Hollis’ consultative process begins with an in-depth discussion of your current finances and future objectives. She will address opportunities that may have been overlooked and determine how we might adjust your investment strategy to help you meet your goals.

By growing up around the financial business, Hollis had the privilege to learn about Wealth Management from a young age and was able to start early to focus her education and passion into building her client-centered business. Her father’s 30-year career in Wealth Management set the stage for the business Hollis would go on to grow.

An Atlanta native, Hollis graduated from the Westminster Schools and went on to study in the Honors Program at The University of Georgia, where she graduated summa cum laude and earned her Bachelor’s in Finance and a minor in Consumer Economics. During her high school and undergraduate years, Hollis interned with Morgan Stanley management, allowing her to become familiar with all facets of the business. Hollis credits this time as critical in developing the work ethic and values that continue to be at the core of her career today.

After college, Hollis joined Morgan Stanley full time and graduated 1st Tier in the Financial Advisor Associate program. Driven to serve clients with expert knowledge, Hollis takes pride in having earned the CFP® (CERTIFIED FINANCIAL PLANNER™) designation as well as the CERTIFIED PORTFOLIO MANAGER™ designation from Columbia University in New York.

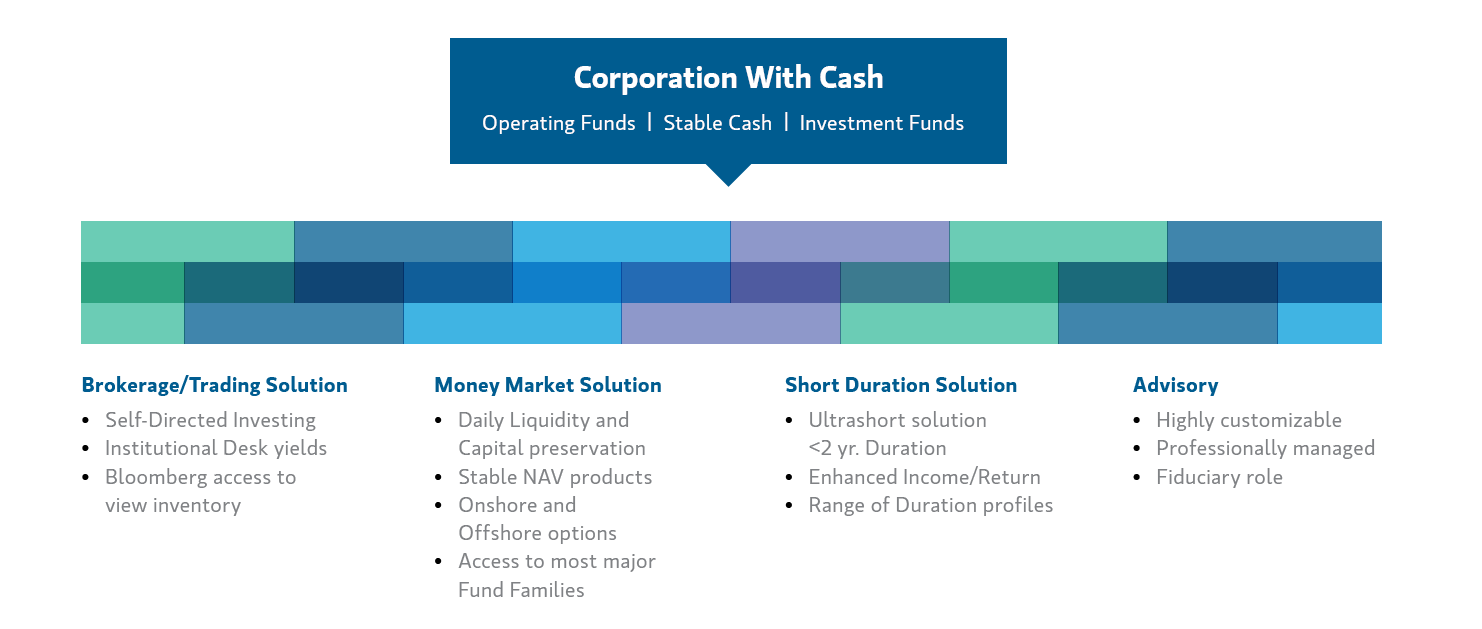

Additionally, as a Corporate Cash Investment Director,

Hollis’ team is able to serve Institutional Clients with a distinctive knowledgebase. In order to help strengthen their corporate services offerings alongside their Ultra-High Net Worth services, Hollis, Rett and Paula joined The Peachtree Group in 2019, aligning their strengths as one of the largest wealth management teams in the Southeast.

Hollis and her husband Michael live in the Peachtree Heights East neighborhood of Atlanta with their children, Fletcher and Sloane, and their miniature Goldendoodle, Cheerios. During her free time Hollis loves to travel and enjoys explore the world with her family.

Capabilities

- Financial Planning

- Estate Planning Strategies

- Corporate Investment Solutions

- Trust Accounts

- Cash Management and Lending ProductsFootnote5

Securities Agent: WY, AK, AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA, VI, VT, WA, WI, WV; General Securities Representative; Investment Advisor Representative

NMLS#: 1848315