About Benjamin A Lanphar

For over 25 years, I have been helping families reach their financial goals.

Oftentimes, as I grew up in Vancouver, Washington, my grandfather and I would watch his favorite show together, “The Nightly Business Report.” Realizing that I liked the show's content, my grandfather cultivated my interest. His tutelage culminated in a trip to see his financial advisor when I was ten years old. It was at that meeting that I took my tiny savings and procured my first stock. Thus began a lifelong interest in the inner workings of the financial markets.

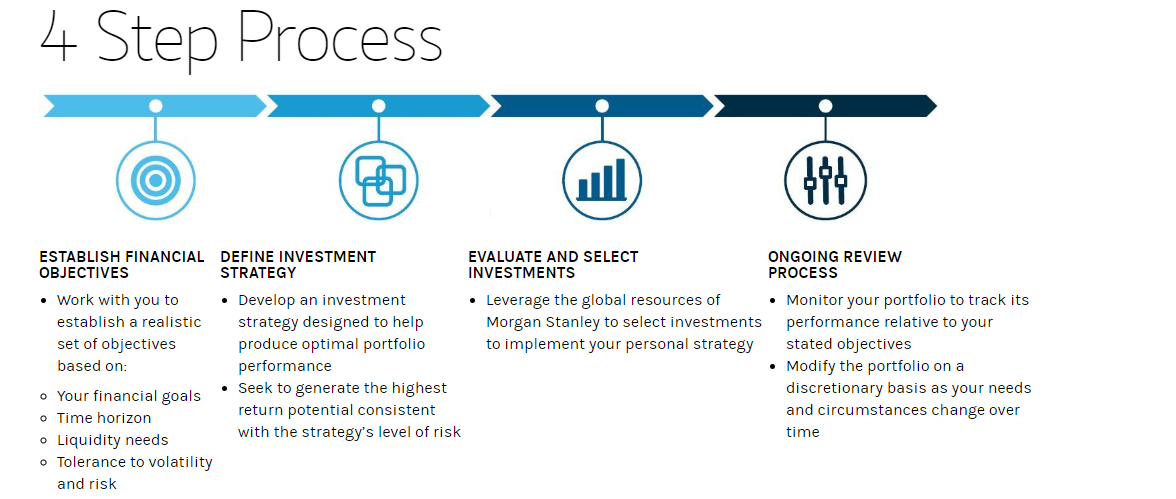

I opened a wealth management practice at a financial advisory firm in Gresham, Oregon in January of 2000. As a Financial Advisor, the core tenet of my practice is to go beyond simply providing sound investment advice. The right investments matter, yes. But a great financial plan does not come solely from knowing investments; it comes from knowing you. My clients and I often have conversations you might not expect from a Financial Advisor, having less to do with the details of asset allocation strategy and more to do with the details of your life. By getting to know you, I can develop a wealth management strategy aimed at helping you grow and preserve your wealth.

Over time, my business has grown. Needing the ability to do more for my clients, I moved my practice to Morgan Stanley in the fall of 2007. My clients now have access to the tools, resources, and research of one of the largest financial firms in the world.

I have twins who keep most of our free time occupied. When I do get a free moment, I enjoy fishing the Northwest’s rivers, cooking for family and friends, and music.

Securities Agent: NE, WA, OR, SC, UT, ME, MS, ID, WY, WV, WI, VT, VI, VA, TX, TN, SD, RI, PR, PA, OK, OH, NY, NV, NM, NJ, NH, ND, NC, MT, MO, MN, MI, MD, MA, LA, KY, KS, IN, IL, IA, HI, GA, FL, DE, DC, CT, CO, CA, AZ, AR, AL, AK; BM/Supervisor; General Securities Representative; Investment Advisor Representative

NMLS#: 1312660

Industry Award Winner

Industry Award Winner