About Andy McKay

Andy is a Financial Advisor at our Raleigh, North Carolina Office. Andy helps high net worth clients and families make smart decisions so their money is able to serve the people, causes and goals they cherish. Additionally, Andy focuses on retirement plan education and participation among Graystone's corporate retirement clients. His approach encourages participants to see successful retirement planning as a lifelong process.

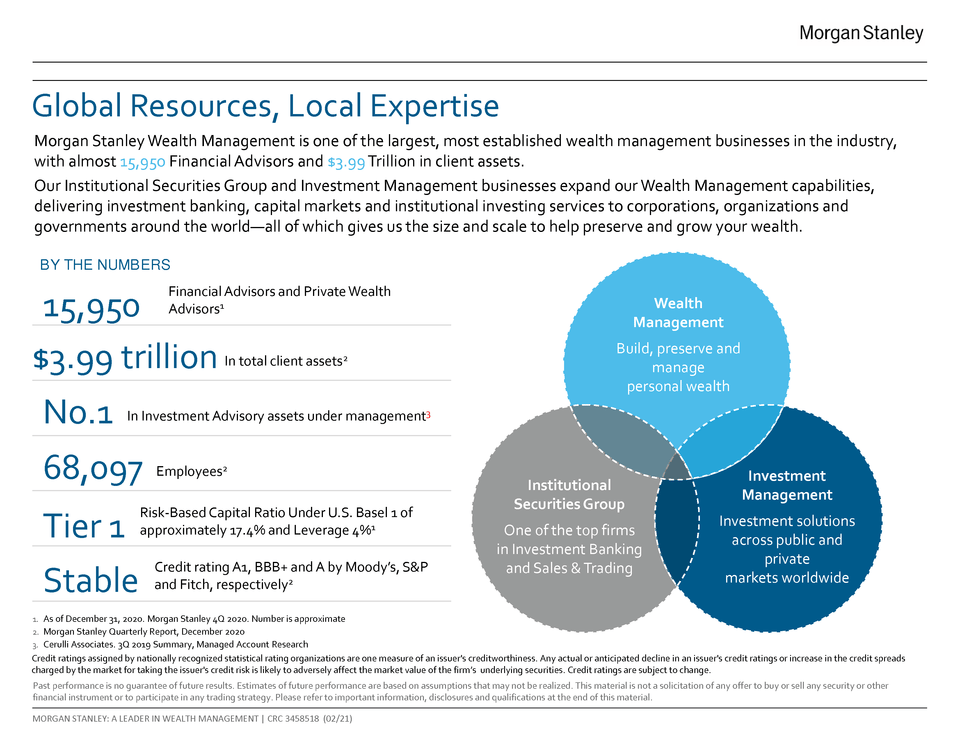

Andy is a Certified Financial Planner(TM) with nineteen years of experience in the financial services industry. He has worked at Morgan Stanley since 2010 and has been a member of the Graystone team since 2014.

Andy attends Edenton Street United Methodist Church (ESUMC) where he serves on the Finance Committee and previously served as Treasurer. He is a Scoutmaster with BSA Troop 395 and is an active member of F3.

Securities Agent: GA, KY, UT, ME, DE, TN, FL, AZ, SD, NC, CT, WV, WA, PA, OK, MO, IN, CO, NY, MA, AL, TX, NH, NE, KS, IL, DC, CA, SC, OH, NV, NM, LA, HI, OR, NJ, MS, IA, VA, MN, MD, AR, VT, PR, MI; General Securities Representative; Investment Advisor Representative