Michael Johnson

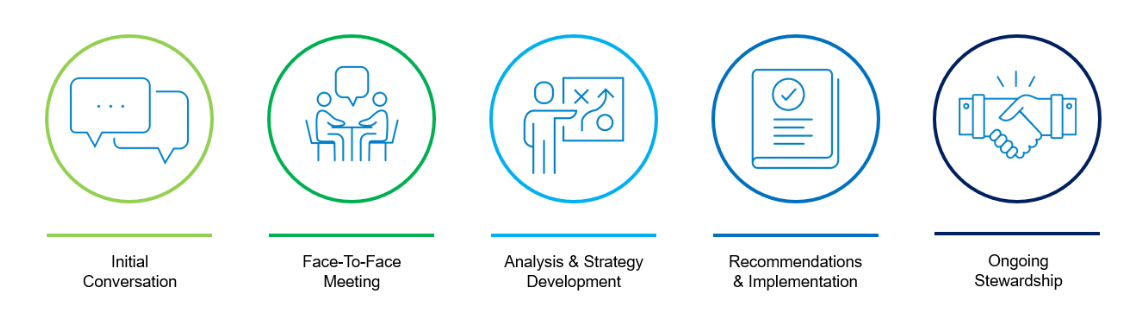

• Understand what is important to you, your family and your legacy

• Identify any circumstances unique to your personal situation

• Learn about your investment experience and tolerance for risk

• Gather important data, documents and financial statements

• Conduct a detailed analysis using various financial planning and risk analysis tools

• Leverage relationships and resources for insights, including proprietary investment and risk models

• Develop a comprehensive financial plan to help build, preserve and transfer your wealth according to your goals

• Focus on preservation of capital

• Utilize an open architecture manager selection process

• Coordinate with your legal and tax advisors to incorporate all aspects of your life into your plan

• Present your plan in detail, including various "what if" scenarios

• Refine your plan based on our discussions

• Once approved, prioritize activities and establish timelines for each solution

• Prepare paperwork to begin moving assets to Morgan Stanley

• Set up tools to provide convenient access to your accounts

• Schedule regular meetings and calls to track progress towards your goals

• Provide tailored reports that include detailed information on the performance of your investments

• Discuss changes in your life, adjusting your plan accordingly

• Constantly monitor your investments to keep them aligned with your goals and the latest market analysis and views

• Provide ongoing advice, education and assistance with various wealth management services, including cash management, estate planning and philanthropic efforts