2024, 2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

Securities Agent: MD, CA, CO, VI, GA, DE, PA, NH, CT, SD, NC, MI, MA, WY, OH, VA, NV, AZ, NY, NJ, WA, FL; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1316519