Being a CERTIFIED FINANCIAL PLANNER® Jesse's held to one of the highest ethical standards. Our team's goals are to help provide our clients (i) confidence about re-thinking retirement, (ii) their dream vacation/home, or (iii) transitioning wealth to the next generation or charity of their choice.

We get to understand your (i) personal, lifestyle, financial goals and (ii) concerns in order to create your (iii) personal wealth strategy. Utilizing Portfolio Management Designation, we provide investment advise to high networth individuals as well as successful professionals to select the investment products to maximize returns on a tax efficient basis.

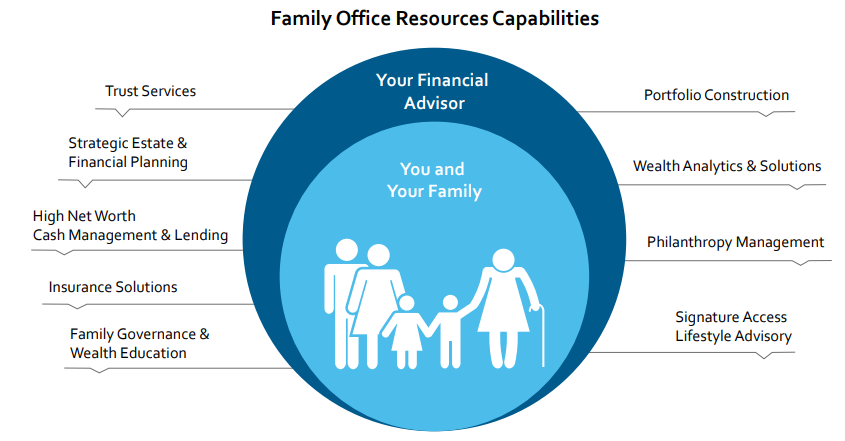

With 54 years of investment experience, we’ve grown our practice with a small niche of clientele with our personalized portfolio construction process. By utilizing all of Morgan Stanley Wealth Managements and various external resources, we have the ability to address any tax, life insurance, estate/trust, liability concerns and provide personalized solutions.

Long Island natives, our team has spent the last 30 years in the community and devoting our free time to better it. Residing in Saint James with his wife, Caitlyn both are active in the community. Volunteering his free time by working with Wings for Widows to assist Widows with understanding their top priorities after spouse passes and Home For Our Troops, to help US Veterans with home building/construction through manual and financial assistance. He spends his free time assisting the less fortunate in the homeless community through his non-for-profit organization and feeding less fortunate families across the world by organizing meal packaging events with another non-for-profit organization, "Rise Against Hunger". In his free-time, Jesse enjoys powerlifting, golfing, 1/2 Marathons, Spartan Races, and hosting financial literacy seminars through Suffolk County Community College and SUNY Binghamton.

Disclaimers:

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third‐party corporate trustee.

Services Include

- Professional Portfolio Management

- Financial Planning

- Retirement Planning

- Wealth Planning

- Estate Planning Strategies

- Trust Services

- Planning for Education Funding

- Long Term Care Insurance

- 401(k) Rollovers

- Alternative Investments

- Cash Management and Lending ProductsFootnote10

- Business Planning

- Planning for Individuals with Special Needs and their Families

- Trust Accounts

- Life Insurance

Securities Agent: HI, WV, OR, MO, TX, NM, FL, CT, AR, MS, AL, OH, IN, DE, VA, NY, ME, DC, CA, WA, UT, NE, MI, LA, WI, SC, OK, NJ, IL, CO, WY, PA, NC, MN, GA, AK, VT, RI, NV, MA, IA, AZ, TN, NH, MD, KY; General Securities Representative; Investment Advisor Representative

NMLS#: 1913305