With more than 20 years of experience in financial services industry, Galit has grown her practice by developing strong relationships with her clients built on a foundation of trust and high touch service. Galit prides herself on being a complete resource to her clients, going above and beyond to deliver a comprehensive plan that takes in to account any goals or aspirations clients have. Galit empowers her clients through education, simplifying complex financial concepts and communicating it to clients in ways that make sense to them. Above all, Galit is driven by truly making a difference in the lives of those she supports.

Over the course of her career Galit has built an extensive network of specialists that she consults for expert advice from trust and estate lawyers, CPA’s, insurance professionals and real estate agents. Attention to detail, availability and white glove service are the cornerstones of Galit’s practice. With the support of her team in tandem with the best-in-class resources from the firm, Galit provides clients with an exceptional client service experience.

Galit was born in Israel and grew up in New York City. Throughout her career she has held various roles on Wall Street which has allowed to her to gain a deep understanding of many different asset classes. Galit is devoted to education and holds several different degrees, including a Doctorate in Management and International Economics from Pace University, an M.A. in Organizational Leadership from Columbia University, an M.B.A. in Management from Baruch College and a B.A. in English Literature from Rutgers University. She has also been an adjunct business professor at Columbia University for the past 10 years.

Galit lives in New York City, Connecticut and Florida with her husband and three children. Outside of work she enjoys fitness, nutrition and spending time outdoors. She is passionate about women who are pursuing careers in the financial services industry.

Capabilities

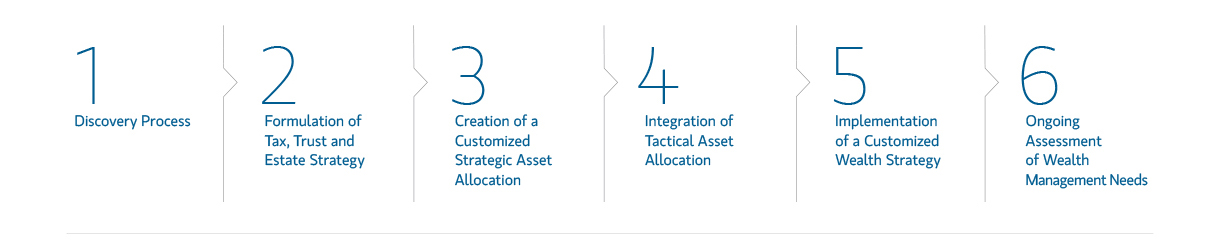

- Comprehensive Wealth Planning

- Investment Management

- Tax, Trust & Estate Advisory

- Cash Management & Lending

- Family Governance & Wealth Education

- Insurance Solutions

AL, AK, AZ, CA, CO, CT, DE, FL, GA, HI, ID, IL, KY, ME, MD, MA, MI, MS, MO, NV, NJ, NM, NY, NC, OH, OR, PA, RI, SD, TN, TX, UT, VT, VA, WA, WI, WY; General Securities Representative

Founded in 1977, Private Wealth Management is the division of Morgan Stanley Wealth Management that is dedicated to serving the firm’s most affluent clients, including some of the world’s most accomplished entrepreneurs, executives and stewards of multigenerational wealth. Functioning as an exclusive investment boutique within a global financial firm, we deliver sophisticated solutions that leverage the intellectual capital and insight of Morgan Stanley’s substantial global resources. Drawing on a deep understanding of your financial life, our goal is to help you:

- Manage investments with an unwavering focus on your financial strategy and personal goals

- Create comprehensive, multigenerational wealth management plans based on your needs, challenges and the values that guide your life and legacy

- Simplify financial complexity to help you achieve clarity and control

Private Wealth Management Highlights

- Approximately 300 teams specialized in assisting individuals and families with $20MM+ in investable assets

- Over $1.2 trillion in AUM

- Comprising 26% of the Barron’s Top 100 Financial Advisors list for 2025

- Direct access to ultra high net worth experts in philanthropy, family dynamics, wealth transfer, lifestyle advisory and other areas of interest to ultra high net worth families

1 Morgan Stanley Wealth Management, September 2025

Source: Barron's (Awarded March 2025) This ranking was determined based on an evaluation process conducted by Barron's for the period Oct 2023-Sept 2024. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors paid a fee to Barron's to obtain or use the ranking. This ranking is based on an algorithm that includes client retention, industry experience, review of compliance records, firm nominations, and quantitative criteria, including assets under management and revenue generated for their firms. Investment performance is not a criterion. Rankings are based on the assessment of Barron's and may not be representative of any one client’s experience. This ranking is not indicative of the Financial Advisor’s future performance. Morgan Stanley Smith Barney LLC is not affiliated with Barron's. Barron’s is a registered trademark of Dow Jones & Company, L.P. All rights reserved.

Industry Award Winner

Industry Award Winner