Michael L Matthys, CFA®

Industry Award Winner

Industry Award WinnerCOORDINATED, INTEGRATED, AND ELEVATED: ALIGNED WITH YOU

We are an innovative, credentialed, and driven wealth management practice offering meaningful guidance and an elevated standard of client care to successful individuals, families, and business owners, both locally and throughout the country.

Our mission is to become an essential partner and advocate for our clients. This means that we leverage our experience, creative energy, and a vast array of resources to help clients define and pursue what matters most, while guiding them through their most pressing challenges and consequential decisions.

WHY CLIENTS CHOOSE US

We meet our clients where they are at and take them where they want to go.

With decades of experience behind us, we are often the "first call" from clients looking to address a wide range of financial concerns. As our clients and their families grow and evolve, they ask different kinds of questions and require new and expanded capabilities from their Financial Advisors. Our team's highly credentialed and broad knowledge base has facilitated our long history of growing alongside our client families and addressing their evolving circumstances, milestones, and challenges.

To successfully execute on a world-class client experience and develop a mutually rewarding relationship, we srive to agree to the following.

On our end, we will:

In return, we ask that our clients are:

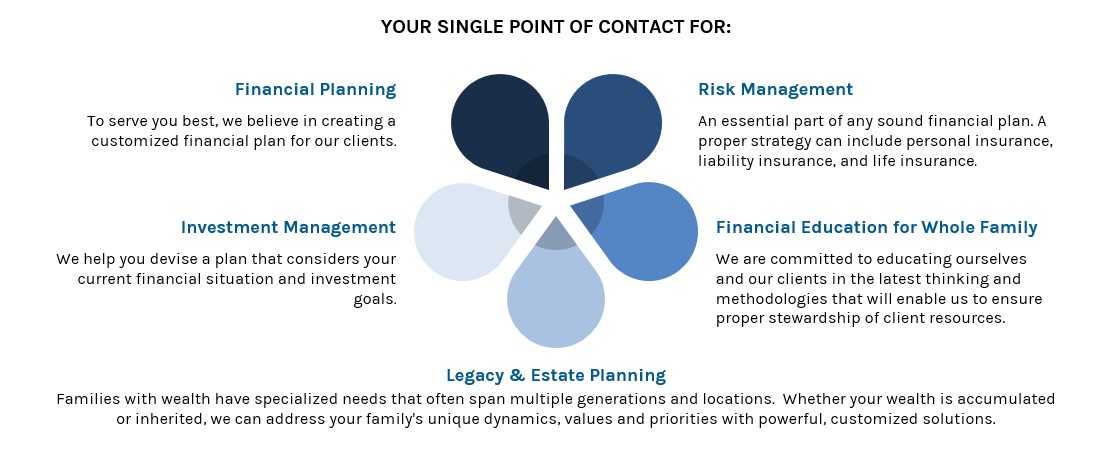

With a "coach and guide" mindset and approach, we bring together, the sometimes confusing, often overwhelming elements of long-term financial success, financial planning, and investment management. We do this with a sense of purpose and responsibility, which are designed to provide clients with confidence and clarity.

The credentialed skills of a Family Wealth Director and a Family Wealth Advisor, coupled with our team's many years of experience working with families, uniquely positions us to deliver a broader spectrum of family-centric wealth management solutions to our clients.

In addition to the services listed above, we also help families address complex issues that fall outside the bounds of a traditional advisory relationship, such as:

Therefore, you can spend more time enjoying your wealth and less time managing it.