Charlie Wixson

With a deep-seated passion for finance and a dedication to helping others achieve their financial goals, I have built a distinguished career as a financial advisor at Morgan Stanley. My journey in the financial world began over 35 years ago, driven by a relentless pursuit of excellence and a commitment to delivering personalized financial solutions. Throughout my career, I have navigated the complexities of the financial markets, gaining invaluable insights and experience that I now leverage to benefit my clients.

At the core of our practice is a client-centric approach, where understanding your unique financial goals and needs is paramount. We offer a comprehensive suite of services, including personalized investment strategies, retirement planning, risk management, and wealth preservation. My expertise spans across various financial instruments and market conditions, ensuring that your portfolio is tailored to optimize growth while mitigating risks. Whether you are planning for retirement, seeking to grow your wealth, or looking to secure your financial future, we are here to provide the guidance and expertise you need to achieve your goals.

Educating Clients and Multi-Generational Wealth

Education is a cornerstone of our practice. I believe in empowering our clients with the knowledge and tools they need to make informed financial decisions. Through regular updates, personalized consultations, and educational resources, we ensure that you are always informed about your financial options and strategies. Additionally, we specialize in multi-generational wealth planning, helping families to build and preserve wealth across generations. By understanding the unique dynamics and goals of each family, we create tailored strategies that ensure financial security and prosperity for both current and future generations.

Financial literacy is crucial for making informed and confident financial decisions on behalf of yourself and your loved ones. By leveraing trusted and credible sources, you can navigate financial challenges wisely and recognize how your own emotional biases impact your decision making. As a wealth management team, one our our responsibilities is to educate our clients. However, there are many ways for you to take this initiative yourself, in addition to the support of your Financial Advisor.

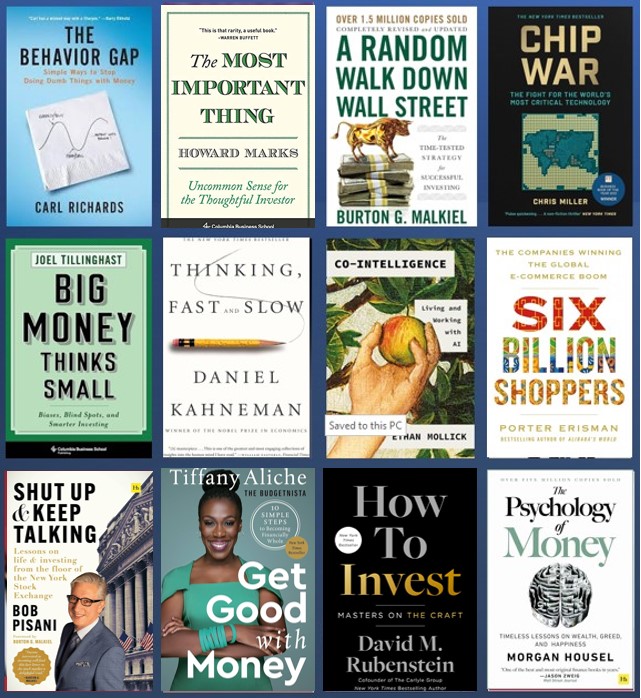

To help you get started, we are sharing a list of exceptional reads from our own personal collection, covering a variety of topics ranging from behavioral finance to personal development.

Testimonial(s) are solicited by Morgan Stanley Wealth Management Canada and provided by current client(s) at the time of publication. No compensation of any kind was provided in exchange for the client testimonial(s) presented. Client testimonials may not be representative of the experience of other clients and are not a guarantee of future performance or success.

3846129 9/24