CapQuest Group at Morgan Stanley

Industry Award Winner

Industry Award WinnerOur Mission Statement

Your Future is our Future - Your Quest is our Quest

Our Story and Services

We understand the financial dynamics of leading a business, owning real estate, or navigating the corporate world. Whether your priorities include goals for financial freedom, planning for your retirement lifestyle, buying a vacation home, optimizing cash flow for your business, planning for succession, or managing equity compensation, our team crafts customized financial plans to address the challenges and opportunities unique to your situation.

Our services go beyond traditional wealth management. From advanced tax strategies to retirement planning, estate planning strategies, risk management, and family governance, we develop strategies that can help you make the most of your financial capital. Through detailed scenario analysis and strategic advice, we seek to ensure you are prepared for every financial decision, helping you navigate market fluctuations and safeguard your long-term wealth.

As Financial Advisors, we are committed to putting your interests first. Through ongoing communication and leveraging the vast resources of Morgan Stanley, we provide the guidance and insight needed to help turn your financial vision into reality. Our team works collaboratively to help ensure your financial plan evolves as your business, investments, and personal circumstances change. We become your dedicated Financial Advisor for unbiased advice and we can help address any of your financial matters during your life journey.

At CapQuest Group, we seek to empower you to focus on your passions and goals while we manage the complexities of your financial journey. Your future is our future, and your quest is our quest.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please visit us at http://www.morganstanleyindividual.com or consult with your Financial Advisor to understand these differences.

- Wealth ManagementFootnote1

- Financial PlanningFootnote2

- Business PlanningFootnote3

- Business Succession PlanningFootnote4

- Cash Management and Lending ProductsFootnote5

- Divorce Financial AnalysisFootnote6

- Life InsuranceFootnote7

- Long-term Care InsuranceFootnote8

- Philanthropic ManagementFootnote9

- Planning for Individuals with Special Needs and their Families

- Trust AccountsFootnote10

- Estate Planning StrategiesFootnote11

- Alternative InvestmentsFootnote12

- Executive Financial ServicesFootnote13

In The Press

Forbes Best-In-State Wealth Advisor 2020-2025

Forbes Best In State Welath Wealth Managent Teams 2024-2025

Forbes Top Women Wealth Advisors Best-In- State 2020-2025

Five Star Wealth Manager Award Winner 2019-2024

Named one of Top Wealth Advisor Moms 2017-2021 as Published in Working Mother

Morgan Stanley Master's Club 2018, 2019, 2020, 2021, 2022

2020-2025 Forbes Best in State Wealth Advisor

Source: Forbes.com (Awarded 2020-2024). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award

2024-2025 Forbes Best in State Wealth Management Teams

Source: Forbes.com (Awarded 2024-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in March of year prior to the issuance of the award

2020-2025 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded 2020-2024). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

2019-2025 Five Star Wealth Manager Award

Source: fivestarprofessional.com (Awarded 2019-2024) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2025 Award - 02/24/2025 - 09/02/2025

2024 Award - 02/13/24 - 08/30/24

2023 Award - 02/13/23 - 08/31/23

2022 Award - 02/21/22 - 08/19/22

2021 Award - 01/18/21 - 09/03/21

2020 Award - 02/10/20 - 09/11/20

2019 Award - 02/11/19 - 09/20/19

2017-2021 Working Mother Magazine & SHOOK Research's Top Wealth Advisor Moms

Source: Workingmother.com (Awarded October 2017-2021). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was given.

Your Resources

Wealth Management Virtual Events and Replays

Find detailed information in the link below.

Location

Meet CapQuest Group

About Rachel R. Cohen

Rachel provides customized advice and wealth management strategies to individuals, business leaders and multi-generational families. She helps them manage their financial assets so they can focus on the areas of their life that bring them joy, meaning and purpose.

After graduating from Penn State University in 1990, Rachel began her career at Merrill Lynch as a Financial Advisor. It is here where she discovered that finance was her true passion. With a commitment to ongoing education, she continued her studies at night, earning an MBA in Finance at Temple University. In 2009, she joined Morgan Stanley’s global headquarter offices to have comprehensive access to the firm’s thought leaders and analysts.

Rachel’s dedication to her clients is equaled only by her focus on her family and community. She serves on the Parent Council at the University of Pennsylvania, among other committees, and since 2005, she has been an active volunteer with Simon’s Heart. Rachel was recognized as “Best in State Wealth Advisor” & “Top Woman Wealth Advisor” by Forbes in 2020-2023 and “Top Wealth Advisors Mom” by Working Mother and SHOOK Research in 2017-2021.

Rachel resides in Whitemarsh with her husband and two sons. Outside of the office, she enjoys real estate, spending time with her family and friends, and traveling.

2017-2021 Working Mother Magazine & SHOOK Research's Top Wealth Advisor Moms

Source: Workingmother.com (Awarded October2017-2021). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was given.

2020-2023 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded 2020-2023). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

NMLS#: 1262285

About Philip C. Grossman

Phil Grossman is a native of the Philadelphia area and currently resides in Dresher, PA with his wife Barbara and their dog Rex. He has three daughters, three sons-in-law and a grandson. For several years, he served as Master of Ceremonies at Relay for Life of the Wissahickon Valley. This event benefits the American Cancer Society and has raised over $ 150,000 each year. He is a past President of the Board of Directors for the Victim Services of Montgomery County, Inc, and a past President of the Upper Dublin Lodge of B’nai B’rith. He enjoys biking, hiking, reading, following Philadelphia sports teams, and trying new foods

NMLS#: 1274574

About Adam Steinhauser

Adam employs a sophisticated and dynamic strategy to manage the "big picture" for individuals and their families. Through a detailed planning process, he not only identifies your goals but also examines how each goal influences and interacts with the others. The foundation of working with Adam is to instill confidence that your goals are attainable while managing unnecessary risks. Furthermore, all clients benefit from regular progress reviews or "snapshots" of their current status. Adam's realistic approach acknowledges that life is ever-changing, and he seeks to ensure that financial plans evolve accordingly. He is committed to keeping you informed about your progress at every stage.

Adam holds a bachelor's degree in Finance from Pennsylvania State University and an M.B.A. from the NYU Stern School of Business. He resides in Lower Moreland, PA, with his wonderful wife and two sons. In his personal time, Adam enjoys coaching baseball and cherishing family moments. He is also determined to secure his first little league championship next season.

NMLS#: 1285408

About Todd M. Roth

His passion for investments and financial planning derives from the strong work ethic of his parents and the intentional life lessons they taught him at a young age about the power of money and how it can help you achieve the goals you set out for yourself.

Todd earned his bachelors from the University of Pennsylvania in Political Science, Philosophy, and Economics. As a Pitcher, he was a 4-year varsity baseball starter, freshman All-American, first team all-Ivy, a 2-year Captain, in addition to being included in the Penn Baseball Hall of Fame. Outside of work, Todd serves on the board for the University of Pennsylvania Baseball Alumni, coaches his son's baseball team and is an active volunteer in his community.

NMLS#: 1035745

About Casey Dearth

About Tiffany Betchel

When not working, Tiffany loves to read, go to the beach and be with her family.

About Melissa Shoupe

About Virginia Rockey

Prior to joining Morgan Stanley, Virginia worked as a Senior Investment Specialist at Merrill. In her role there, she nurtured existing relationships and helped solidify new clients through service and product knowledge. Outside the office, Virginia enjoys writing, roller skating, and finding new cafés and restaurants to frequent with her friends.

About Serena Mao

She is a graduate from Saint Joseph’s University with a degree in Marketing and Finance. Serena currently resides in Conshohocken prioritizing spending time with friends and family. In her free time, she likes to stay active, and as a former gymnast, now volunteers to train Special Olympics gymnasts.

Contact Rachel R. Cohen

Contact Philip C. Grossman

Contact Adam Steinhauser

Contact Todd M. Roth

Awards and Recognition

2019-2025 Five Star Wealth Manager Award

Source: fivestarprofessional.com (Awarded 2019-2024) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2025 Award - 02/24/2025 - 09/02/2025

2024 Award - 02/13/24 - 08/30/24

2023 Award - 02/13/23 - 08/31/23

2022 Award - 02/21/22 - 08/19/22

2021 Award - 01/18/21 - 09/03/21

2020 Award - 02/10/20 - 09/11/20

2019 Award - 02/11/19 - 09/20/19

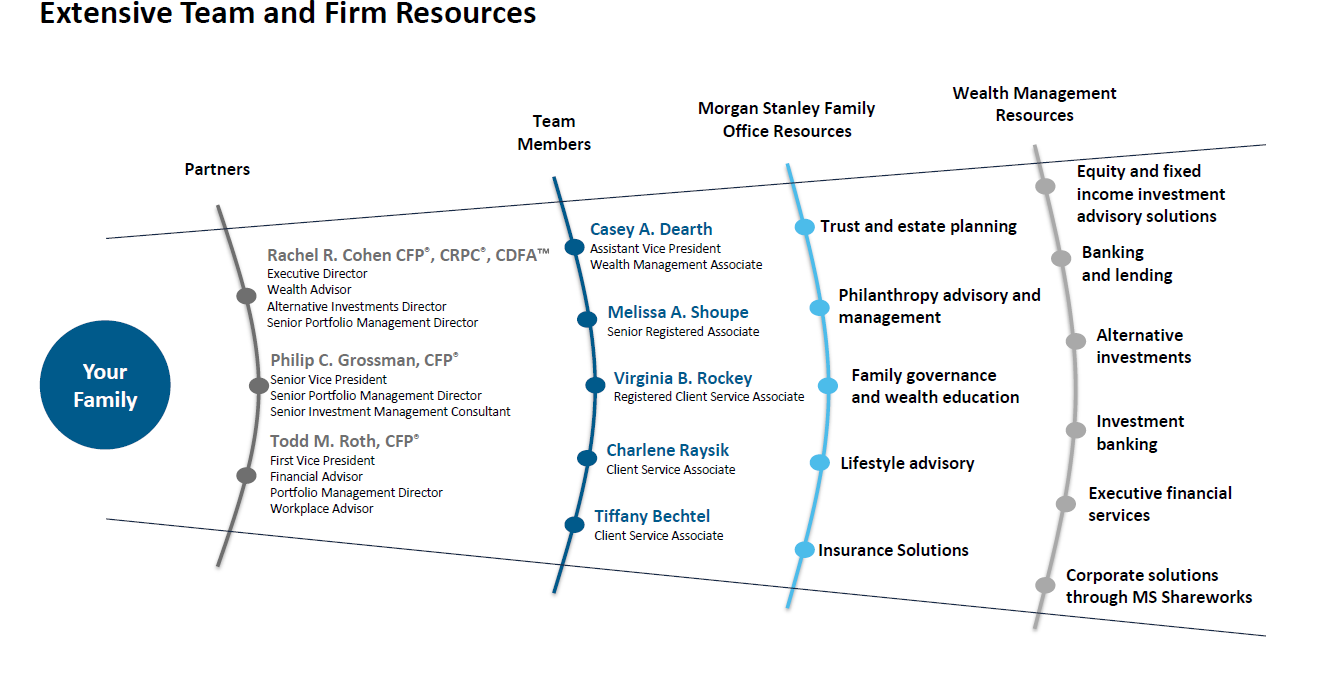

The Power of Partnerships

About Lorry Rosado

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Lorry began her career in financial services in 1984 and joined Morgan Stanley in 2017. Prior to joining the firm, she was a Banking Advisor at Merrill Lynch, as well as a Senior Premier Client Manager at Bank of America.

Lorry lives in East Brunswick, NJ with her family. Outside of the office, Lorry volunteers as a Coach for the Fast Break Basketball Buddy Ball program, focused on providing an opportunity for disabled children and young adults to enjoy the game of basketball. In her free time, she enjoys spending time with family.

About Lewis Harrison

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Lewis began his career in financial services in 2006 and joined Morgan Stanley in 2014 as an Associate Private Banker. Prior to joining the firm, he was an Internal Banking Specialist at the Bank of America/Merrill Lynch. He also served as an Investment Service Advisor with the Merrill Lynch Financial Advisory Center.

Lewis is a graduate of the University of Kansas, where he received a Bachelor of Science in Communications and Economics. While at the University of Kansas, Lewis played guard on the school’s basketball team which reached the Final Four in 2002. He lives in Fort Washington, Pennsylvania with his family. Outside of the office, Lewis supports all Kansas City sports teams, enjoys beach vacations, and spending time with family and friends.

About Adrian Schwartz

Adrian began his career in financial services in 2011 and joined Morgan Stanley in 2021. Prior to his current position, Adrian worked at TD Ameritrade in New York where he worked with some of the firm’s wealthiest clients in the region and managed two branches.

Adrian graduated from Rutgers Business School with an MBA and holds his CERTIFIED FINANCIAL PLANNER designation. Adrian lives in Manalapan, NJ with his wife and two young children. Outside of work, Adrian spends most of his time with his family. When the opportunity presents itself, he also enjoys playing guitar and golfing.

About Chris Smith

Prior to joining Morgan Stanley (Dean Witter), Chris worked in the Retirement Plans department of Prudential Securities and prior to that the District Agency department of Prudential Insurance Company. Chris holds a Bachelor of Arts degree in Communication/Journalism and Psychology from St. John Fisher College in Rochester, NY. He lives in Saratoga Springs, NY with his wife Sharon and two boys, Ryan and Michael and has a passion for golf, skiing and horse racing.

About Victor Diune

Victor has spent the last 22 years at Bank of America/Merrill Lynch. Most recently, he was a Director, Wealth Strategist, working with Merrill Private Wealth Advisors and Financial Advisors, along with their UHNW clients advising them on estate and legacy planning, wealth transfer strategies and philanthropic planning. He was also responsible for developing, consulting and implementing business succession plans as well as providing advice on fiduciary investment management and tax reduction strategies.

Victor received a Bachelor of Arts degree in Political Science from University of Illinois in Urbana-Champaign, received his JD/MBA degree from Suffolk University Law School/Sawyer School of Management, and his LLM in Tax from Boston University School of Law. He holds a Series 7 and 66 securities licenses. He currently lives in Hopkinton, MA with his wife and their 4 children.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts, estate planning, charitable giving, philanthropic planning and other legal matters.

Morgan Stanley does not accept appointments, nor will it act as a trustee, but it will provide access to trust services through an appropriate third-party corporate trustee.

Trusts are not necessarily appropriate for all clients. There are risks and considerations which may outweigh any potential benefits. Establishing a trust will incur fees and expenses which may be substantial. Trusts often incur ongoing administrative fees and expenses such as the services of a corporate trustee, attorney, or tax professional.

Trust services are provided by third parties who are not affiliated with Morgan Stanley. Neither Morgan Stanley nor its affiliates are the provider of such trust services and will not have any input or responsibility concerning a client’s eligibility for, or the terms and conditions associated with these trust services. Neither Morgan Stanley nor its affiliates shall be responsible for any advice or services provided by the unaffiliated third parties. Morgan Stanley or its affiliates may participate in transactions on a basis separate from the referral of clients to these third parties and may receive compensation in connection with referrals made to them.

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

8Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

12Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley