F. Thomas Schlappatha, CFP®

Our team is committed to providing a premier wealth management practice with an emphasis on helping families reach their personal and financial goals. We believe that implementing a personalized financial plan is the best way for families to accomplish both. Whether you're preparing for retirement, saving for a child's college education, or looking to buy a new home, a comprehensive plan that incorporates all aspects of your wealth should provide a helpful roadmap for keeping you on track towards those goals.

Working together starts with a conversation that goes beyond discussing finances. We strive to build a strong relationship with all clients by gaining a thorough understanding of their unique lifestyle, goals, and family. From there, we can build an optimal plan built on objective investment guidance. And as life changes in the future, we'll make the appropriate adjustments to fit your new situation.

We pride ourselves in being compassionate, attentive, and flexible financial advisors whom clients and families can trust as they manage their wealth for the long-term. Please contact us if you are interested.

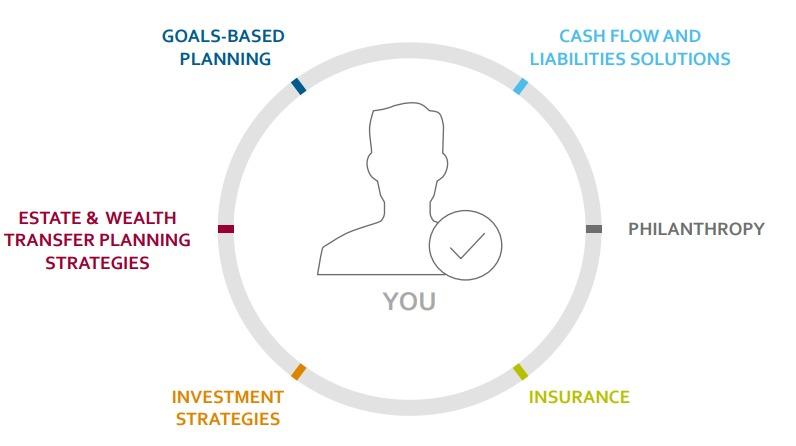

Reaching your goals often involves going beyond investment advice - we provide a wide array of offerings and services centered on you and customized to help meet your needs, and provide access to specialists to help pursue specific goals.

Retirement Planning

Estate Planning

Philanthropy