Anne-Marie Cummings

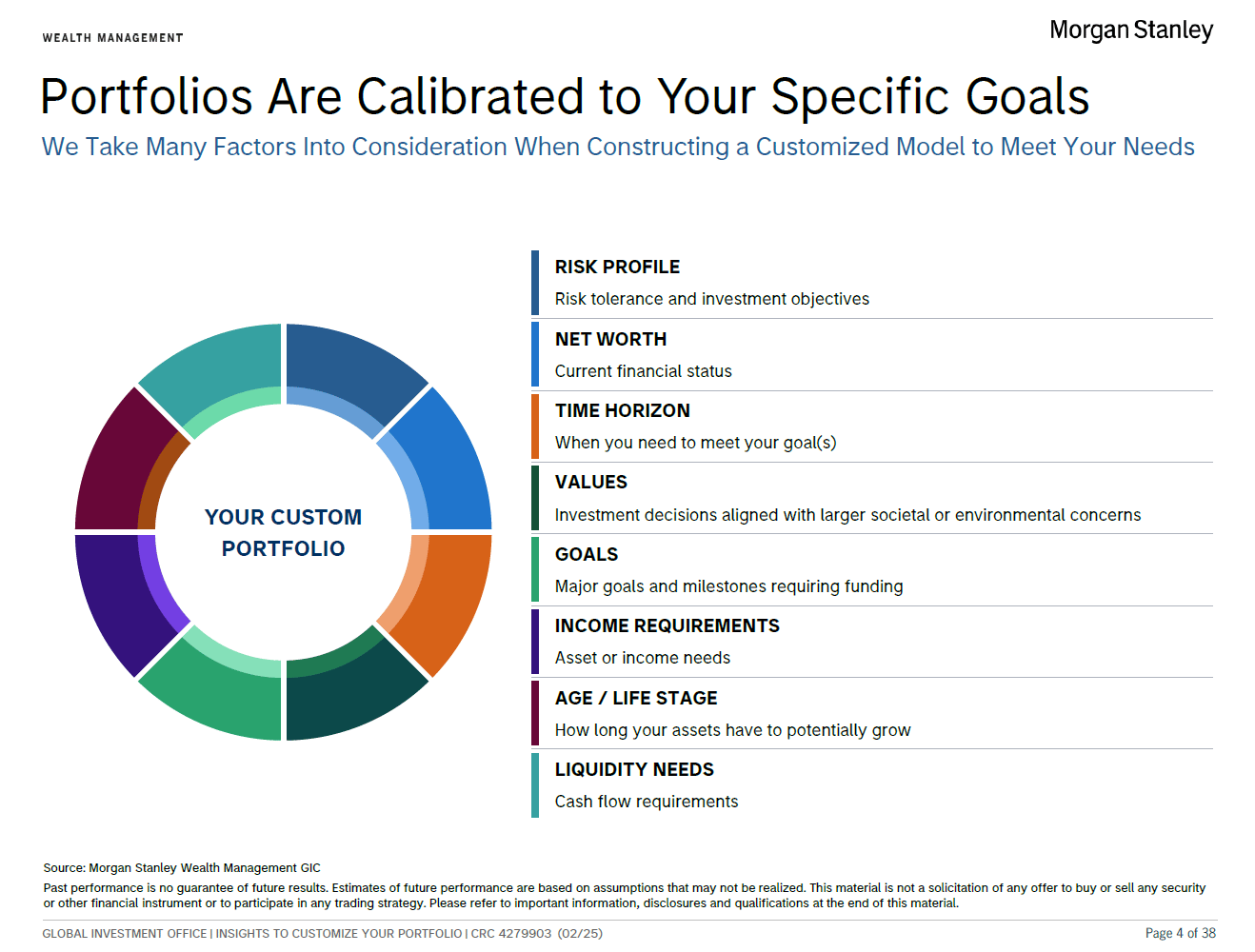

On the surface, it seems rather simple — manage investments and resources in pursuit of a goal. However, if you're like most of the clients we serve, you have an array of goals. Often these goals are multi-faceted and complex, requiring the experience of a number of professionals. When working with us, our clients may benefit not only from the day-to-day advice and guidance that we provide. They can also benefit from an extensive team of Morgan Stanley professionals who are available for additional support and guidance. All working together with one focus - You. Our approach to goals-based wealth management seeks to tie together your entire financial outlook — income, expenses, investments, debt, business interest, real property — in one strategy. We start by: