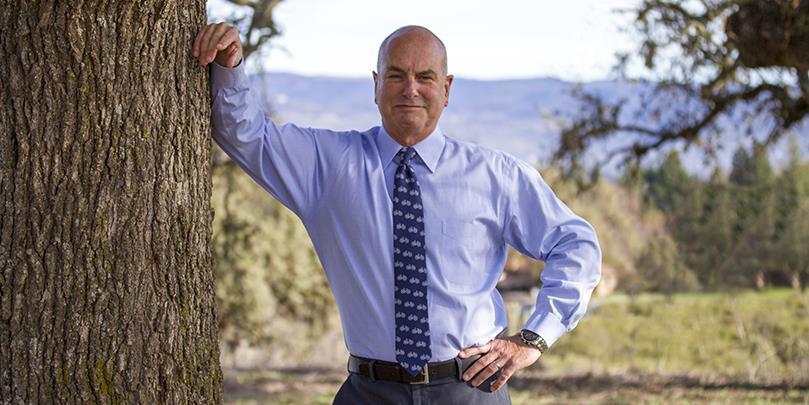

Jon has been a financial advisor for over 46 years, residing in Napa since 1985. Having built a solid base of business by teaching classes at the local college and word of mouth, his investment process has been refined to a methodical process of risk aversion, seeking undervalued situations, and blending this into a customized solution for individual client needs.

When he's not spending time with his family he'll most likely be cycling, hiking, backpacking, training for his 13th Alcatraz swim, diving, fishing, sailing or reading.

Services Include

- 401(k) Rollovers

- Asset Management

- Exchange Traded Funds

- Financial Planning

- Fixed Income

- Professional Portfolio Management

- Retirement Planning

- Wealth Management

Securities Agent: HI, TN, WA, NY, TX, NC, LA, CO, NV, FL, ID, NJ, ND, MT, MS, GA, AZ, AK, PR, MN, MA, DE, VA, IN, WV, OK, MD, WY, VI, SC, DC, WI, MO, MI, IA, NM, NE, KY, RI, NH, UT, SD, KS, VT, PA, ME, CT, AR, IL, OR, OH, CA, AL; BM/Supervisor; General Securities Representative; Investment Advisor Representative

NMLS#: 1295672

CA Insurance License #: 0A80251