Katie Reed

My career as a Financial Advisor has afforded me the opportunity to meet and develop meaningful relationships with a select number of successful business owners and executives. I love sharing experiences to develop connections and simplify complex material into understandable information for making important decisions. I feel privileged to have earned the close trust of a special group of wonderful individuals and their families.

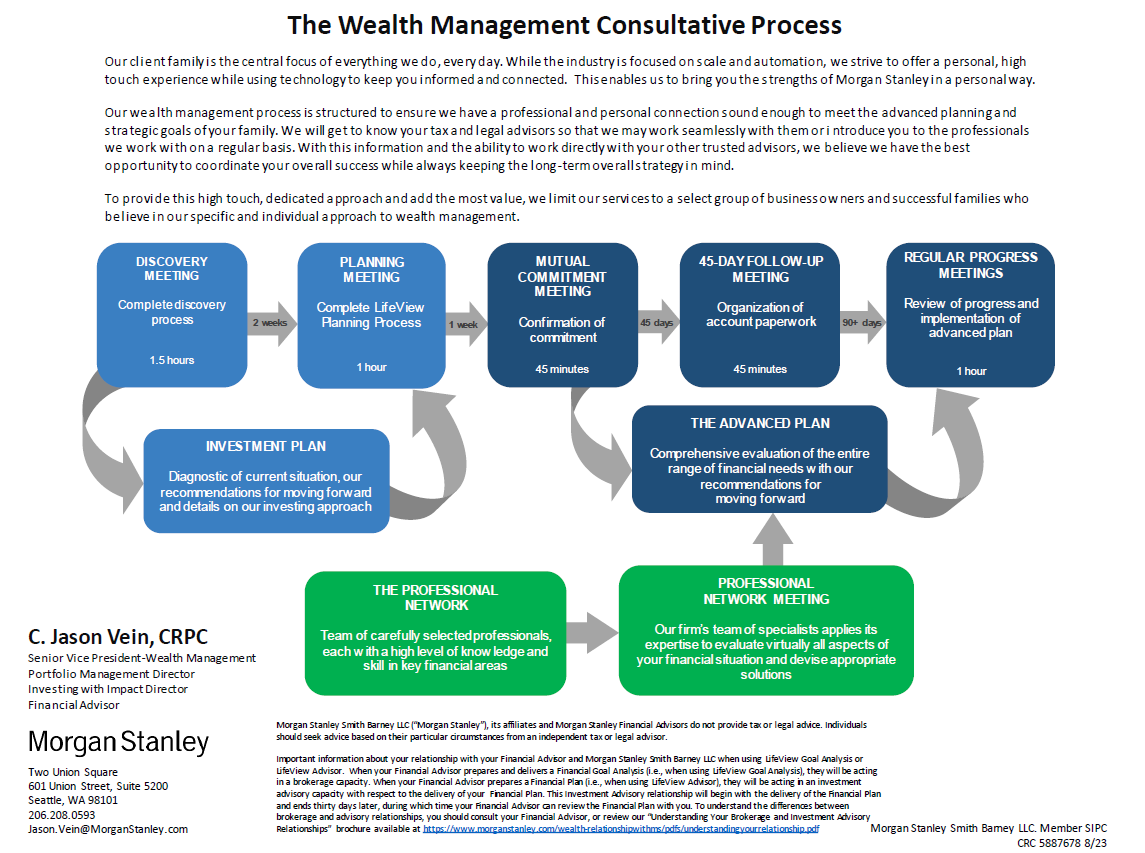

Stewardship of your financial resources will guide our relationship. My passion is managing those resources to maximize their effectiveness for you and your family. As a Portfolio Management Director, I can personally manage your investments in a customized portfolio. I have learned over the years to play to my strengths while working with your attorney and accountant as well as specialists from my network to offer you comprehensive and integrated wealth solutions.

Through focused collaboration, I aim to promote greater income equality and transparency at the corporate level. Further, guiding better decisions for gender equality has inspired me to become an Investing with Impact Director, which I hope will inspire many more. Working with families like yours, together we can align your resources with strategies best suited to achieve the purposes for your wealth.

Over my career, I have developed and refined a thoughtful process to help my clients make informed decisions with their money and their lives. I limit my practice to a small group of families where I can have the greatest impact by staying well connected and involved in the decision-making processes of life.

More about me:

I was born in Grand Forks, North Dakota, to a family with backgrounds in the military, banking and farming where I learned about hard work, responsibility and accountability. Dad was a Colonel in the Air Force; Grandpa was in banking. Both liked to fly, and I picked up a love of flying from them. We moved a lot because of the military, so I had to make friends quickly and often.

Early Saturday morning board and card games with Dad built out my competitive edge and critical thinking. He never let me win; I had to earn a victory. My persistence and hard work eventually paid off. With Grandpa, we discussed markets, banking and personal finance strategy. He drilled me on the importance of planning for the future, good times or bad. He taught me both were coming and how you dealt with each mattered – a lot.

I graduated from the University of Washington Business School with a concentration in Finance while working 30 hours a week at a bank in a variety of roles and responsibilities. After 15 years of building my practice as a financial advisor and enjoying life on the banks of Lake Washington in Kirkland, I met my wonderful wife and started the next major pivot in my life.

Today, we have four kids and one grandchild and like to spend our time on the water or near it: ocean, lakes or waterfall hikes. I enjoy triathlons, cycling, yoga, pickle ball, racing with SCCA and piloting N393PS on new adventures.

2012-2025 Five Star Wealth Manager Award

Source: fivestarprofessional.com 2012-2025 The award was determined based on an evaluation process conducted by Five-Star Professional based on objective criteria. The award was not based on a specific time period.