Thomas Frame

While each strategy is different and has its own unique investment objectives, there are some core tenets that can be found across the security selection process:

We look for energetic, smart, and highly ethical management teams who are averse to high levels or leverage and understand how best to allocate a company's balance sheet and cash flow to maximize compounding of shareholder value. These companies typically come with large moats around their businesses and high levels of Return On Invested Capital (ROIC). A combination that helps create stability and pricing power.

Each of our strategies will have its own mandate; growth, value, dividend, etc, but these basic characteristics are found across the majority of investments we make, including in the Private Market.

More detail on each of the core strategies can be found in the following fact sheets:

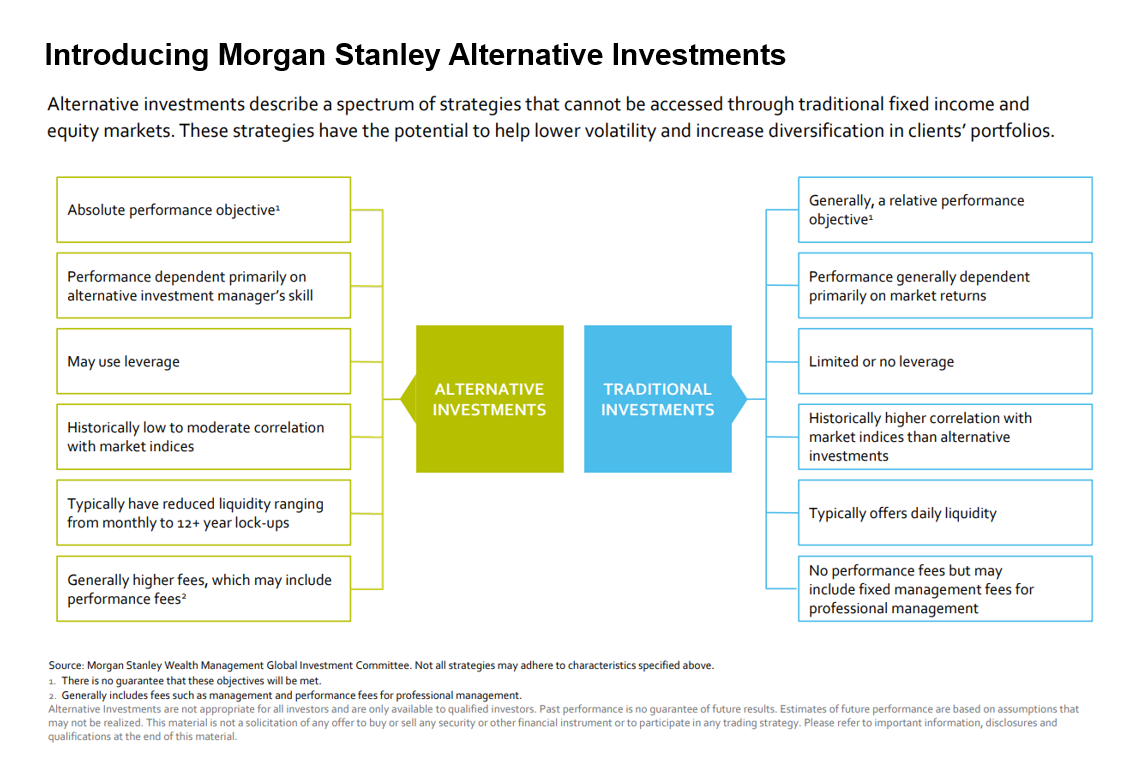

Our leading alternatives platform offers 200+ third-party and proprietary funds, including first look and exclusive opportunities, that may help qualified investors enhance returns, reduce volatility, manage taxes and generate income—while maintaining a goals-based approach for asset allocation.

Our platform offers world-renowned hedge fund managers specializing in a variety of strategies. Hedge funds have become increasingly popular with a broader segment of the investing public due to their ability to offer diversification and higher potential returns when compared to traditional equity investments.

Morgan Stanley Wealth Management announced the launch of its Private Markets Transaction Desk, a concierge service that empowers eligible shareholders and investors to buy and sell eligible private company shares in the secondary market.

Amid volatility in stocks and bonds, institutional and individual investors might seek diversification in the growing private equity secondaries market.