Morgan Stanley Private Wealth Management

Andrew L Cushman

Executive Director,

Private Wealth Advisor,

Senior Portfolio Management Director,

Executive Director

Direct:

(203) 625-4679(203) 625-4679

My Mission Statement

We help you create comprehensive, multigenerational wealth management plans based on your goals, challenges and the values that guide your life.

WELCOME

As Morgan Stanley Private Wealth Advisors, we combine our own talents and experience with the vast resources of a global financial services firm to help address the planning, governance, liability management and investing needs of ultra high net worth families, their businesses and philanthropic enterprises. We take a holistic approach that is grounded in investment strategy, but covers virtually every aspect of your financial life: risk management, liabilities, trusts and estate strategies and even family dynamics and lifestyle management issues. Our goal is to help preserve and grow your financial, family and social capital so that it can have a positive impact today and for generations to come.

We look forward to learning more about you and your family, and discussing the resources we can place at your disposal.

We look forward to learning more about you and your family, and discussing the resources we can place at your disposal.

Securities Agent: DE, OH, NY, KY, IL, WA, IN, VT, VA, MI, SC, PA, GA, TX, DC, RI, NV, NJ, MN, MA, LA, UT, CT, AZ, WV, MT, ID, FL, CA, TN, OR, NC, ME, MD, CO; General Securities Representative; Investment Advisor Representative

NMLS#: 1279260

NMLS#: 1279260

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

About PWM

Founded in 1977, Private Wealth Management is the division of Morgan Stanley Wealth Management that is dedicated to serving the firm’s most affluent clients, including some of the world’s most accomplished entrepreneurs, executives and stewards of multigenerational wealth. Functioning as an exclusive investment boutique within a global financial firm, we deliver sophisticated solutions that leverage the intellectual capital and insight of Morgan Stanley’s substantial global resources. Drawing on a deep understanding of your financial life, our goal is to help you:

- Manage investments with an unwavering focus on your financial strategy and personal goals

- Create comprehensive, multigenerational wealth management plans based on your needs, challenges and the values that guide your life and legacy

- Simplify financial complexity to help you achieve clarity and control

Private Wealth Management Highlights

- Approximately 300 teams specialized in assisting individuals and families with $20MM+ in investable assets

- Over $1.2 trillion in AUM

- Comprising 26% of the Barron’s Top 100 Financial Advisors list for 2025

- Direct access to ultra high net worth experts in philanthropy, family dynamics, wealth transfer, lifestyle advisory and other areas of interest to ultra high net worth families

1 Morgan Stanley Wealth Management, September 2025

Source: Barron's (Awarded March 2025) This ranking was determined based on an evaluation process conducted by Barron's for the period Oct 2023-Sept 2024. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors paid a fee to Barron's to obtain or use the ranking. This ranking is based on an algorithm that includes client retention, industry experience, review of compliance records, firm nominations, and quantitative criteria, including assets under management and revenue generated for their firms. Investment performance is not a criterion. Rankings are based on the assessment of Barron's and may not be representative of any one client’s experience. This ranking is not indicative of the Financial Advisor’s future performance. Morgan Stanley Smith Barney LLC is not affiliated with Barron's. Barron’s is a registered trademark of Dow Jones & Company, L.P. All rights reserved.

Approach

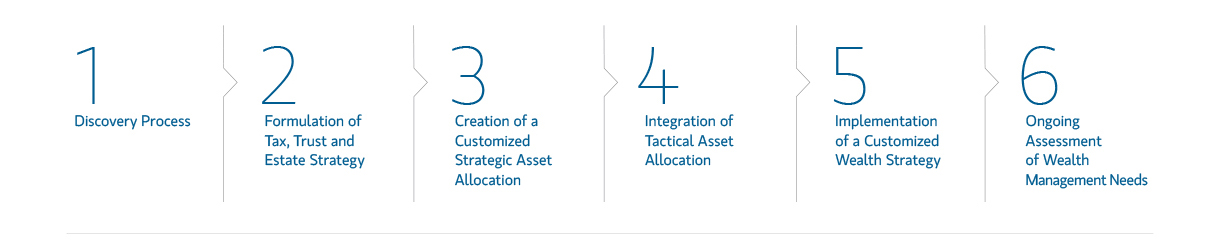

Discovery Process

Investing the time to learn about you and your family; your assets and liabilities and the risk exposures, enables us to formulate strategies and customize the relationship to your needs.

Formulation of Tax, Trust and Estate Strategy

Working with your tax and legal advisors, we help analyze your income and estate tax circumstances to identify and tailor planning techniques that may be used to address your objectives.

Creation of Customized Strategic Asset Allocation

Your customized asset allocation reflects risk, opportunities and taxation across multiple entities, while integrating your investing and estate plans.

Integration of Tactical Asset Allocation

Short-term adjustments seek to capitalize on temporary market distortions. Before making adjustments, we analyze the impact of taxes and trading costs on potential returns.

Implementation of a Customized Wealth Strategy

After comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform.

Ongoing Assessment

In coordination with your other advisors, we can conduct ongoing reviews and comprehensive reporting to ensure that your strategy adapts to changing financial and family needs.

Location

One Fawcett Place, 3rd

Floor

Greenwich, CT 06830

US

Direct:

(203) 625-4679(203) 625-4679

Wealth Management

Global Investment Office

Portfolio Insights

Private Wealth Management Podcast

Bringing you engaging stories and key insights surrounding the complexities associated with significant wealth, including:

- Intergenerational Planning

- Philanthropic Giving

- Non-Traditional Assets

- Managing Family Wealth

LISTEN | Passion Assets: Investing in Art

Article Image

Managing Significant Wealth

- Investment Management

- Wealth Transfer & Philanthropy

- Cash Management & Lending

- Family Governance & Wealth Education

- Lifestyle Advisory

- Business Services

Insights and Outcomes

Thought Leadership for our ultra high net worth clients, which contains thought-provoking articles, authored by leading experts from Morgan Stanley Family Office Resources.

We look forward to discussing your needs and goals, and the exceptional resources we can place at your disposal.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The securities/instruments, investments and investment strategies discussed on this website may not be suitable for all investors. The appropriateness of a particular investment or investment strategy will depend on an investor's individual circumstances and objectives. The views and opinions expressed on this website may not necessarily reflect those of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). This website and its associated content are intended for U.S. residents only.

Morgan Stanley and its Private Wealth Advisors do not provide tax or legal advice. Visitors to this website should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Private Wealth Advisers may only transact business in states where they are registered or excluded or exempted from registration. Transacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where Morgan Stanley Private Wealth Advisers are not registered or excluded or exempt from registration.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

See the Financial Advisors Biographies for Registration and Licensing information.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Investment Management Consultants Association, Inc. owns the marks CIMA®, Certified Investment Management Analyst® (with graph element)®, and Certified Investment Management Analyst® .

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Life insurance, disability income insurance, and long-term care insurance are offered through Morgan Stanley Smith Barney LLC's licensed insurance agency affiliates.

Lifestyle Advisory Services: Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Awards Disclosures | Morgan Stanley

Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The securities/instruments, investments and investment strategies discussed on this website may not be suitable for all investors. The appropriateness of a particular investment or investment strategy will depend on an investor's individual circumstances and objectives. The views and opinions expressed on this website may not necessarily reflect those of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). This website and its associated content are intended for U.S. residents only.

Morgan Stanley and its Private Wealth Advisors do not provide tax or legal advice. Visitors to this website should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Private Wealth Advisers may only transact business in states where they are registered or excluded or exempted from registration. Transacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where Morgan Stanley Private Wealth Advisers are not registered or excluded or exempt from registration.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

See the Financial Advisors Biographies for Registration and Licensing information.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Investment Management Consultants Association, Inc. owns the marks CIMA®, Certified Investment Management Analyst® (with graph element)®, and Certified Investment Management Analyst® .

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Life insurance, disability income insurance, and long-term care insurance are offered through Morgan Stanley Smith Barney LLC's licensed insurance agency affiliates.

Lifestyle Advisory Services: Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Awards Disclosures | Morgan Stanley

CRC 4237142 (02/2025)