The Gotham Group at Morgan Stanley

Our Mission Statement

Our Story and Services

The Gotham Group is a team of experienced Financial Advisors who serve entrepreneurs, entertainers, athletes, media professionals and families who are busy pursuing their careers, have complex finances and are planning for the next generation.

Christina Schatz is a Morgan Stanley-credentialed Senior Portfolio Manager and one of the very few Financial Advisors in the firm to be designated a Global Sports and Entertainment Director.

Jonathan Glantz is a Certified Financial Planner (CFP®) with more than 30 years of experience creating strategies to address complex financial challenges.

Brett Spindler brings extensive analytical skills to the table in his search for third party investment managers who have what it takes to manage our clients' hard-earned capital.

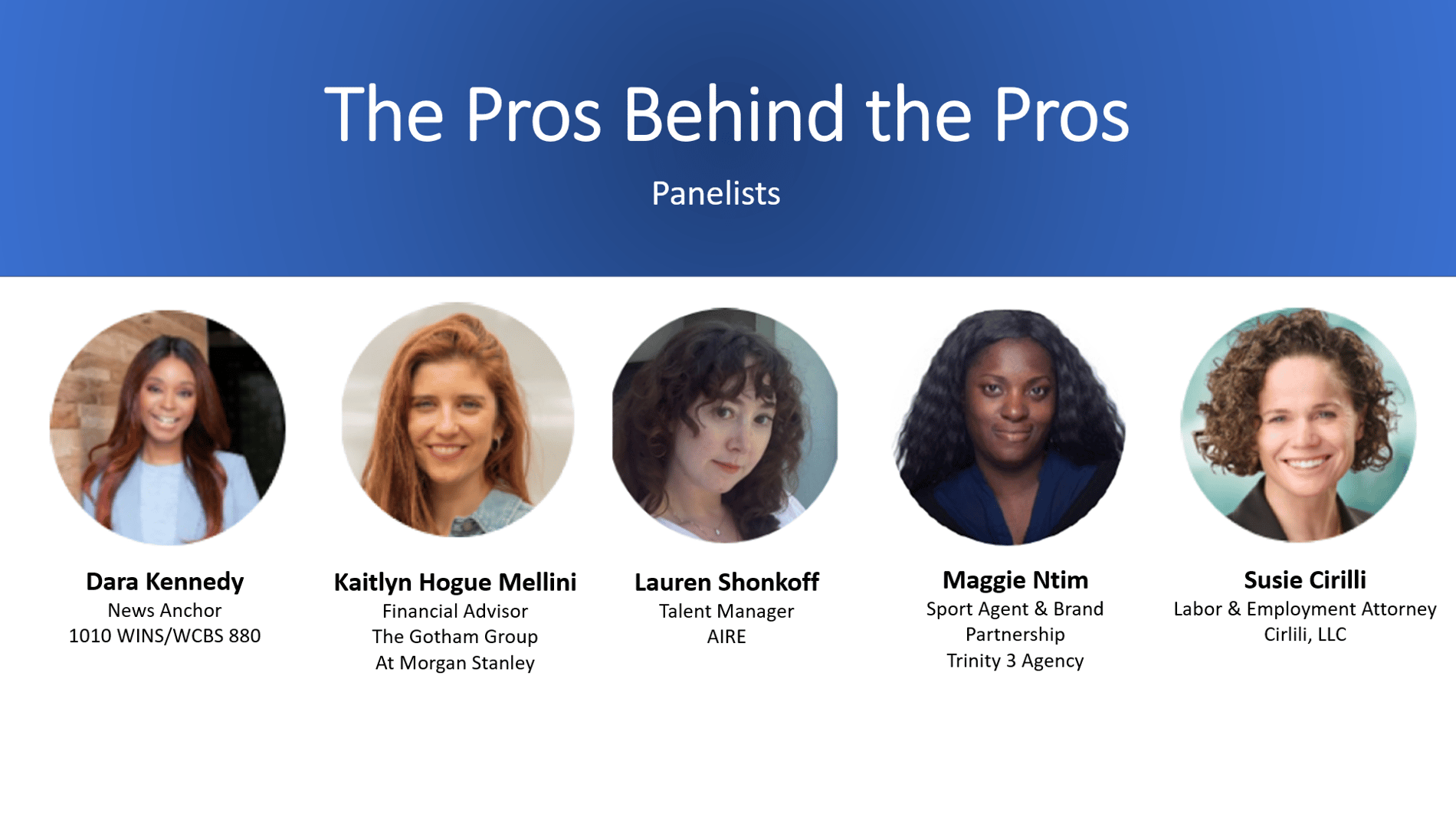

Kaitlyn Mellini brings a diverse, international sales background and commitment to providing clients with clarity, confidence, and empowerment.

The founders of The Gotham Group offer more than 70 combined years of experience to the clients we advise. That advice includes investments, of course, but it also encompasses such diverse dimensions of your financial life as lending, philanthropy, insurance, and estate planning strategies.

Together, we offer the complementary skills necessary to help you succeed in your financial life, just as you have in your career.

Awards & Recognition

2025 Forbes Best-In-State Wealth Management Teams

2025 Forbes Best-In-State Wealth Advisors- Christina Schatz

2025 Forbes Best-In-State Wealth Advisors- Brett Spindler

2024 Forbes Best-In-State Wealth Management Teams

2024 Forbes Top Women Wealth Advisors Best-In-State- Christina Schatz

2024 Forbes Best-In-State Wealth Advisors- Christina Schatz

2024 Forbes Best-In-State Wealth Advisors- Brett Spindler

2023 Forbes Best-In-State Wealth Advisors- Christina Schatz

2023 Forbes Best-In-State Wealth Advisors- Brett Spindler

Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (2025, 2024). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Forbes Top Women Wealth Advisors Best-In-State

Source: Forbes.com (Awarded Feb 2024) Data compiled by SHOOK Research LLC for the period 9/30/22 - 9/30/23.

Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2025, 2024, 2023). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

- Professional Portfolio ManagementFootnote1

- Wealth ManagementFootnote2

- Wealth PlanningFootnote3

- Alternative InvestmentsFootnote4

- Estate Planning StrategiesFootnote5

- Asset Management

- Philanthropic Services

- Art AdvisoryFootnote6

- Trust ServicesFootnote7

- Sustainable InvestingFootnote8

- Foreign ExchangeFootnote9

- Lending Products

Location

Meet The Gotham Group

About Christina Schatz

Christina began her financial services career at Merrill Lynch in 1990 before joining a Morgan Stanley predecessor firm three years later. She built her practice advising not only athletes and entertainers, but entrepreneurs, professionals and other successful people with complex finances. As a Morgan Stanley credentialed Senior Portfolio Manager, she has managed both equity and fixed income on a discretionary basis for clients who would rather not make day-to-day investment decisions. Her focus, however, goes far beyond investing to encompass virtually every aspect of her clients’ financial lives.

Born in Greece, Christina came to the US as a young girl and grew up in Queens. She received a BA from The University of Maryland and spent several years working for lobbyist organizations in Washington, DC. She still believes that people have the right to complain only if they are willing to become part of the solution. As a result, she serves on the board of The Sea Cliff Civic Association and NEO Philanthropy, an organization committed to justice, equity and dignity around the world. Previously, she was a board member and a volunteer at several women’s shelters in the New York area. That was before whatever spare time she had was taken up by her five children, ages 11-23. Christina and her husband Jim reside with their family in Sea Cliff, NY.

NMLS#: 1279285

About Brett Spindler

A graduate of Arizona State University with a BS in Business Administration, Brett began his financial services career at Oppenheimer & Co. in 1995. Outside the office, he is active in his community, and enjoys skiing and tennis. Brett currently resides in Cresskill, NJ with his wife, Deborah, and their two children.

NMLS#: 1270055

About Jonathan R Glantz

During the several decades in which he’s advised clients. Jonathan has served as a branch sales manager, supervising trainees and coming up with ideas to initiate dialogue between Financial Advisors and their clients. He earned Morgan Stanley’s Senior Portfolio Manager designation that enabled him to offer discretionary investment management to his clients and relieve them of day-to-day investment decisions they preferred not to make on their own. His Certified Financial Planner designation from The College of Financial Planning provides him with the credentials to develop comprehensive plans that go beyond investments to encompass lending, estate planning and a wide variety of other key financial disciplines.

Jonathan is a graduate of Amherst College with a BA in American Literature. He and his wife reside in Manhattan where they look forward to spending as much time as possible with their new grandchild.

NMLS#: 1253302

About Kaitlyn Hogue Mellini

Originally from Oregon, Kaitlyn earned her BA and MA in Art History from the University of Denver. In 2011 she heard London calling and she and her husband quit their jobs in order to build a life in Kentish Town, North London. Her varied career experiences were united by the common thread of business development, providing exceptional service to clients and stakeholders, and helping solve complex problems for high-net-worth individuals.

She became interested in becoming a Financial Advisor and working with multi-generational families, sports and entertainment executives and talent, collectors, and small business owners – because she understands the stress that can come with feeling like there are not enough hours in the day to take on the job of managing your personal finances. She finds deep fulfilment in learning the stories of her clients and helping them feel confident and empowered to pursue their dreams.

Kaitlyn is an avid theatre-goer, reader, film-lover, knitter and traveler. Most weekends, you will find her wandering through Central Park with her husband and 4-year-old child.

About Elizabeth Berstler

Liz grew up on a small goat farm in rural New Jersey and channels her love of agriculture through gardening, knitting and exploring sheep and fiber festivals. Liz’s love of the outdoors influences her extracurricular activities and travel plans centered around hiking, cycling, swimming, and fishing.

About Hermine Abajian

As a Portfolio Associate with The Gotham Group, Hermine has many roles including operational support and trading. However, her focus continues to be the relationship with her clients and providing excellent customer service.

Hermine was born in Armenia and is a proud and active member of her local Armenian American community. Hermine resides in Roslyn, NY with her husband Nazareth, and twins Jack and Olivia. She loves living on Long Island with its many perks including the best bagels in the world, lovely beaches, and great wineries.

Contact Christina Schatz

Contact Brett Spindler

Contact Jonathan R Glantz

The Power of Partnerships

About Supriya A. Jagnanan

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Supriya began her career in financial services in 1994 and joined Morgan Stanley in 2022 as an Associate Private Banker. Prior to joining the firm, she was a Senior Branch Manager at HSBC Bank. She also served as a Premier Sales Coach and a Senior Premier Relationship Manager at HSBC Bank.

Supriya lives in Forest Hills, New York with her family. Outside of the office, Supriya enjoys spending time with her family, cooking and traveling.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Portfolio Insights

Wealth Management for Athletes and Entertainers

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley does not assist with buying or selling art in any way and merely provides information to clients interested learning more about the different types of art markets at a high level. Any client interested in buying or selling art should consult with their own independent art advisor.

7Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

9GlobalCurrency is available to clients of Morgan Stanley Smith Barney LLC with an eligible brokerage account. Before undertaking foreign exchange transactions, clients should understand the associated risks.

Engaging in foreign currency transactions entails more varied risks than normally associated with transactions in the domestic securities markets. Attention should be paid to market, credit, sovereign, and liquidity risks. The foreign exchange transactions and deposits discussed in this material may not be appropriate for all clients. The appropriateness of a particular investment or strategy depends upon a client’s particular circumstances and objectives. This material does not provide individually tailored investment advice.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley