David Christopher Keck, CFP®, CEPA®

First Vice President,

Financial Advisor,

Senior Portfolio Manager

Direct:

(302) 644-6625(302) 644-6625

Toll-Free:

(800) 258-3131(800) 258-3131

My Mission Statement

Working with you to preserve and grow wealth for your long-term goals

My Story and Services

David is dedicated to analyzing client investments and portfolios, providing comprehensive portfolio management. Leveraging the extensive global resources of Morgan Stanley, he strives to deliver effective and informed investment advice to clients. Financial planning serves as the foundation for David's financial recommendations and investment decisions, seeking to help ensure that each client's portfolio is aligned with their long-term goals and risk tolerance.

David's career began at Thermo Fisher Scientific, a global scientific supply company, where he managed multi-million-dollar relationships and provided attentive, responsive service. Since transitioning to a financial advisor role in 1999, his scientific background has enhanced his detailed, problem-solving approach to wealth management.

He holds a Bachelor of Science degree in Biology from Muhlenberg College and has earned the prestigious CERTIFIED FINANCIAL PLANNER® designation, which requires extensive classroom work and ongoing re-certification.

An active member of his church, David enjoys golfing, gardening, and is an avid bird watcher. He has participated in the Audubon Christmas Bird Count annually since 1991. David resides with his wife, Michelle, and their daughter, Ellie, just outside of Lewes, Delaware, where he was born and raised.

Securities Agent: HI, WV, VA, TX, SC, PA, OH, NY, TN, NJ, WA, NH, NC, MD, MA, LA, KY, IL, GA, FL, DE, DC, CT, CO, CA, AZ, AL; General Securities Representative; Investment Advisor Representative

NMLS#: 1310688

David's career began at Thermo Fisher Scientific, a global scientific supply company, where he managed multi-million-dollar relationships and provided attentive, responsive service. Since transitioning to a financial advisor role in 1999, his scientific background has enhanced his detailed, problem-solving approach to wealth management.

He holds a Bachelor of Science degree in Biology from Muhlenberg College and has earned the prestigious CERTIFIED FINANCIAL PLANNER® designation, which requires extensive classroom work and ongoing re-certification.

An active member of his church, David enjoys golfing, gardening, and is an avid bird watcher. He has participated in the Audubon Christmas Bird Count annually since 1991. David resides with his wife, Michelle, and their daughter, Ellie, just outside of Lewes, Delaware, where he was born and raised.

Securities Agent: HI, WV, VA, TX, SC, PA, OH, NY, TN, NJ, WA, NH, NC, MD, MA, LA, KY, IL, GA, FL, DE, DC, CT, CO, CA, AZ, AL; General Securities Representative; Investment Advisor Representative

NMLS#: 1310688

Securities Agent: HI, WV, VA, TX, SC, PA, OH, NY, TN, NJ, WA, NH, NC, MD, MA, LA, KY, IL, GA, FL, DE, DC, CT, CO, CA, AZ, AL; General Securities Representative; Investment Advisor Representative

NMLS#: 1310688

NMLS#: 1310688

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

BY YOUR SIDE FOR ALL OF LIFE'S MILESTONES

Our practice is built on the devlopment of deep and enduring relationships and the delivery of comprehensive wealth management services.

We work with a broad range of clients to help provide value through advice carefully cultivated for them in seeking the acheivement of some of the following goals:

- Simplify their financial life

- Plan for an enjoyable retirement

- Manage risk and protect their families

- Tax Management Strategies

- Address long-term health care needs

- Educate the next generation on how to manage wealth and carry family values forward

- Achieve important philanthropic goals

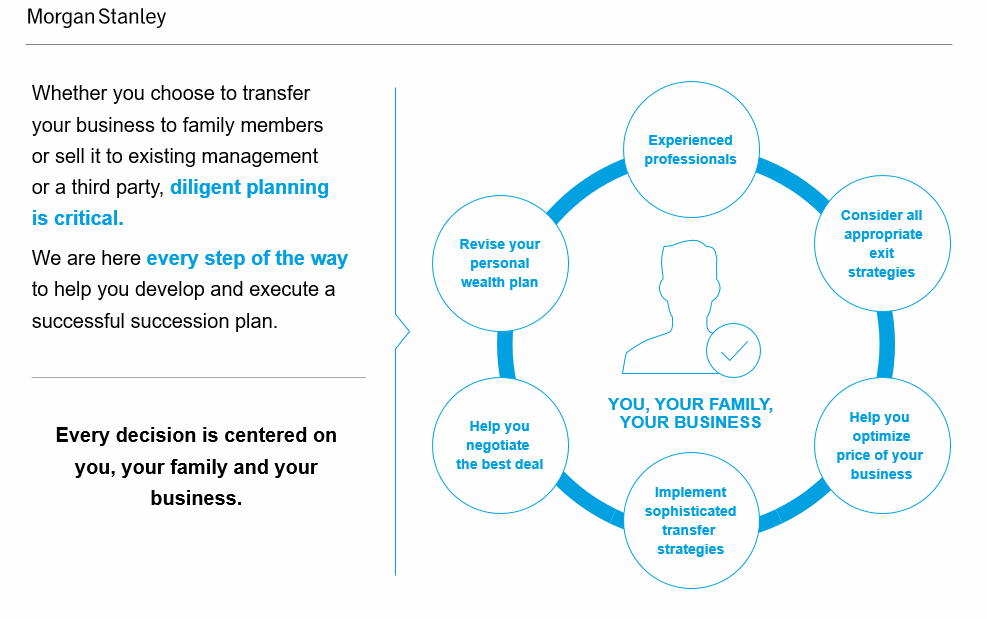

- Help business owners develop a plan for transitoning out of their business, maximizing its value, and seek long-term financial independence after the sale.

The strategies we recommend are tailored to each clients specific needs and carefully coordinated to help provide the knowledge, tools, and resources needed to navigate today's fast-paced world. We are here to help you make informed decisions on virtually any financial issue you face.

Disclosures:

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Our Clients Include:

- Families spanning multiple generations

- Retirees and individuals planning for retirement

- Small business owners and entrepreneurs

- Nonprofit organizations

- New parents and young families

- Referrals from existing clients

Certified Exit Planning Advisor

Seeking financial independence is not just about making the right investments; it's about a comprehensive approach to both personal and financial planning. A Certified Exit Planning Advisor (CEPA) can help bring focused experience to the table, to help you, as a business owner, create a personalized strategy that focuses on your unique life goals and financial aspirations.

Whether it is planning for retirement, saving for future needs, or striving to optimize your business's values, we seek to help ensure that every decision aligns with your long-term objectives. This goes beyond just wealth management, as we will provide you with a roadmap that integrates your personal life with your financial goals. We focus on helping you seek to build, preserve, and transfer your wealth effectively.

Whether it is planning for retirement, saving for future needs, or striving to optimize your business's values, we seek to help ensure that every decision aligns with your long-term objectives. This goes beyond just wealth management, as we will provide you with a roadmap that integrates your personal life with your financial goals. We focus on helping you seek to build, preserve, and transfer your wealth effectively.

CEPA®

The CEPA® designation demonstrates that an advisor has a structured, comprehensive approach and deep experience in exit planning. It can help enhance confidence and credibility with business owner clients by signaling a strong commitment to ongoing professional development. CEPA® advisors guide business owners through the exit planning process using a holistic methodology that integrates business value growth with personal and financial goals.

Location

55 Cascade Lane

Rehoboth Beach, DE 19971

US

Direct:

(302) 644-6625(302) 644-6625

Toll-Free:

(800) 258-3131(800) 258-3131

Fax:

(302) 644-6700(302) 644-6700

Wealth Management

Global Investment Office

Portfolio Insights

Ready to start a conversation? Contact David Christopher Keck today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)