My mission as an advisor is to be at the center of our client's financial lives. I strive to help each client understand how to frame their wealth and their financial goals. This is unique for everyone. Some clients need legacy planning, others need cash flow planning, many need one-off advice on a vexing financial issue, all need asset management. I endeavor to help our clients live comfortable financial lives, and to engage with their wealth on a level that feels right for them. I can provide sage guidance from my 25+ year experience as a professional, FinTech Founder/CEO, investor, philanthropist, and parent to four children. As the financial world is constantly evolving, I too try to remain current - I undergo advanced training on a regular basis to provide modern, relevant solutions.

In terms of the day to day?

I try to help clients every day, often seven days a week. For many, we are their main financial compass and team to whom they turn to sort through difficult issues. I try to clarify the matter, candidly assess what is involved, and work diligently with the stakeholders to work through a resolution. Matters might include cash flow decisions, estate planning decisions, charitable structure decisions, complicated investment decisions (not necessarily regarding a portfolio, yet rather real estate, restricted securities, gifting strategies, 10b5-1 plan strategies, etc.) I work closely with the legal and tax counsel of many clients, as of course these conversations cannot happen in a vacuum.

In terms of asset management, I created and actively manage 7 proprietary portfolio models. I can create your Donor Advised Fund. In addition, we often hire outside talent for 'satellite' strategies and may implement indexing, structures, tactical positions, fixed income, and/or alternatives.

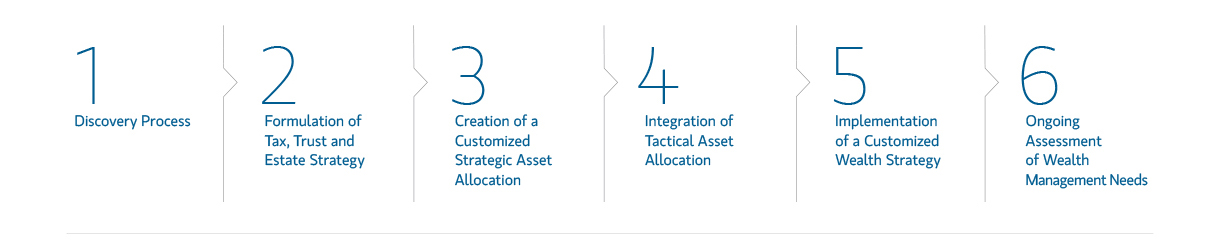

We tie together planning with asset management to provide a complete wealth management solution. Review meetings are held at the frequency and location in which our clients find most comfortable.

Capabilities

- Comprehensive Wealth Planning

- Tax, Trust & Estate Advisory

- Investment Management

- Pre-Liquidity Planning

- Open-Architecture Platform

- Consolidated Reporting

- Family Governance & Wealth Education

- Lifestyle Advisory Services

- Philanthropy Management

- Executive Financial Services

- 10b5-(1) Programs

Securities Agent: MA, MI, TN, GA, CO, AZ, WY, IL, PA, MT, ID, TX, PR, OR, HI, FL, NY, NM, NH, CA, VA, UT, NV, DC, NJ, WA, MD, CT, WI, NC; General Securities Representative; Investment Advisor Representative

NMLS#: 1501582

Founded in 1977, Private Wealth Management is the division of Morgan Stanley Wealth Management that is dedicated to serving the firm’s most affluent clients, including some of the world’s most accomplished entrepreneurs, executives and stewards of multigenerational wealth. Functioning as an exclusive investment boutique within a global financial firm, we deliver sophisticated solutions that leverage the intellectual capital and insight of Morgan Stanley’s substantial global resources. Drawing on a deep understanding of your financial life, our goal is to help you:

- Manage investments with an unwavering focus on your financial strategy and personal goals

- Create comprehensive, multigenerational wealth management plans based on your needs, challenges and the values that guide your life and legacy

- Simplify financial complexity to help you achieve clarity and control

Private Wealth Management Highlights

- Approximately 300 teams specialized in assisting individuals and families with $20MM+ in investable assets

- Over $1.2 trillion in AUM

- Comprising 26% of the Barron’s Top 100 Financial Advisors list for 2025

- Direct access to ultra high net worth experts in philanthropy, family dynamics, wealth transfer, lifestyle advisory and other areas of interest to ultra high net worth families

1 Morgan Stanley Wealth Management, September 2025

Source: Barron's (Awarded March 2025) This ranking was determined based on an evaluation process conducted by Barron's for the period Oct 2023-Sept 2024. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors paid a fee to Barron's to obtain or use the ranking. This ranking is based on an algorithm that includes client retention, industry experience, review of compliance records, firm nominations, and quantitative criteria, including assets under management and revenue generated for their firms. Investment performance is not a criterion. Rankings are based on the assessment of Barron's and may not be representative of any one client’s experience. This ranking is not indicative of the Financial Advisor’s future performance. Morgan Stanley Smith Barney LLC is not affiliated with Barron's. Barron’s is a registered trademark of Dow Jones & Company, L.P. All rights reserved.